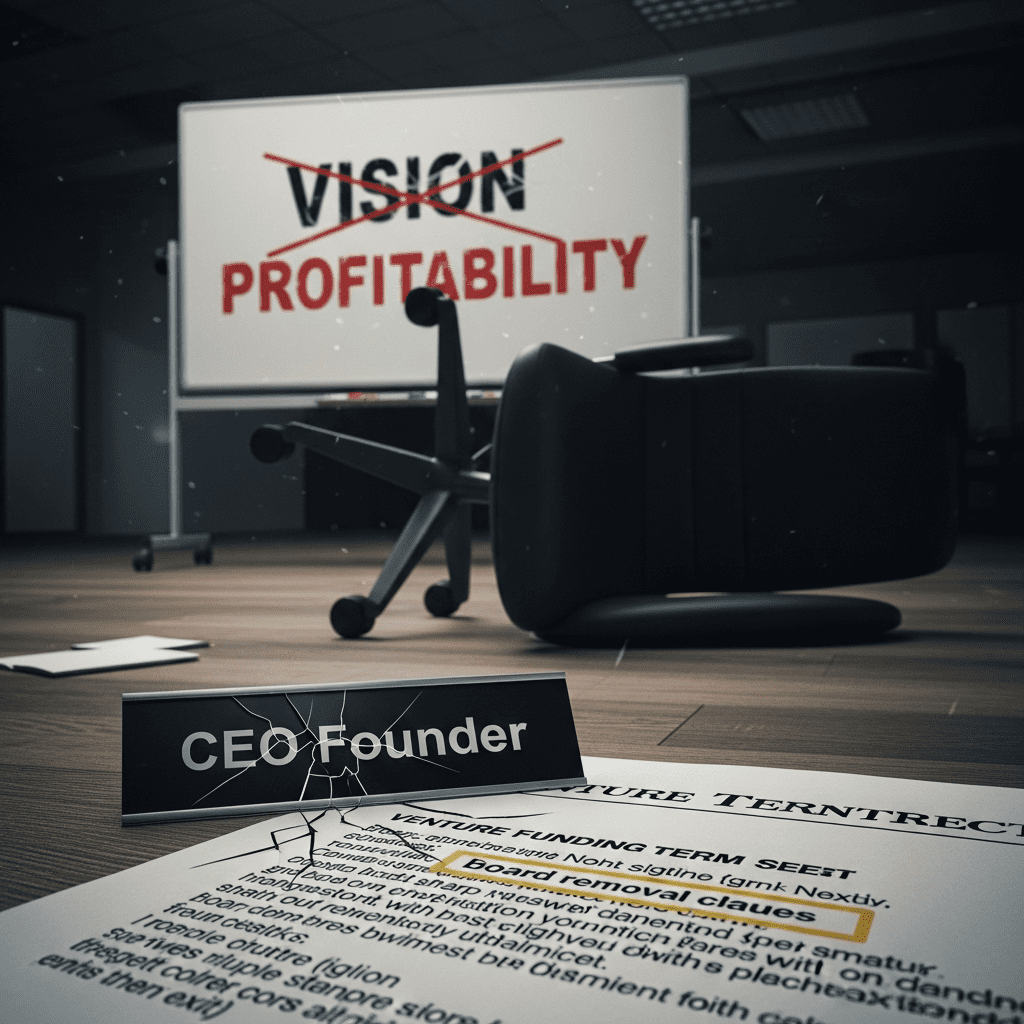

I was fired from my own startup—a phrase that’s becoming increasingly common among founders in 2025. Venture investors at TechForge Innovations ($TFGI) confirmed the board voted 5–2 to remove its founder-CEO after a $120 million funding round, citing “strategic misalignment.” The move highlights a broader shift in startup governance as investor pressure mounts.

Founder Ousters Surge: Startup Boards Remove 34% More CEOs in 2025

Founder ousters have reached a record high this year. According to PitchBook, board-led CEO removals jumped 34% year-over-year as of September 2025. TechForge Innovations ($TFGI) is among the latest examples, following a $120 million Series D round. The board cited missed revenue targets—Q2 revenue came in at $21.3 million, 18% below forecasts (company statement, June 2025).

Across the broader market, 17 of the 50 largest U.S. venture-backed unicorns have replaced their founding CEOs since January, up from 13 in 2024 (CB Insights). With venture funding volumes down 14% year-over-year (Crunchbase), the tolerance for underperformance is shrinking fast.

Why Startup Boards Are Rewriting the Founder Playbook

The era of unchecked founder control is fading. As aggregate tech earnings growth slowed to just 4.1% in H1 2025—the weakest since 2017 (Refinitiv)—investors are demanding more discipline and governance. Proxy contests in late-stage startups have climbed 21% in the past year (Harvard Business Review).

Capital scarcity is also a factor. U.S. venture deal value dropped from $248 billion in 2022 to $170 billion year-to-date (Crunchbase). Boards now view leadership changes as a lever for protecting returns and managing risk. The phrase “I was fired from my own startup” captures a growing reality: vision alone no longer guarantees job security.

How Investors Can Navigate Leadership Turnover Risks

Investors exposed to late-stage or pre-IPO startups must now account for governance instability as a core risk. In 2025, 79% of new VC term sheets included expedited removal clauses for CEOs (NVCA, July 2025). For shareholders in TechForge Innovations ($TFGI) or similar unicorns, monitoring performance metrics and board composition is essential.

High-growth sectors like AI and fintech are seeing similar disruptions. $EVNT and $XAIN, two high-profile startups, recently replaced their founding CEOs amid stalled growth. To mitigate volatility, investors should diversify across founder-led and professionally-managed firms, and track latest financial news and stock market analysis for signals of governance shifts.

What Experts Are Watching After Record Founder Exits

Analysts from Morgan Stanley and the National Venture Capital Association expect the trend to continue. As one strategist put it, “Boards are prioritizing execution over charisma.” With venture capital tightening, boards are unlikely to tolerate prolonged underperformance. Clear evaluation criteria and transparent governance will be key to restoring investor confidence.

Founder Exit Trends Define a New Era for Startup Investors

I was fired from my own startup is more than a headline—it’s a warning. The balance of power in venture-backed companies is shifting toward investors focused on profitability and governance. Founders and backers alike must adapt quickly to survive in this new era of accountability.

For deeper insight into leadership risk and governance shifts, explore ThinkInvest.org for expert commentary and strategy updates.

Tags: startups, $TFGI, founder exit, venture capital, board governance