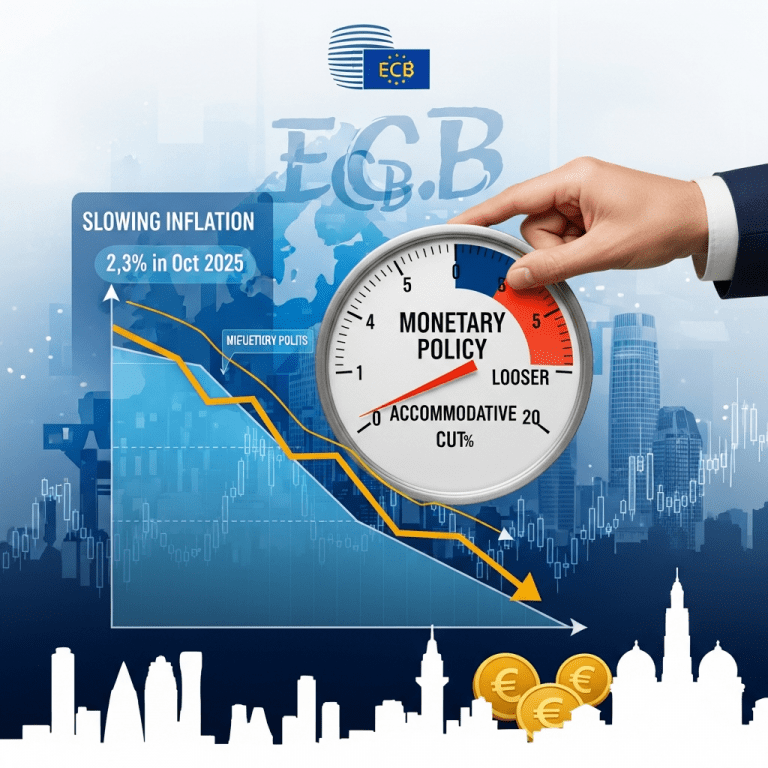

Olli Rehn revealed that the European Central Bank ($ECB) must account for the mounting risk of slowing inflation, signaling a possible policy pivot. The “ECB slowing inflation risk” comes as year-on-year euro area inflation fell to 2.3% in October 2025, sparking debate over the central bank’s next move. Why is this shift surprising for market watchers?

ECB Flags Risk as Eurozone Inflation Drops to 2.3% in October

European Central Bank ($ECB) executive board member Olli Rehn underscored the need to monitor the “ECB slowing inflation risk” as eurozone consumer prices decelerated sharply. The October 2025 Harmonised Index of Consumer Prices (HICP) increased just 2.3% year-over-year, down from 2.9% in September, according to Eurostat data. Core inflation, which strips out volatile energy and food components, also dipped to 2.6%. Rehn’s remarks came on November 16, 2025, as investors recalibrated expectations around the ECB’s rate path amid persistent eurozone economic weakness. Market pricing shows traders now attach a 58% probability to a rate cut by April 2026, up from 41% a month prior, per Bloomberg data.

How Slowing Inflation Alters Eurozone Monetary Policy Landscape

The shift in “ECB slowing inflation risk” reverberates across eurozone fixed income and equity markets. Lower-than-expected inflation suggests that Europe’s cost-of-living crisis is abating more rapidly than anticipated, giving policymakers wider latitude. Historically, periods of subdued inflation have led to prolonged accommodative policy after rate hikes, as seen in 2014 and following the pandemic. Euro government bond yields declined sharply following the latest release, with 10-year German Bund yields falling 22 basis points in two weeks to 2.14% as of November 15, 2025 (Refinitiv). For the banking sector, slower inflation can weigh on net interest margins, while export-oriented manufacturers may benefit from more stable input prices.

How Investors Should Adapt to ECB’s Shifting Inflation Stance

The “ECB slowing inflation risk” challenges investors to reconsider their eurozone allocations. Fixed income traders may find greater opportunities in sovereign bonds as yields have come off recent highs, increasing the attractiveness of longer-duration instruments. Euro Stoxx 50 index ($STOXX50E) climbed 1.4% in the week following the inflation print, reflecting expectations of less aggressive ECB tightening. Equity investors focusing on defensive sectors, such as healthcare and consumer staples, could see stable performance amid subdued inflation. Meanwhile, those holding European bank shares may face volatility if loan growth falters. For broader portfolio positioning and stock market analysis, monitoring ECB policy signals becomes critical. Additionally, tracking forex trading insights is advised, as shifts in inflation and interest rate expectations directly influence the euro’s exchange rate.

What Analysts Expect for ECB Policy and the Eurozone Economy

Industry analysts observe that mounting evidence of slowing inflation strengthens the case for maintaining current interest rates or even beginning a gradual easing cycle in 2026. According to J.P. Morgan strategists, declining price pressures and below-trend GDP growth increase policy flexibility. Investment strategists note that market consensus now anticipates the ECB will remain data-dependent, with further decisions hinging on wage growth and energy price trends. The focus through early 2026 is on navigating “ECB slowing inflation risk” without fueling financial instability.

ECB Slowing Inflation Risk Redefines Investor Playbook for 2025

The evolving “ECB slowing inflation risk” has shifted the 2025 outlook for eurozone assets and monetary policy. Investors should monitor upcoming inflation prints, policy statements, and macro data for guidance on positioning. As the ECB adapts to new price dynamics, agile strategies can help capture opportunities in both fixed income and equities while mitigating risks. Watching the “ECB slowing inflation risk” will remain central for navigating market volatility this year.

Tags: ECB, eurozone, inflation, interest rates, STOXX50E