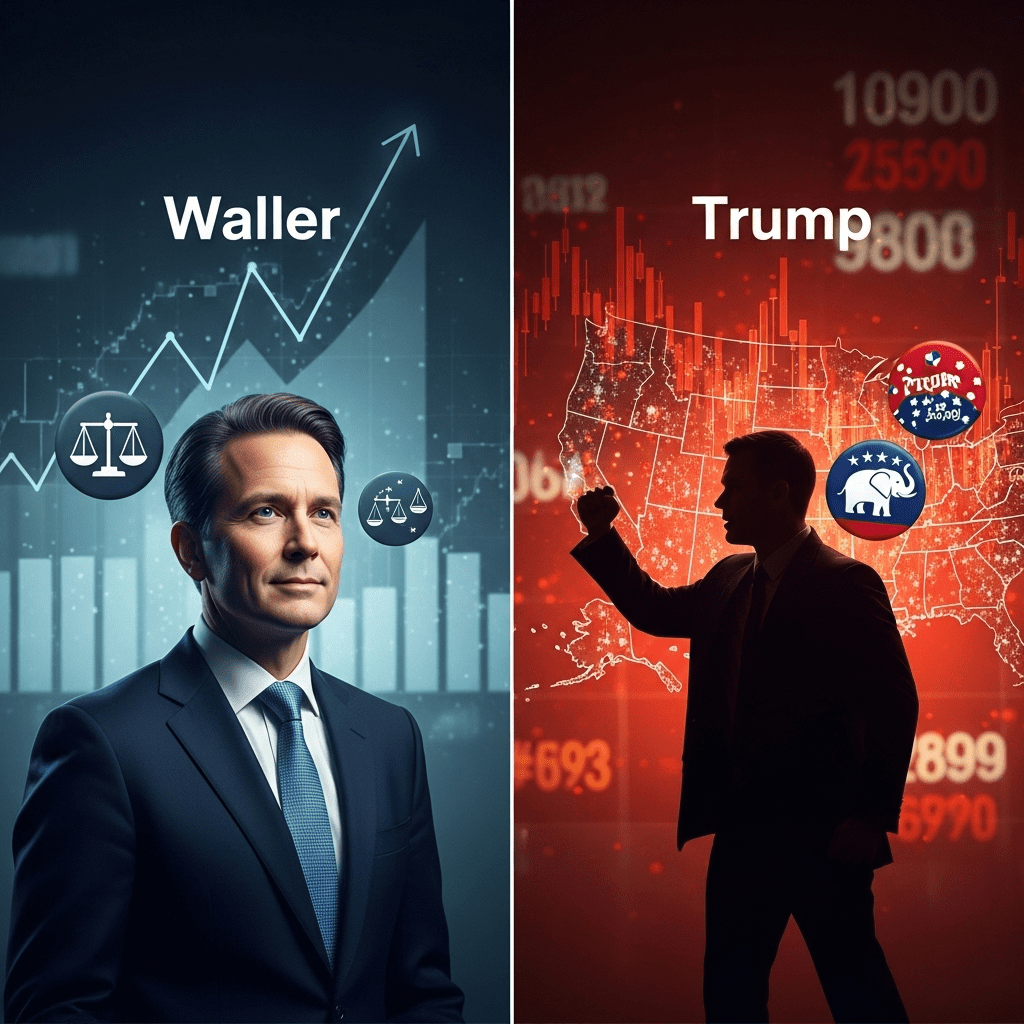

In a pivotal moment for monetary policy, economists favour Waller to lead Fed but expect Trump to pick a loyalist. As speculation swirls about the future chair of the Federal Reserve, the U.S. economic landscape faces uncertainty that could affect markets, households, and policy for years ahead.

Why Economists Favour Waller to Lead Fed but Expect Trump to Pick a Loyalist

Amid the run-up to the 2025 presidential transition, seasoned analysts and market observers are closely following who will be appointed to the top position at the U.S. central bank. Christopher Waller, a current Fed governor, is considered a front-runner among academic and market economists. His data-driven approach and clear communication style have earned high marks, especially as the Federal Reserve enters a complex cycle of inflation management, employment growth, and financial stability.

Waller’s Credentials and Market Reassurance

Waller’s extensive background in macroeconomics and monetary theory aligns with the current needs of the Federal Reserve. Analysts praise his steady hand in navigating rate hikes, his openness to transparency, and his balance between growth and price stability. Having served on the Board of Governors since 2020, Waller has both the experience and the institutional knowledge to reassure markets during turbulent times.

Trump’s Track Record and the Loyalist Factor

Despite the backing of economists, there is strong belief that former President Donald Trump will favor a Fed chair considered loyal to his economic vision. Trump’s prior administration displayed a penchant for appointing officials who publicly supported his policies, often prioritizing loyalty over technocratic independence.

Loyalists and Their Potential Impact

The prospect of a loyalist at the helm could signal shifts in Federal Reserve priorities, from interest rate management to regulatory oversight. Potential candidates who align more closely with Trump’s economic doctrines may support looser monetary policy, even in the face of inflationary pressures, or pursue regulatory rollback to fuel short-term growth. This divide between technocratic merit and political allegiance is central to the debate.

How Fed Leadership Shapes Economic Policy

The question of who leads the Federal Reserve is not just a matter of personality; it fundamentally impacts U.S. and global economic policy. A Waller-led Fed would likely continue on a path of cautious rate adjustments, evidence-based policy, and clear communication with markets. By contrast, a loyalist’s appointment could usher in less predictable actions, adding volatility to financial markets and raising concerns over the Fed’s independence.

Investor Reactions and Market Volatility

With the world watching, markets are already pricing in possible scenarios depending on the outcome. Traditionally, the Federal Reserve’s independence has been a stabilizing force in global finance. However, overt politicization can rattle investors and disrupt capital flows. Many on Wall Street prefer predictability and view Waller as a known quantity—someone who can command confidence from domestic and international investors alike.

Broader Implications for the U.S. Economy

Beyond Wall Street, central bank leadership directly influences employment, household borrowing costs, and inflation. A durable, impartial approach to monetary policy helps foster stable growth. Any sign of policy being dictated by political loyalty rather than economic fundamentals could have far-reaching consequences for average Americans, from mortgage rates to employment prospects.

Expert Voices and Emerging Consensus

A survey from leading financial institutions reveals a near-unanimous preference among economists for experience and a steady hand at the Federal Reserve [see expert insights here]. Yet, many acknowledge the likelihood of political considerations dominating the decision. As a result, business leaders, lawmakers, and advocacy groups are calling for a transparent, bipartisan selection process to protect the Fed’s integrity.

Looking Ahead: The 2025 Federal Reserve Landscape

As the 2025 appointment approaches, observers recommend vigilance and proactive portfolio management. Regardless of the ultimate pick, the transition will be a historic inflection point for monetary policy and economic growth. Aligning strategies with potential changes at the Fed is a wise consideration for investors, corporations, and policymakers alike [investment resources].

Key Takeaways

- Economists overwhelmingly support Christopher Waller for his data-driven, independent approach.

- Political realities suggest Trump may prioritize loyalty over expertise in the Fed chair selection.

- The ultimate decision will shape inflation control, employment trends, and market stability well into 2025 and beyond.

With the highest economic stakes in a generation, the narrative that economists favour Waller to lead Fed but expect Trump to pick a loyalist is far more than a headline—it could be the deciding factor for America’s financial future.