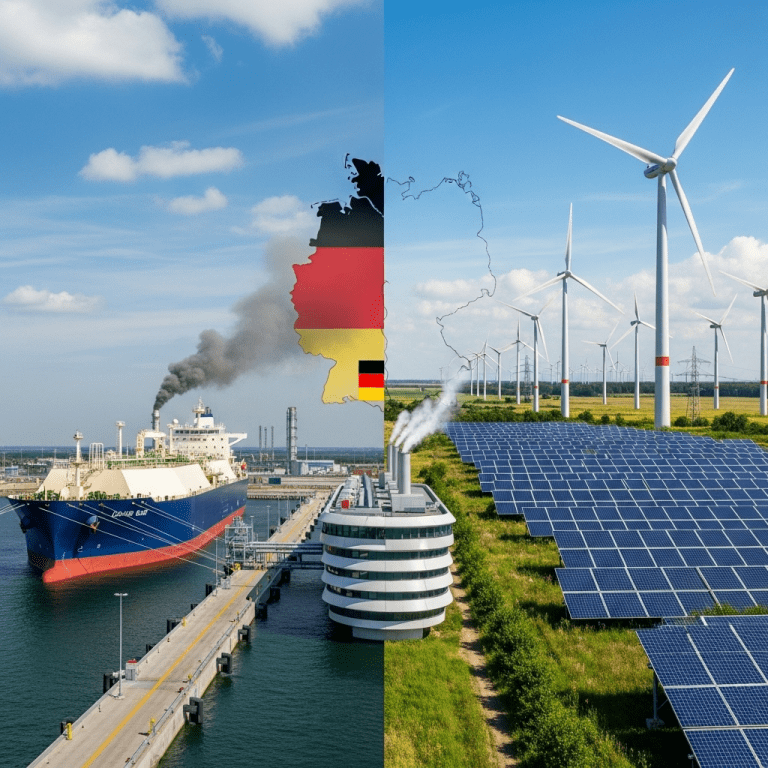

Germany’s dash for gas has struck a raw nerve among climate advocates and investors alike, casting doubt on the country’s ability to meet its ambitious climate targets. As Europe’s largest economy races to secure alternative energy supplies after the sharp reduction in Russian gas imports, questions are mounting over whether this rapid pivot will undermine the nation’s long-term net-zero commitments.

Germany’s Dash for Gas and Its Climate Dilemma

The reality of Germany’s dash for gas presents a fundamental challenge: can the nation reconcile its urgent energy security needs with its binding environmental goals? Since 2022, the Federal Republic has fast-tracked the construction of liquefied natural gas (LNG) terminals and signed new contracts to source gas from global suppliers. While these measures have staved off immediate energy shortages, critics argue that betting on gas infrastructure could lock Germany into fossil fuels for decades, putting its 2045 carbon neutrality target in jeopardy.

Energy Security Versus Environmental Responsibility

Germany’s decision comes against the backdrop of the energy supply crisis exacerbated by Russia’s war in Ukraine. With pipeline gas supplies dwindling, the government prioritized ensuring stable electricity and heating, fearing the fallout for industry and households. Policymakers justified these steps as temporary, emphasizing that new gas infrastructure could eventually transition to hydrogen.

However, industry observers and environmental groups are wary of this logic. In a statement, the German Council of Economic Experts highlighted the “punch in the face” sentiment, warning that new investments risk diverting capital from renewables and embedding gas dependency. The European Commission has also flagged concerns that EU-wide 2030 emissions reduction targets could be compromised if member states, especially energy giants like Germany, over-commit to transitional fuels.

Economic Implications of Germany’s Dash for Gas

Germany’s dash for gas has significant implications for both the national economy and regional energy markets. On one hand, new LNG import capacities bolster energy security and offer short-term relief for industries under strain from high prices and supply uncertainties. Sectors such as chemicals and manufacturing—which contribute heavily to German GDP—are particularly reliant on stable gas supplies.

On the other hand, analysts warn that the rapid gas buildout may divert crucial investment away from solar, wind, and green hydrogen projects. This could delay Germany’s energy transition and slow the adoption of sustainable technology—a cornerstone of future competitiveness. According to data from the German Energy Agency (dena), renewables covered about 52% of gross electricity consumption in 2023, but further progress is threatened by competing priorities over grid infrastructure and market incentives.

Investor Outlook and Risk Factors

For investors, Germany’s evolving energy mix presents a double-edged sword. Aggressive expansion of LNG infrastructure creates short- to medium-term opportunities in supply chain logistics, engineering, and utilities. Yet the regulatory risks from potential carbon pricing, EU taxonomy rules, and public backlash against fossil fuel projects cannot be ignored.

Long-term portfolios focused on clean energy transition may need to reassess their exposure to German gas assets, given the likelihood of tightening regulations as political pressure for decarbonization grows. Staying informed on relevant energy transition strategies can help navigate these uncertainties.

Policy and Global Climate Commitments

Germany’s dash for gas raises pointed questions about the credibility of global climate commitments. Chancellor Olaf Scholz’s government maintains that LNG terminal investments will not prevent Germany from achieving its 2030 and 2045 goals, reiterating plans for a coal phaseout and massive renewables scaling. Nevertheless, environmental NGOs counter that every new gas contract distances the nation from compliance with the Paris Agreement.

The International Energy Agency (IEA) has stated that advanced economies must halt new fossil infrastructure development to keep global warming below 1.5°C. Germany’s approach, therefore, will likely influence other EU nations’ energy decisions—and potentially the continent’s collective emissions trajectory.

Path Forward: Balancing Security and Sustainability

As 2025 unfolds, Germany faces a pivotal moment in energy policymaking. Striking the right balance is imperative: ensuring energy security while accelerating investments in green infrastructure. Policymakers are exploring mechanisms such as carbon contracts for difference and enhanced renewable subsidies to align investment flows with climate targets.

For stakeholders, from institutional investors to local communities, close monitoring of policy shifts and technological advances will be crucial. Staying updated on macroeconomic trends and EU climate policymaking could offer fresh insights as Germany navigates its complex energy future.

Ultimately, whether Germany’s dash for gas is a necessary stop-gap or a costly detour will depend on its ability to transition swiftly to a decarbonized economy—without undermining hard-won climate ambitions.