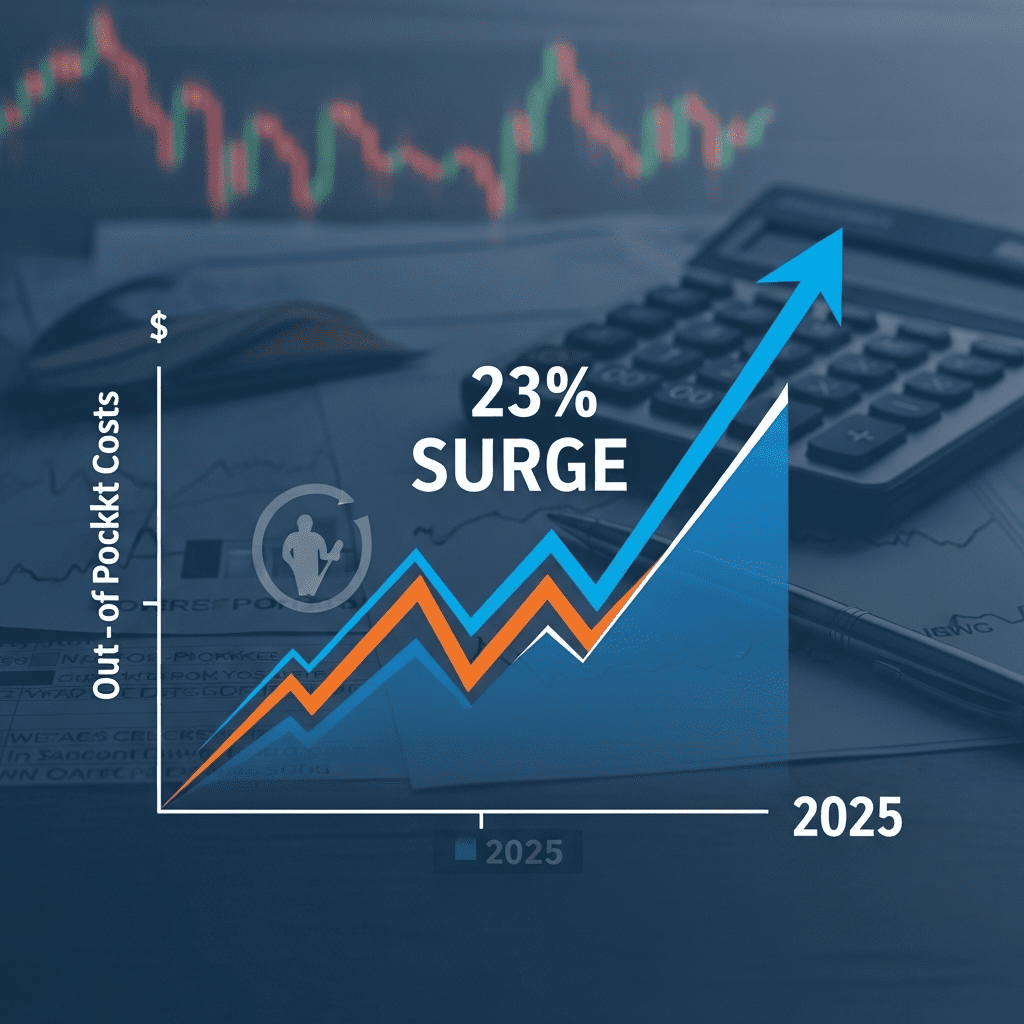

Dave Ramsey revealed a tough reality: Medicare’s average out-of-pocket costs soared 23% in 2025, shocking retirees and portfolios across the sector ($SPY). The Dave Ramsey Medicare warning lands as seniors face unexpected financial risks, challenging conventional retirement planning wisdom and raising urgent questions for investors.

Medicare Out-of-Pocket Costs Spike 23%: Key Data From 2025

Medicare’s standard Part B premium jumps to $186.50 per month in 2025, up from $169.90 in 2024, marking a 9.8% increase per the Centers for Medicare & Medicaid Services (CMS, Oct 2024). The bigger shock is out-of-pocket expenses: the average retiree now pays $6,721 annually for uncovered services, a 23% rise year-over-year (Kaiser Family Foundation, August 2025). Medical inflation outpaces core CPI (3.1% vs. 2.4%) according to Bureau of Labor Statistics data from September 2025. Financial advisor Dave Ramsey underscored, “Medicare is not all-inclusive. Ignoring these gaps could devastate a retirement portfolio” (Ramsey Solutions, 2024 fiscal year statement).

Why Health Coverage Gaps Are Disrupting Retiree Portfolios Sector-Wide

Healthcare equities, including UnitedHealth Group ($UNH) and Humana ($HUM), have seen heightened volatility as Medicare-linked questions destabilize retiree spending. According to Bloomberg (September 2025), $UNH traded down 2.1% while $HUM fell 3.5% in Q3 as investors reassess the impact of rising uninsured costs. Broader S&P 500 Health Care index returned just 3.2% YTD (as of November 8, 2025), trailing the S&P 500’s 7.8% (Yahoo Finance, Nov 2025). Lower discretionary income among retirees squeezes both healthcare and adjacent sectors like consumer staples and real estate, driving portfolio rebalancing and a conservative shift in asset allocation.

How Investors Should Position Amid Medicare Warning Shocks

Investors—especially those focused on sectors highly sensitive to retiree spending—should update risk models and stress-test for persistent medical inflation. Exposure to healthcare providers and Medicare Advantage insurance names ($UNH, $HUM) requires closer scrutiny given increased payout risks and variable profit margins. For diversified portfolios, rising retiree costs may depress long-term consumption and indirectly pressure major consumer stocks. Consider stock market analysis on defensive allocations, or revisit investment strategy built around inflation-resistant assets. Investors may also explore latest financial news for further developments on policy or Medicare reforms that could shift sector performance.

What Analysts Expect Next for Health Sector and Retirees

Industry analysts observe that sustained medical cost inflation could drag sector earnings and mute expansion in retirement-focused funds. Market consensus suggests further Medicare premium hikes are likely in 2026 if inflationary trends persist. Investment strategists note that policy interventions—ranging from supplemental insurance reforms to cost-containment measures—will be a major market catalyst, but clarity is unlikely before mid-2026 (per Fidelity, BofA Global Research, and sector reviews dated September-October 2025).

Dave Ramsey Medicare Warning Signals Risks for Retirees in 2025

Dave Ramsey’s Medicare warning in 2025 underscores a seismic shift for retiree portfolios as out-of-pocket health expenses surge. Investors should monitor Medicare reform updates and medical inflation data, as these factors could trigger new volatility across stocks tied to aging demographics. Proactive portfolio adjustments are critical in a landscape defined by rising financial risks for retirees.

Tags: medicare, dave ramsey, healthcare stocks, $UNH, retiree investing