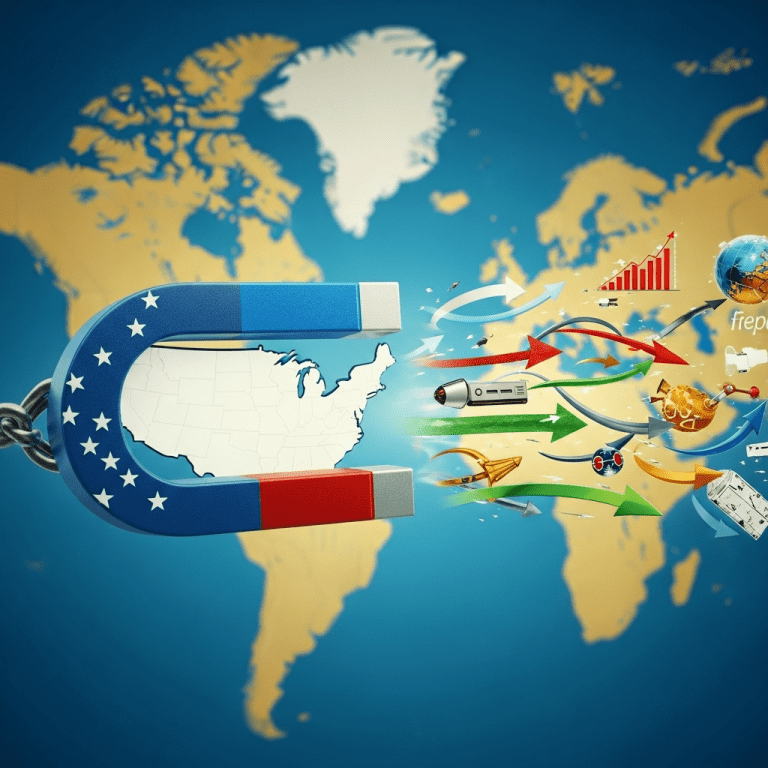

In 2025, America is sucking in growth from the rest of the world, creating significant ripple effects across the global economy. As the U.S. continues to outperform other developed economies, investors and policymakers are debating what this dynamic means for international markets and future growth patterns.

Why America is Sucking in Growth from the Rest of the World

The United States has consistently demonstrated economic resilience, buoyed by strong labor markets, continued technological innovation, and robust consumer spending. In contrast, many other global economies have struggled with stagnation, inflationary pressures, and geopolitical uncertainty. As a result, capital flows increasingly gravitate towards U.S. assets, reinforcing the notion that America is sucking in growth from the rest of the world as it becomes the preferred destination for global investment.

Capital Flows and the Dollar’s Strength

One of the leading factors in this phenomenon is the strength of the U.S. dollar. The American currency gains value as investors seek safe haven assets and higher real returns in the States, often to the detriment of emerging markets and even other advanced economies. This influx of capital not only bolsters domestic activity but also leads to tighter financial conditions abroad. For those seeking further investment insights, it’s clear that U.S. assets remain a dominant force in international portfolios.

Impact on Global Trade and Industries

As capital and economic activity concentrate in the United States, export-driven economies around the world face headwinds. Strong consumer demand and increased industrial activity in America may benefit select overseas suppliers, but many sectors find it harder to compete with the U.S. in attracting new investment or developing advanced technologies. While some multinational corporations profit from the robust American consumer, smaller economies risk becoming increasingly dependent on U.S. business cycles. Those interested in diversifying can explore opportunities highlighted in market analysis reports.

The Long-Term Implications as America Sucks In Growth from the Rest of the World

The medium- to long-term effects of this trend are significant. Persistent capital inflows can lead to an overvalued dollar, making U.S. exports less competitive while driving up the cost of servicing dollar-denominated debt globally. Meanwhile, economic divergence could widen, potentially fostering political and trade tensions as other nations seek to rebalance global growth shares.

Risks to Emerging Markets and Global Stability

For emerging markets, the consequences are particularly acute: higher borrowing costs, weaker local currencies, and slowing investment. Reliance on U.S. monetary policy becomes a double-edged sword, as Federal Reserve decisions have outsized effects on global liquidity conditions. This makes strategic adaptation more vital than ever, as emphasized by recent global economics commentary.

What Should Investors Watch in 2025?

As America’s economic momentum persists, investors should monitor several key indicators in 2025: U.S. GDP growth rates, Federal Reserve policy shifts, the dollar index, and international trade volumes. Diversification and vigilance against concentrated risks in any single region—the U.S. included—are critical. Moreover, as capital keeps flowing stateside, staying informed on global developments ensures proactive portfolio management in an ever-shifting landscape.

In summary, as America is sucking in growth from the rest of the world, understanding these global economic dynamics will be essential for navigating the challenges and opportunities in the years ahead.