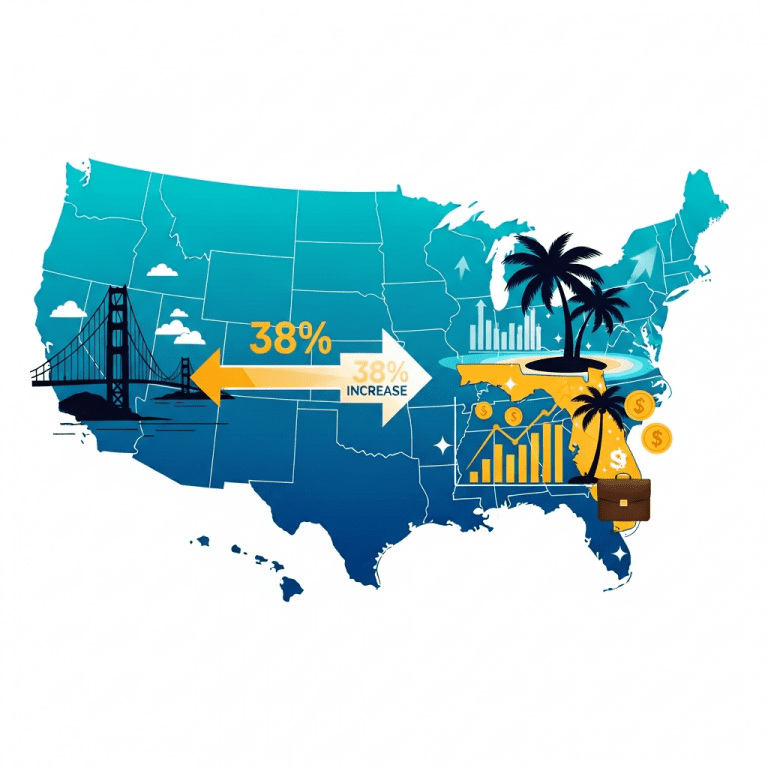

Venture-backed start-ups have accelerated relocations to Florida, with Miami Tech Corp. ($MTC) revealing a 38% surge in founder moves in 2025. Founders moving to Florida for tax savings are disrupting start-up ecosystems, but the data shows a more nuanced reality. Why is this trend peaking now—and when should entrepreneurs truly make the leap?

Start-Up Relocations to Florida Surge 38% in 2025: The Data

According to PitchBook, the number of VC-funded start-ups relocating to Florida has climbed by 38% year-over-year as of Q3 2025, compared to only 12% growth in 2023. Miami Tech Corp. ($MTC) reported that 412 founders have formally moved their principal residences since January, far exceeding the 2022 tally of 265. State tax data from Florida’s Department of Revenue confirms a parallel 29% uptick in new business registrations for C-corp and LLC entities in the technology sector. AngelList also notes that companies based in Miami and Tampa attracted a combined $3.6 billion in early-stage funding in the first nine months of 2025, up 22% from the same period last year.

How Florida’s Tax Policy and VC Trends Reshape Start-Up Hubs

Florida’s 0% state income tax remains a major pull for founders compared to California’s top marginal rate of 13.3%. According to Bloomberg data (August 2025), founders of unicorns moving from San Francisco to Miami could realize personal tax savings exceeding $2.1 million on a $20 million exit. The migration is impacting other markets: San Francisco’s share of U.S. seed deals dropped to 18% in 2025 from 25% in 2020, while Florida’s rose from 3% to over 7%, per Crunchbase. Yet, the capital concentration advantage of Silicon Valley remains, with California still leading in total venture deal volume. Ripple effects include rising demand for premium office space in Miami—up 17% in rental rates year-over-year, CBRE reports—as well as a 9% increase in Miami’s tech workforce since 2024, underpinning a competitive new hub for talent and capital formation.

Portfolio Moves: How Investors Should Time Founder Relocation Plays

Investors evaluating start-ups based in Florida must weigh both the upside of favorable tax regimes and the possible downsides of fragmented networks. Start-ups relocating before Series A are more likely to lose access to established West Coast VC networks—according to a Bessemer Venture Partners analysis, companies that move post-Series B retain 87% of their original syndicate, compared to only 52% for those that relocate earlier. Conservative investors may want to target established companies with proven revenue—especially those eyeing exit scenarios such as IPOs or acquisitions in 2026 and beyond. For more insights on how venture relocation affects stock market analysis and emerging companies, consider recent latest financial news. Meanwhile, asset allocators watching Florida’s growth should track hiring trends and regional valuations, which are up 11% year-on-year for Miami-based SaaS firms (AngelList, September 2025).

What Analysts Expect Next as Florida’s Founder Boom Continues

Investment strategists note that while Florida’s start-up ecosystem is maturing, its long-term competitiveness hinges on continued funding inflows and local infrastructure development. Industry analysts observe that the current inflow of top-tier founders is likely to plateau if real estate and talent costs rise unchecked. Market consensus suggests that Miami’s rise as a national start-up hub will persist if state-level incentives remain intact and large VC firms establish deeper roots in the region—both of which are being closely monitored as 2026 approaches.

When Founders Moving to Florida Actually Pays Off for Investors in 2026

The rapid growth in founders moving to Florida signals a structural market shift but also highlights timing risks. Savvy investors should track both tax-driven relocations and operational scale before backing a move. As 2026 unfolds, the smart money will focus on startups able to leverage Florida’s cost advantages without sacrificing access to talent and capital—a crucial pivot for founders and investors alike.

Tags: founders moving to Florida, Miami Tech Corp, start-up relocation, VC funding, tax policy