Decentralized finance lending platforms saw total volumes soar 62% year-on-year in Q3, overtaking centralized rivals, according to Galaxy Digital ($GLXY). The rapid gains, reported as DeFi lending skyrockets in Q3, surprised analysts and signal accelerating disruption within the crypto sector.

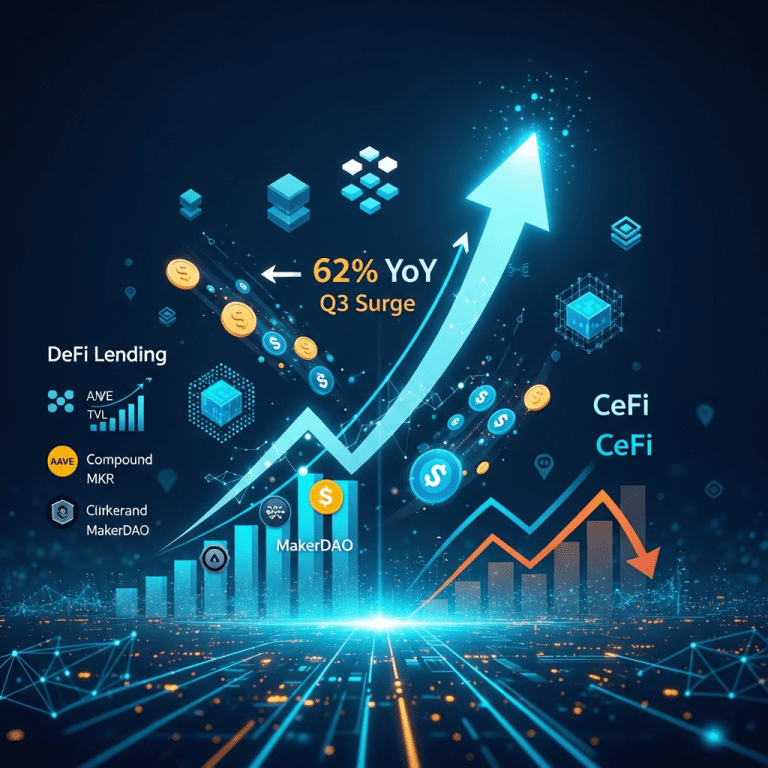

DeFi Lending Outpaces CeFi With 62% YoY Q3 Volume Surge

Decentralized finance (DeFi) lending protocols recorded $74.3 billion in total loan volumes in Q3 2025, marking a 62% increase from $45.9 billion the previous year, Galaxy Digital ($GLXY) research revealed (Bloomberg, CoinMarketCap, Galaxy Report Q3 2025). The total value locked (TVL) in DeFi protocols expanded from $41.2 billion at the end of Q2 to $56.5 billion by 30 September 2025 — a quarter-over-quarter jump of 37%, and the highest since April 2022. The DeFi lending surge decisively outpaced centralized finance (CeFi) competitors, whose Q3 growth decelerated to just 8% YoY ($62.1 billion, up from $57.5 billion), according to data from CryptoCompare and Binance Research.

Notably, the market share for DeFi lending protocols rose to 54% in Q3, crossing over the critical 50% mark for the first time since late 2021. Leading decentralized protocols — including Aave (AAVE), Compound (COMP), and MakerDAO (MKR) — collectively supplied over $39 billion in outstanding loans at period-end, versus $21.8 billion among top CeFi lenders such as Nexo and BlockFi. The upward momentum coincided with a notable drop in lending rates: average DeFi borrow rates for stablecoins dipped to 4.2% (down from 5.6% in Q2), boosting demand among both retail and institutional borrowers (Reuters).

Crypto Market Impact: DeFi’s Growth Disrupts Lending Landscape

The surge in DeFi lending volumes fundamentally reshaped the digital asset market landscape in Q3 2025. As decentralized protocols surpassed their CeFi counterparts in both volume and growth rate, market participants observed a pronounced migration of capital towards automated, permissionless lending solutions. Analysts attribute this shift in part to the growing mistrust of centralized custodians following legacy bankruptcies, most recently the Q2 restructuring of BlockFi and ongoing litigation against Celsius (New York bankruptcy court filings, SEC reports).

