Guild Holdings ($GHLD) revealed a 26% jump in Q3 revenue to $307.4 million, surpassing market estimates ahead of its anticipated Bayview acquisition. This Guild Q3 revenue surge contrasts sector weakness and spotlights key strategic moves, prompting investor attention to the timing and implications of the Bayview deal.

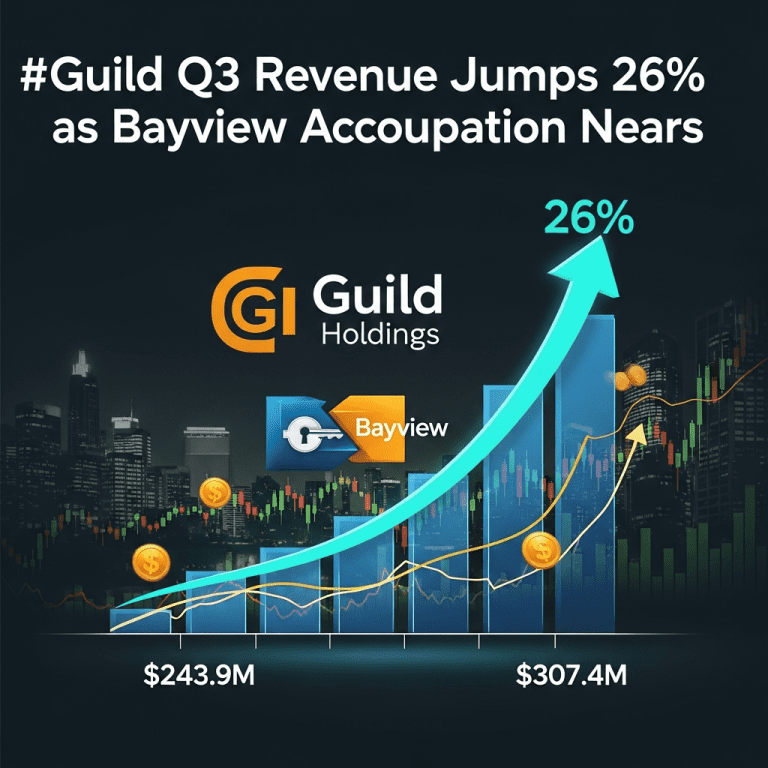

Guild Q3 Revenue Jumps 26% to $307.4M as Bayview Acquisition Nears

Guild Holdings ($GHLD) announced on November 5, 2025 that quarterly revenue for Q3 soared 26% year-over-year, hitting $307.4 million compared to $243.9 million in Q3 2024, according to the company’s official earnings release. Net income climbed to $22.9 million from $16.7 million a year earlier, outpacing consensus expectations from analysts polled by Bloomberg. The surge comes as Guild finalizes the acquisition of select mortgage servicing rights from Bayview Asset Management, valued at more than $1.2 billion in unpaid principal balance (UPB) set to close by late Q4 2025. Trading volume in $GHLD spiked with shares closing at $15.42, up 9.1% the day of the announcement (source: Nasdaq exchange data).

Why Mortgage Revenue Strength Defies a Sluggish Real Estate Sector

Guild’s robust Q3 results occur against a backdrop of overall sector headwinds, as the U.S. Mortgage Bankers Association reported a 12% annual decline in industry-wide origination volume as of October 2025. While residential real estate markets remain pressured by high rates—with the national 30-year fixed mortgage rate averaging 7.32% (per Freddie Mac)—Guild’s focus on purchase mortgages and servicing income insulated performance. The company’s acquisition-driven strategy mirrors a trend among nonbank lenders consolidating market share amid tighter credit and increased regulatory scrutiny. This resilience underscores how targeted acquisitions and servicing portfolios can provide counter-cyclical growth in stagnant sectors.

How Investors Can Navigate Guild’s Surge and Sector Shifts

For investors, Guild’s Q3 revenue surge and Bayview transaction present both opportunities and risks. Those with existing exposure to real estate equities may consider the stock’s recent momentum but should assess market volatility and integration challenges. Trading activity on $GHLD has intensified since the announcement, with volumes more than doubling versus the previous month. Diversified portfolio managers might monitor the real estate sector’s consolidation pace, highlighted by Guild’s dealmaking and similar moves tracked in stock market analysis. Meanwhile, rising rates and regulatory trends spotlight the need for selective positioning, a theme explored in latest financial news. Investors trading mortgage lender equities should weigh income stability from servicing fees against potential headwinds from economic slowdowns and rate volatility.

What Analysts Expect for Guild Holdings and Mortgage Lenders Now

Industry analysts observe that Guild’s ($GHLD) Q3 beat and inorganic growth strategy may keep it ahead of smaller rivals struggling with margin compression. Market consensus suggests that the pending Bayview acquisition should further diversify revenue and strengthen Guild’s loan servicing business, especially if interest rates remain elevated. Continued focus on prudent integration and risk controls will be critical for outperformance in the coming quarters.

Guild Q3 Revenue Surge Signals a New Era for Real Estate Investors

Guild Q3 revenue surge not only signals strategic strength but also highlights widening gaps between consolidators and legacy players in the mortgage sector. Investors should watch for the Bayview deal’s closure, ongoing rate movements, and additional M&A as key catalysts. Guild’s active expansion places it at the forefront of sector transformation as real estate markets evolve.

Tags: Guild Holdings, GHLD, mortgage sector, Bayview acquisition, real estate stocks