Subscribe to Updates

Get the latest News & Ai updates from Think Invest.

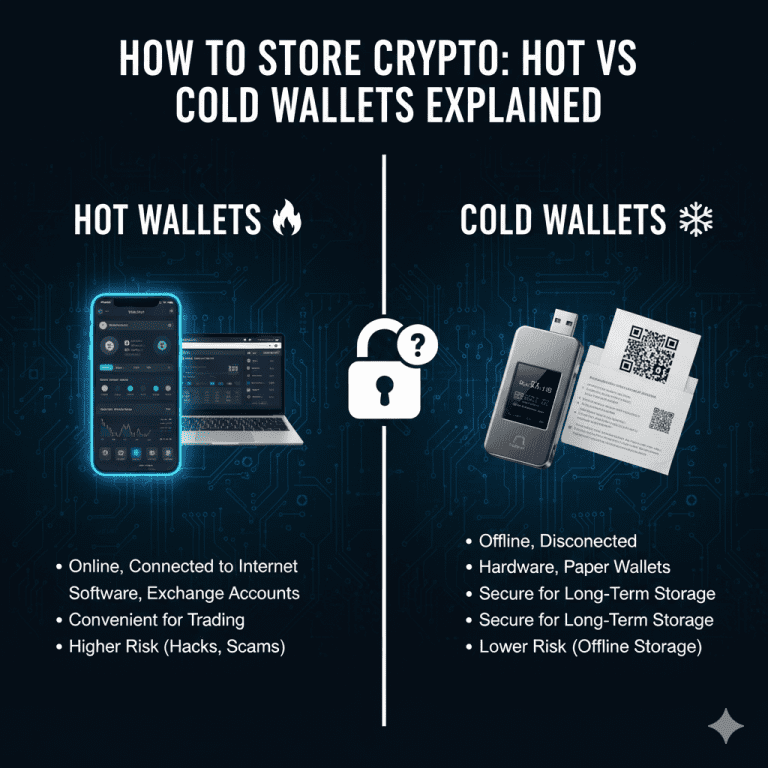

How to Store Crypto: Hot vs Cold Wallets Explained

Mickael Rois

Specializes in financial journalism, providing readers with concise, reliable analysis of markets and economic developments.

Related Posts

Trade With A Regulated Broker

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Your capital is at... ℹ

Disclaimer

The materials provided on this website, including news updates, analyses, opinions, and content from third-party sources, are intended solely for educational and informational purposes. They do not constitute financial advice, recommendations, or an invitation to take any specific action, including making investments or purchasing products. Any financial decision you make should be based on your own research, careful consideration, and consultation with qualified professionals. Content on this site is not tailored to your personal financial circumstances or objectives. Information may not be provided in real-time and may not always be accurate or complete. Market prices referenced may come from market makers rather than official exchanges. Any trading or investment decisions you make are entirely your responsibility, and you should not rely solely on the content provided here. ThinkInvest makes no warranties regarding the accuracy, completeness, or reliability of the information presented and shall not be liable for any losses, damages, or other consequences resulting from its use. This website may feature advertising and sponsored content. ThinkInvest may receive compensation from third parties in relation to such content. The inclusion of third-party content does not constitute endorsement or recommendation. ThinkInvest and its affiliates, officers, and employees are not responsible for your interactions with third-party services or websites. Any reliance on the information presented on this website is at your own risk.Risk Disclaimer

This website provides information on cryptocurrencies, contracts for difference (CFDs), and other financial instruments, as well as related brokers, exchanges, and market participants. These instruments are complex and carry a significant risk of loss. You should carefully evaluate whether you understand how they work and whether you can afford the potential financial losses. ThinkInvest strongly recommends conducting your own thorough research before making any investment decisions. Do not invest in any instrument that you do not fully understand, including the risks involved. All trading and investment decisions are made at your own risk. The content on this website is intended for educational and informational purposes only and should not be taken as financial advice or a recommendation to buy, sell, or hold any particular instrument. ThinkInvest, along with its employees, officers, subsidiaries, and affiliates, is not responsible for any losses or damages resulting from your use of this website or reliance on its content.

© 2025 Thinkinvest. Designed by Thinkinvest.