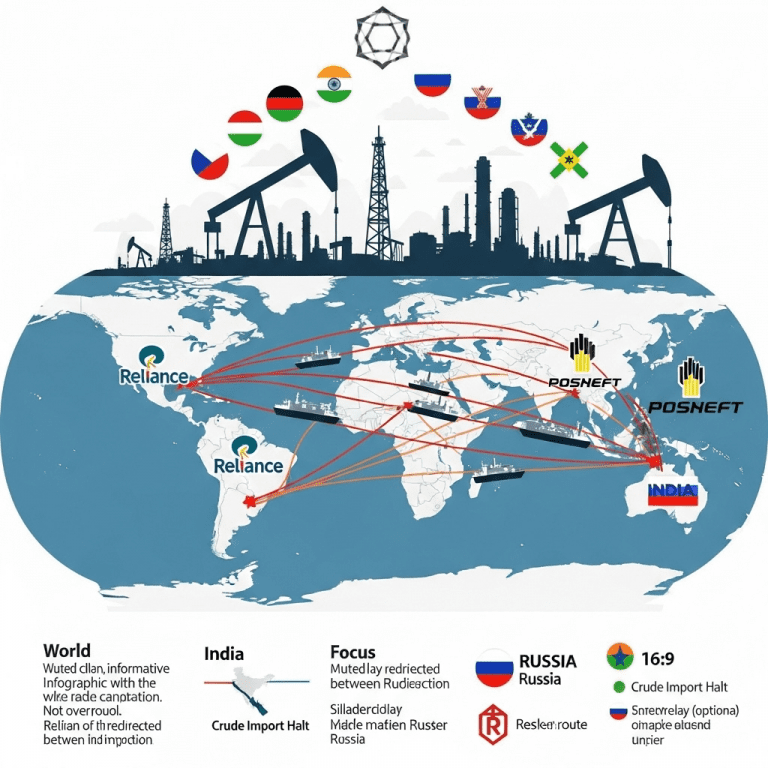

The news that Indian Reliance to halt crude imports from Rosneft after U.S. sanctions has sent ripples across the global energy sector. This decision, coming into effect in early 2025, could reshape crude oil trade routes, impact energy security in Asia, and influence both domestic and international markets. As Reliance Industries, India’s largest private sector corporation and one of the world’s top refinery operators, responds to new geopolitical pressures, investors and industry stakeholders need to understand the wide-ranging implications.

Indian Reliance to Halt Crude Imports from Rosneft After U.S. Sanctions: Geopolitical Context and Market Impact

In late 2024, the U.S. government expanded its sanctions against Russian oil due to the continuing Ukraine conflict, explicitly targeting crude exports from Rosneft, a Russian oil giant. The sanctions threaten secondary repercussions for international buyers, which prompted Reliance Industries to announce an immediate suspension of fresh crude procurement from Rosneft starting January 2025.

This move highlights the growing intertwining of global geopolitics and energy markets. As India relies heavily on imported crude to fuel its rapidly expanding economy, the decision by its largest refiner to distance itself from Russian barrels marks a significant shift. For context, during 2023–2024, Russian crude accounted for nearly 35% of India’s total oil imports, with Reliance being a major customer of Rosneft.

With this halt, Reliance will reallocate its sourcing, potentially increasing purchases from the Middle East, Africa, and South America. Analysts note this shift could reinforce existing supply chains, but may also lead to increased procurement costs due to reduced access to discounted Russian oil. Market participants should closely monitor the global energy landscape for resulting price volatility and trade realignment.

Ripple Effects on the Indian Refining Sector

Reliance operates the Jamnagar refining complex, the world’s largest, processing over 1.4 million barrels per day (bpd). The ban on Rosneft crude imports will require operational adjustments, such as recalibrating refinery configurations to process alternative grades. There may also be downstream pricing effects. India’s competitive refining sector, which exports significant volumes of petroleum products, may see lower profit margins if alternative feedstocks are more expensive or less suited to their infrastructure.

Meanwhile, competitors in India such as Indian Oil Corporation and Bharat Petroleum may temporarily benefit if they are able to maintain Russian oil flows at discounted rates, unless broader sanctions enforcement closes all loopholes. Investors seeking market trend analysis should pay attention to volatility in refining margins, changes in product flows, and possible government interventions to stabilize prices.

Global Oil Trade Dynamics After Indian Reliance Moves Away from Rosneft

The decision by Indian Reliance to halt crude imports from Rosneft after U.S. sanctions has wider consequences that could reshape oil trade dynamics throughout Asia and beyond. Bulk purchases from India have helped absorb sanctioned Russian crude since 2022, buffering global markets from greater disruption. As Reliance steps back, smaller refiners in Asia or the Middle East may not be able to absorb the volumes, potentially leading to Russian barrels searching for new buyers, greater price pressure on Rosneft, or shifts in discounts offered on Russian crude.

Other major energy importers such as China, which continues to buy Russian oil, might face increased scrutiny or even indirect risk exposure if sanctions enforcement tightens. OPEC+ members, particularly those in the Gulf, may see an opportunity to regain lost market share in India, leading to possible renegotiations of long-term supply contracts and pricing agreements.

Investor Outlook: Risk Factors and Strategic Considerations

For investors and portfolio managers, the long-term impact of Reliance’s decision depends on several key factors:

- Oil Price Volatility: Reduced access to discounted Russian crude may drive global prices higher, particularly for favored grades in the Asian market.

- Supply Chain Security: Reliance’s pivot to alternative suppliers could introduce logistical challenges and transitional risks, affecting operational efficiency and financial performance.

- Regulatory Environment: Stricter enforcement of secondary sanctions could trigger similar moves by other refiners, accelerating decoupling in global oil trade.

- Energy Transition: Heightened energy security concerns might prompt India and other Asian nations to accelerate renewable investments and seek broader energy diversification — a theme well-explored in our energy investing resources.

Conclusion: Navigating the New Energy Order in 2025

The strategic decision by Indian Reliance to halt crude imports from Rosneft after U.S. sanctions signals a new phase for the global oil market in 2025. With geopolitical factors increasingly dictating commercial decisions, market participants must remain vigilant. Monitoring alternative supply channels, regulatory developments, and evolving energy policies will be essential for investors seeking to manage risks and identify opportunities in a dynamic environment. As Reliance adapts, its experience will serve as a case study for how energy leaders navigate the intersection of geopolitics and commerce in an era of heightened uncertainty.