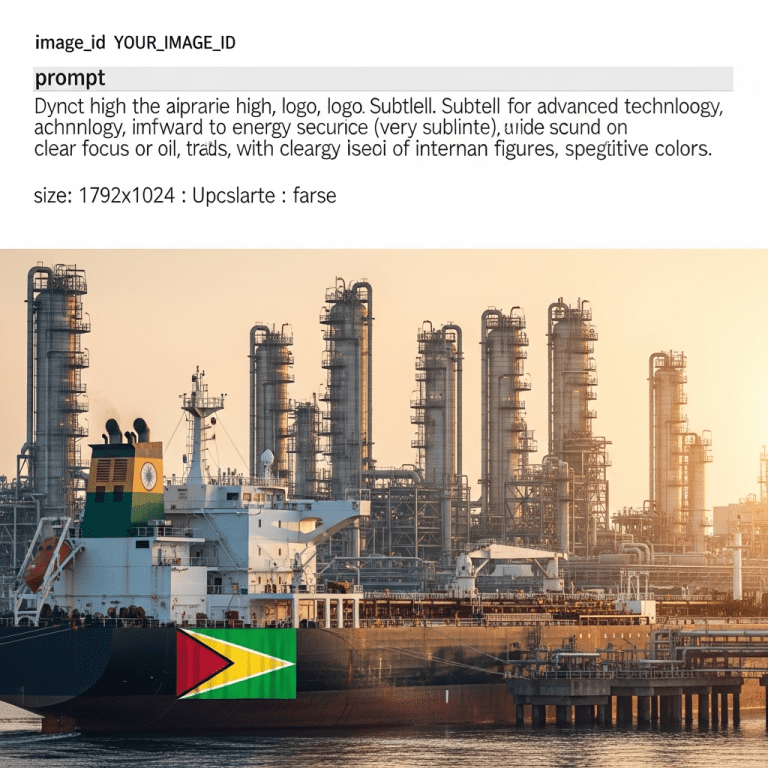

In a major 2025 energy market development, Indian refiners pivot to Guyanese oil as they diversify crude supplies and strengthen trade ties with emerging producers. This strategic realignment is set to redefine India’s oil import landscape while signaling a broader transformation in global energy flows.

Indian Refiners Pivot to Guyanese Oil Amid Global Rebalancing

The focus on Guyanese crude marks a significant departure for Indian refiners, who have traditionally relied on Middle Eastern suppliers, particularly Saudi Arabia and Iraq, for the bulk of their imports. As production and exports soar from Guyana’s massive offshore discoveries, Indian importers like Indian Oil Corporation (IOC), Bharat Petroleum (BPCL), and Reliance Industries have begun signing contracts for Guyanese oil cargos—from Liza, Unity, and Payara fields.

India’s move is influenced by multiple factors: supply reliability, rising Middle East crude prices, and the appeal of lighter, sweeter grades from Guyana that fit Indian refinery configurations. This transition also aligns with India’s push for improved supply security and cost competitiveness in the wake of volatile OPEC+ production quotas and geopolitical tensions.

Guyanese Oil Production: A New Global Player

Guyana, once a minor player in the world energy scene, has vaulted onto the global stage since discovering over 11 billion barrels of recoverable oil off its coast. Supported by ExxonMobil, Hess, and CNOOC, the country’s daily output is expected to surpass 1.2 million barrels per day by late 2025—making it the world’s fastest-growing oil producer. This rapid rise allows Guyana to offer steady volumes and competitive pricing, attracting major buyers like India seeking to hedge against regional risks.

How Indian Refiners Pivot to Guyanese Oil: Strategic Implications

The pivot is not merely a reaction to supply dynamics. Indian refiners are leveraging Guyana’s light sweet crude to optimize refining margins, reduce sulfur-handling costs, and mitigate greenhouse gas emissions from their operations. This helps them meet tightening global environmental standards and positions Indian products favorably in export markets. Moreover, by securing long-term offtake agreements, India taps into Guyana’s production growth, fostering a mutually beneficial trade partnership.

Reducing Dependency on Traditional Suppliers

Historically, India imported nearly 60% of its crude from the Middle East. However, recent tensions and price spikes—exacerbated by OPEC+ policies and disruptions in the Suez Canal—highlighted the strategic risks of over-dependence. Guyanese oil, with its stable Atlantic routes and growing volumes, provides a vital alternative. This diversification strengthens India’s energy security while reinforcing its negotiating power with legacy suppliers.

Investment and Infrastructure Opportunities

India’s interest in Guyanese oil extends beyond spot purchases. Indian firms are eyeing upstream investment opportunities and partnerships in Guyana’s sector, echoing similar moves made in Russia and Africa. There are also discussions for joint ventures in refining, logistics, and storage infrastructure—aimed at consolidating India’s presence in the South American energy corridor.

Market Impact as Indian Refiners Pivot to Guyanese Oil

The increased sourcing of Guyanese crude is expected to influence pricing benchmarks and shipping logistics within the Atlantic basin. This shift could erode some of the Middle East’s market share in the Asia-Pacific, intensifying competition among suppliers. For India, the move is likely to enhance cost efficiency, while for Guyana, it promises revenue security and market diversification beyond its US-centric export focus.

Energy Transition and Sustainability Factors

Another driving force behind the Indian refiners pivot to Guyanese oil is the growing priority placed on sustainability. Guyana’s offshore fields yield lighter grades that are less carbon-intensive to refine, supporting India’s decarbonization efforts and 2070 net-zero targets. This aligns with global trends where energy consumers seek not just reliable, but also cleaner, crude supplies to future-proof their portfolios.

The Road Ahead: Risks and Outlook

While the Indian refiners pivot to Guyanese oil presents clear benefits, challenges remain. Guyana’s rapid production ramp-up faces logistical, regulatory, and infrastructural hurdles. Similarly, India must continue balancing its diverse crude basket to avoid overexposure to new markets. Ongoing diplomatic engagement and transparent investment frameworks will be crucial in sustaining the momentum.

As the energy market evolves, this pivot signals a new era of South-South cooperation and resource rebalancing. Indian refiners are poised to tap emerging opportunities, not only strengthening their supply chains but also shaping market trends for years to come.

For more insights on global energy dynamics and emerging market strategies, explore investment insights, learn more about portfolio diversification, or keep up-to-date with evolving sector trends at ThinkInvest.org.