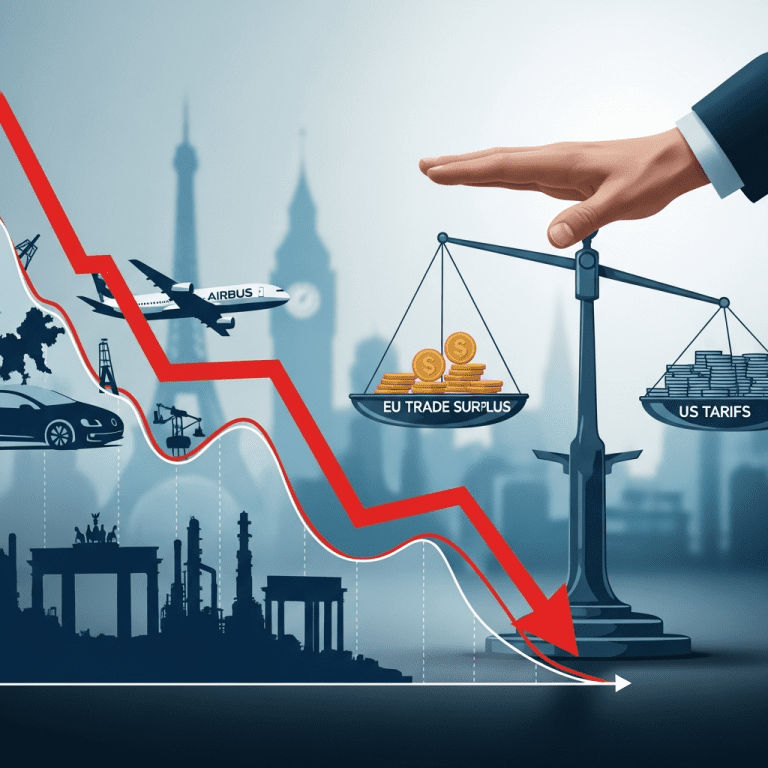

Brussels officials revealed a $55 billion drop in the EU trade surplus after Trump’s tariff escalations upended flows for Volkswagen ($VWAGY) and Airbus ($EADSY). Europe gauges fallout from Trump’s tumultuous year—a move that stuns investors expecting post-pandemic stability across key sectors.

Trump Tariffs Cut EU Export Volumes by 8%: Trade Deficit Widens

European Union export volumes to the United States fell 8% year-over-year through October 2025, according to Eurostat preliminary data released November 14. Key industries—including autos, chemicals, and aerospace—reported accelerated declines after the White House imposed sweeping new tariffs on June 1, 2025. For instance, Volkswagen ($VWAGY) North American deliveries dropped 12% in Q3, while Airbus ($EADSY) saw a 9% slide in orders from U.S. carriers (Bloomberg, 2025). The EU’s goods trade surplus with the U.S. shrank from $202 billion in 2024 to $147 billion by October 2025, slicing 27% off net trade gains in under a year. Paris and Berlin signaled continued uncertainty unless bilateral negotiations restart.

Why European Manufacturing Feels Pressure After Trade Shock

The tariff shockwaves quickly rippled through Europe’s export-driven manufacturing sector. The Eurozone Manufacturing PMI sank to 46.8 in October, its lowest level since May 2020 (IHS Markit, 2025), signaling contraction. Germany’s industry orders contracted 4.7% year-on-year in September, with machinery and vehicle shipments hardest hit. The Stoxx Europe 600 Industrials index is down 11.2% year-to-date, underperforming broader European indices (Reuters, Nov. 2025). Analysts at Deutsche Bank warn that prolonged trade frictions could erode Europe’s global share in advanced manufacturing, undermining the region’s recovery trajectory post-COVID-19.

How Investors Should Navigate European Trade Fallout Risks

Investors holding European industrial stocks face mounting volatility, as persistent trade disruptions reshape sectoral earnings forecasts. Active managers are trimming exposure to automakers like BMW ($BMWYY) and parts suppliers, both of which flagged potential profit margin contractions in recent guidance. The euro weakened 2.1% against the U.S. dollar in October, reflecting declining confidence in export-led growth. Defensive plays—such as consumer staples and utilities—outperformed, with the MSCI Europe Utilities index up 4.8% since June. Diversification across sectors and attention to policy shifts are paramount. For deeper insights, see stock market analysis and the latest financial news for ongoing updates on market reactions to global policy.

What Analysts Expect for Europe’s Trade Outlook in 2026

Industry analysts observe that trade policy uncertainty will remain a headwind into early 2026. While EU policymakers contemplate WTO action and targeted subsidies, U.S. election dynamics and global supply chain realignment complicate forecasts. Market consensus suggests European exporters may stabilize only if tariffs are eased or alternative deals emerge. Investment strategists note rising interest in regional supply chains and intra-EU trade—potential buffers against external shocks.

Europe Gauges Fallout From Trump as Investors Track Next Moves

Europe gauges fallout from Trump’s turbulent trade tactics as markets monitor the next phase in U.S. policy and EU response. Investors should watch for signals from November’s G20 summit and potential tariff rollbacks, which could trigger sectoral rebounds or renewed disruptions. Staying nimble and monitoring bilateral negotiations will be crucial as the landscape evolves.

Tags: Europe trade, Trump tariffs, export decline, Volkswagen $VWAGY, manufacturing risk