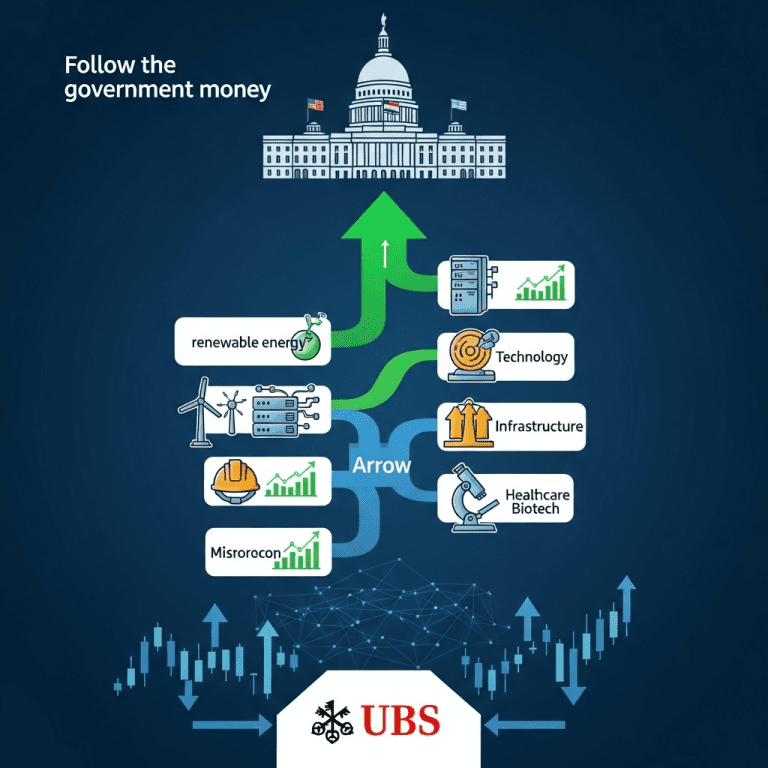

In an ever-evolving stock market, savvy investors increasingly recognize the relevance of the ‘follow the government money’ strategy—especially as UBS Wealth harnesses this approach for consistent returns in 2025. By tracking government policies and public spending, UBS Wealth identifies lucrative market opportunities, offering clients a strategic advantage.

How to Follow the Government Money With UBS Wealth in 2025

UBS Wealth continues to refine its ability to ‘follow the government money’, leveraging fiscal policy shifts and new regulatory trends. The firm meticulously analyzes public sector budget allocations, infrastructure bills, and stimulus packages to understand how capital flows from governments to industries—and, ultimately, to individual companies.

This data-driven process empowers their wealth managers to anticipate growth sectors well before retail investors catch on. For instance, as climate policy and energy transition funding surge across various economies, UBS Wealth identifies actionable opportunities in green technology, clean energy, and infrastructure stocks. The firm’s research desk actively maps these flows for underlying investment thesis development, translating macroeconomic policy into tactical sector allocation.

Why Government Spending Moves Markets

Government expenditure shapes the broader economic environment and can catalyze entire sectors. Whether it is the U.S. ramping up renewable power investments or the EU unveiling digital transformation funds, these movements redirect massive capital toward public and private stakeholders. Understanding these dynamics is key for successful equity strategies in 2025, and the ability to ‘follow the government money’ gives institutional investors an edge over the market.

Case Study: Renewable Energy Boom

UBS Wealth has capitalized on recent renewable energy legislation worldwide. For example, after assessing the flow of funds from the Inflation Reduction Act and Europe’s Green Deal, they increased exposure to solar, battery storage, and utility companies poised to benefit. As a result, clients seeking portfolio themes tied to sustainable investing have enjoyed outsized returns relative to sector averages.

The Lasting Power of Following the Government Money in Investment Portfolios

UBS Wealth’s ongoing success with this method highlights why institutional investors are doubling down on government policy analysis. This strategy is not about short-term speculation: it’s about building a long-term investment roadmap informed by reliable trends.

By systematically tracking central bank policy, fiscal stimulus announcements, and regulatory shifts, UBS Wealth offers clients a comprehensive, forward-looking approach. These insights enable not only tactical stock picks but also guide asset allocation decisions in areas such as infrastructure, defense, cybersecurity, and healthcare—each frequently targeted by government programs and subsidies.

Integrated Analysis With Modern Tech

Leveraging AI-driven analytics and machine learning, UBS Wealth now synthesizes vast datasets on government contracts, grant awards, and public tenders. This enhanced capability provides actionable signals for traders and private wealth clients. As governmental priorities change—especially in the run-up to elections or during major global events—UBS can pivot quickly to hot sectors, helping clients stay one step ahead in the evolving marketplace.

Conclusion: Adopting a Policy-Driven Investment Mindset

Investors looking for consistent long-term growth can take a page from UBS Wealth’s playbook by paying close attention to shifts in government money flows. In a global economy shaped by fiscal and regulatory action, this approach helps mitigate risk while positioning for upside. As 2025 unfolds, the ‘follow the government money’ strategy promises to remain a powerful tool for firms and individuals alike. For further reading on building effective investment frameworks, explore these wealth management strategies that incorporate macroeconomic trends.