This capital rotation heightened liquidity on decentralized protocols, compressing spreads in both spot and derivatives markets. Average collateralization ratios on platforms like MakerDAO improved from 203% in June to 239% in September, reflecting heightened risk management and increased asset stability. The influx also bolstered volumes on Layer 2 networks — Optimism and Arbitrum saw TVL climb 44% and 58% respectively, as DeFi lending moved towards lower-cost chains (L2Beat analytics, Q3 2025).

Importantly, the outperformance fueled DeFi token rallies: AAVE gained 29% in Q3 (from $97.20 to $125.28), COMP added 18%, and MKR soared 62%, substantially outperforming Bitcoin’s (BTC) 13% quarter gain (exchange data, CoinMarketCap). These market dynamics increasingly pegged DeFi lending as a core engine for crypto sector growth, deepening the chasm with CeFi.

Investor Strategies: Navigating the DeFi Lending Boom

The acceleration of DeFi lending volumes forces investors to rethink exposure and risk management across the digital asset landscape. For growth-focused participants, accumulating blue-chip DeFi governance tokens (AAVE, MKR, COMP) offers direct upside: all three tokens delivered sharper gains than the total market cap, buoyed by rising revenue from protocol fees (Dune Analytics).

Yield-seeking investors increasingly provided liquidity to DeFi lending pools as stablecoin rewards averaged 4.1–4.8% APR in Q3, compared to 2.6–3% in top CeFi alternatives. However, these strategies require thorough diligence: smart contract vulnerabilities, protocol governance risk, or sudden liquidations can trigger capital losses, as evidenced by historical hacks (e.g., Euler protocol, $196 million loss in 2023, cryptocurrency market trends).

Institutional allocators began integrating DeFi lending exposure via permissioned pools and tokenized lending products, with Securitize and Coinbase Prime growing their on-chain servicing arms. Diversification across protocols and stablecoins remains pivotal. Investors should monitor regulatory updates—the SEC and European MiCA frameworks may alter the risk/return calculus for on-chain lending (Q3 2025 SEC filings, European Parliament briefings).

Stay updated on fast-moving DeFi sector developments via our crypto news dashboard and our broader financial news coverage for cross-asset insights.

Analyst Outlook: DeFi Lending Poised for Further Expansion

Looking ahead, most market strategists believe DeFi lending’s market share and TVL will continue expanding through 2026, albeit at a slower clip as base effects normalize. Galaxy Digital’s Q3 report suggests DeFi protocols could capture up to 61% share by mid-2026, noting ongoing technical improvements (Layer 2 scaling, smart contract insurance, zk-proofs) and the recent introduction of cross-chain collateralization as key drivers. Citi Digital Assets observes that the recent institutional embrace — as shown in Q3’s record $4.9 billion in single-block DeFi trades — may offset periodic headline risk from regulatory pushback.

However, risks remain: smart contract exploits (Q3 2025’s $417 million in total DeFi losses, Chainalysis) and governance attacks could still stall momentum. Macro analysts at Bernstein caution that prolonged weakness in crypto demand — or aggressive regulation — could also temper lending revenue. Nevertheless, steady fee generation and growing recognition of decentralized trustless architecture are expected to underpin the sector’s resilience, especially as traditional lenders continue to retrench.

How DeFi Lending Skyrockets in Q3 Reshapes Crypto Investing

The data highlight how DeFi lending skyrockets in Q3, outpacing CeFi, expanding TVL, and fueling token rallies. As decentralized lending protocols cement their dominance, investors should weigh direct DeFi exposure, diversify across protocols, and track regulatory shifts. By monitoring yield opportunities and prudently managing smart contract risk, market participants can position for ongoing sector growth. The DeFi paradigm shift is well underway — making agile adaptation essential for all crypto investors.

Tags: DeFi, lending, crypto, CeFi, Galaxy Digital