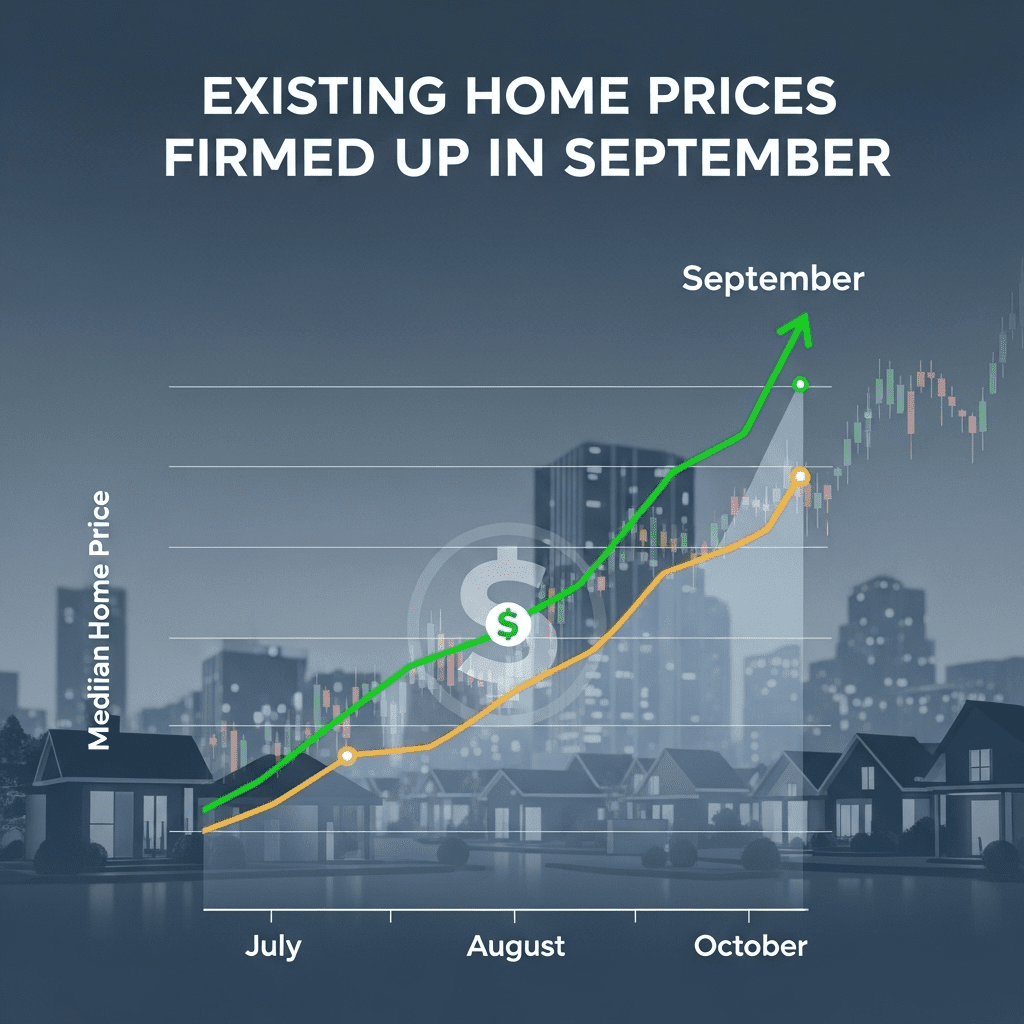

In a notable turn for the U.S. housing sector, existing home prices firmed up in September, signaling potential shifts in the real estate landscape as we head toward 2025. Amid fluctuating mortgage rates and ongoing inventory constraints, this price stability offers both homeowners and investors fresh data points to consider in their strategies.

Why Existing Home Prices Firmed Up in September

Several key factors contributed to why existing home prices firmed up in September. According to the National Association of Realtors, the median price for existing homes rose 2.5% year-over-year, reaching $410,200, marking a steady recovery from earlier sluggishness in sales activity. Persistent inventory shortages—especially in high-demand urban and suburban markets—continue to create upward pressure on prices, as demand consistently outstrips available supply.

Mortgage rates, which remain elevated compared to early 2020s lows, have contributed to a ‘lock-in’ effect. Many homeowners with favorable rates are reluctant to sell and repurchase at current rates, thereby constraining inventory even further. As a result, buyers are competing for a limited pool of listings, pushing prices higher rather than allowing the market to soften.

Regional Variations and Price Dynamics

The pattern that existing home prices firmed up in September is not uniform nationwide. Major metropolitan areas—such as San Francisco, Miami, and Dallas—have reported stronger price gains than the national average, largely due to robust employment figures and resilient demand. Conversely, some markets that experienced rapid appreciation during 2021-2022, like Boise and Phoenix, have plateaued or posted only modest gains as local inventories rebalance.

Seasonality also plays a role. Traditionally, September marks the beginning of a cooler sales season, but this year’s data suggests an exception to the rule. Factors such as remote work flexibility and persistent demand from first-time homebuyers are disrupting historical trends, keeping price momentum stronger than anticipated.

Investment Implications as Existing Home Prices Firmed Up in September

For real estate investors, the fact that existing home prices firmed up in September presents both challenges and opportunities. On the one hand, rising prices can translate to equity gains for current owners and potentially stronger rental yields as buyers remain on the sidelines. On the other, elevated entry costs and tight credit conditions may limit new investment activity, especially for those targeting fix-and-flip or short-term horizon strategies.

This market dynamic emphasizes the importance of data-driven decision-making. Seasoned investors will benefit from monitoring local indicators—such as days on market, active listings, and regional employment figures—to identify undervalued opportunities or emerging risks. For detailed investment insights tailored to shifting conditions, strategic planning is paramount.

Buyer and Seller Perspectives on Firmed Prices

For prospective buyers, the news that existing home prices firmed up in September may reinforce concerns about housing affordability—especially as mortgage rates hover above 7% for conventional loans. Nevertheless, some analysts expect that continued wage growth and cooling inflation could gradually ease pressure in coming quarters.

Sellers, meanwhile, may find today’s pricing backdrop attractive enough to list, particularly in markets with renewed bidding activity. Yet the calculus of moving—given financing costs—remains complex, and many are opting to hold for better conditions. Consulting with real estate and financial advisors is recommended to time transactions effectively and maximize returns. Explore more about real estate market shifts on our financial education platform.

Looking Ahead: Will Existing Home Prices Continue to Firm?

While existing home prices firmed up in September, the outlook for coming months will depend on several macroeconomic and policy variables. The Federal Reserve’s stance on interest rates, employment resilience, and potential legislative changes affecting housing stock all play critical roles. Most experts expect modest appreciation or stable prices through the next quarter, barring dramatic shifts in supply or credit markets.

For investors and homeowners alike, staying informed is more important than ever. Access regular market analyses and economic forecasting tools to stay ahead as conditions evolve. As 2025 approaches, prudent navigation of real estate’s risk-reward landscape will be essential for capitalizing on persistent shifts in U.S. home values.