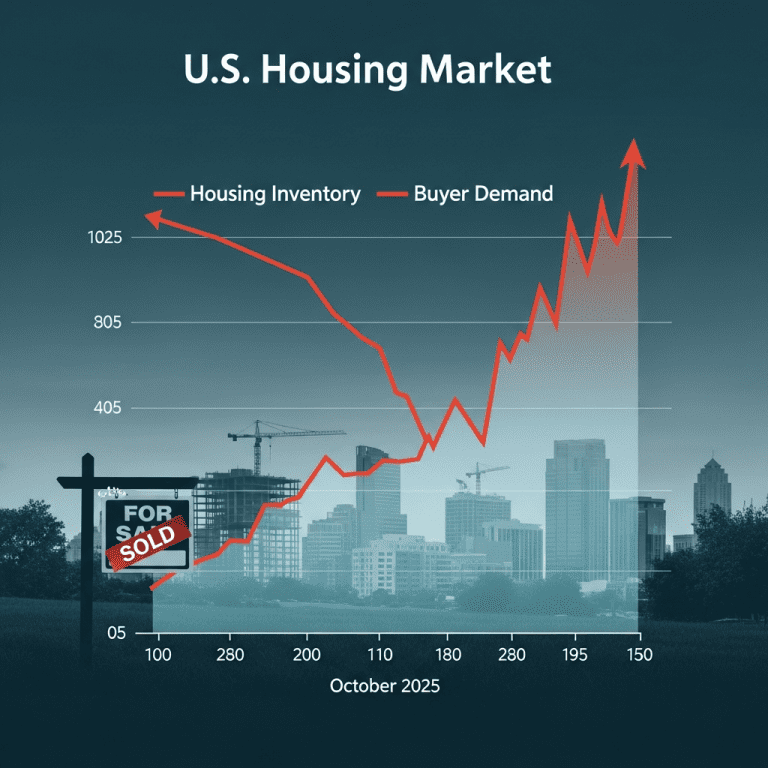

Zillow ($Z) revealed U.S. housing inventory fell 17% year-on-year in October 2025 as demand picked up, reversing recent trends. The phrase “housing inventory falls as demand picks up” is echoed in market data, surprising analysts expecting a softer housing recovery this fall. Will persistently low listings reshape the real estate landscape?

U.S. Housing Inventory Drops 17% Amid Surging Buyer Demand

Home listings across the United States declined sharply, with Zillow ($Z) reporting just 860,000 active homes on the market in October 2025, down from 1.04 million a year earlier—a 17% year-over-year contraction. Redfin ($RDFN) data corroborates these figures, showing new listings fell 8% month-on-month in October, driven by would-be sellers holding off as mortgage rates stabilized near 6.7% (Freddie Mac, Oct. 2025). Meanwhile, existing-home sales volume climbed 12.3% versus September, per National Association of Realtors (NAR) data published November 7, signaling renewed buyer urgency despite higher prices.

Why Real Estate Market Tightening Signals Broader Sector Shifts

This sudden shortage of available homes comes as the U.S. economy navigates mixed signals. The Case-Shiller National Home Price Index hit a new high in September 2025, up 6.1% year-on-year (S&P Dow Jones Indices, October 31). Persistently tight inventory keeps upward pressure on prices despite modest improvement in affordability as wage growth stabilizes. Industry observers note that current months’ supply—averaging 2.5 in October—remains below the 5–6 months typically considered a balanced market, exacerbating competition in key metro regions. Rising construction costs and slow permitting continue to curtail new development, further amplifying supply constraints.

How Investors Can Navigate 2025’s Low Housing Inventory Trend

Investors focusing on real estate or housing-related equities face a mixed risk landscape. Real estate investment trusts (REITs) concentrated in single-family rentals—such as Invitation Homes ($INVH)—are poised to benefit from renters priced out of homeownership. Conversely, homebuilders like D.R. Horton ($DHI) report uneven new home pipeline growth, burdened by higher input costs (company earnings, Oct. 2025). Active traders should monitor stock market analysis for housing-linked equities, while long-term investors may find opportunities in construction supply chains. For broader impacts on household credit dynamics and U.S. spending, consult the latest financial news and industry updates.

Analysts Predict Inventory Pressures Will Persist Into 2026

Market consensus suggests inventory will remain constrained through at least mid-2026, with no rapid influx of sellers on the horizon. According to analysts at Moody’s Analytics, ongoing demographic trends and delayed move-ups will likely reinforce scarcity even if mortgage rates gradually ease. Industry strategists emphasize that without significant policy intervention or a large-scale shift in construction activity, buyers should anticipate sustained competition for limited supply.

Inventory Decline Signals Structural Change as Housing Demand Surges

The ongoing trend—housing inventory falls as demand picks up—signals a fundamental realignment in the real estate sector. Investors should watch for shifts in lending conditions, regulatory action targeting affordability, and upcoming earnings from top homebuilders. Observing how housing supply and demand play out in 2025 may offer early clues to broader U.S. economic resilience, making market vigilance crucial as this dynamic unfolds.

Tags: housing inventory, real estate, $Z, REITs, homebuilders