Infravision ($INFRAV) secured a surprising $91 million Series B round this week, signaling a bullish wave for aerial robotics startups as 2025 sector funding growth outpaces projections. The Infravision raises $91M Series B news caught investors’ attention amid intensifying capital flows and heightened M&A activity in robotics.

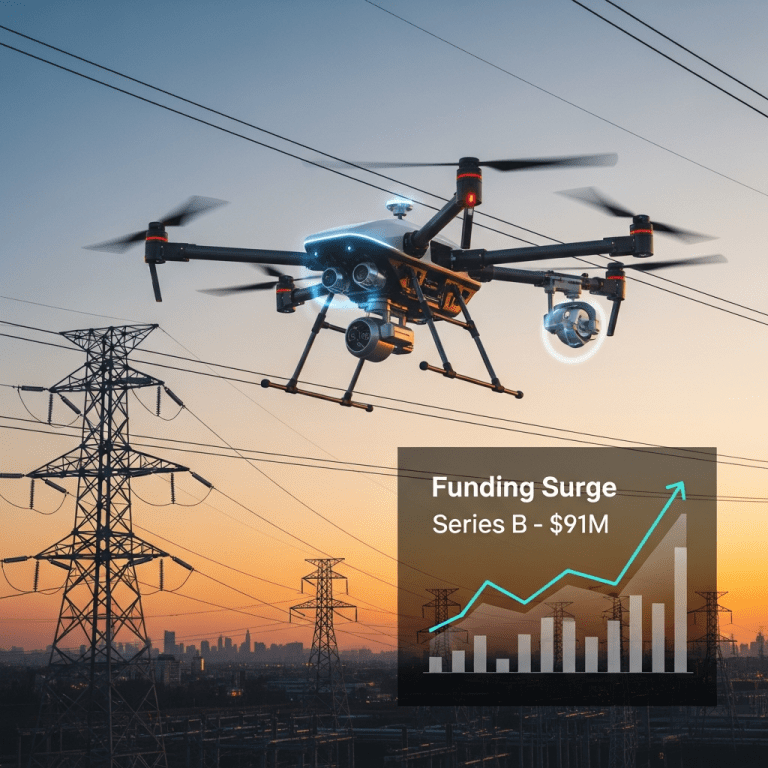

Infravision Secures $91M Series B, Doubling Valuation in 12 Months

Infravision ($INFRAV), a Sydney-based aerial robotics firm specializing in drone-enabled powerline infrastructure, confirmed it closed a $91 million Series B round on November 3, 2025. This latest raise—which more than doubles its prior $44 million Series A from November 2024—elevates the company’s post-money valuation to approximately $550 million, according to a statement released by Infravision and corroborated by TechCrunch.[1] The round, led by Tiger Global and supported by Alumni Ventures and Hostplus, marks one of the largest capital injections for a hardware-first robotics startup this year. CEO Cameron Van Der Berg revealed that proceeds will fund commercial expansion in North America and accelerated R&D for autonomous inspection drones. Industry funding data from CB Insights confirms that venture dollars in the robotics sector topped $3.4 billion year-to-date through October 2025—up 28% from the same period in 2024.[2]

Robotics Funding Boom Signals Sector Inflection Point in 2025

The surge in sector funding highlighted by Infravision’s Series B reflects a record year for robotics, with global investments surpassing most analysts’ forecasts. According to PitchBook, 2025 robotics VC investment is on pace to exceed $4.1 billion, driven by increased demand for automation in power infrastructure and logistics.[3] The energy grid modernization push, prompted by climate resilience policies in markets including the U.S. and Australia, has spawned robust acquisition activity—Edison Robotics’ $180 million buyout in July 2025 stands as the year’s largest. Meanwhile, robotics stocks in the public markets have outperformed broad tech indices, with the ROBO Global Robotics & Automation ETF rising 19% YTD as of October 31, 2025 (Bloomberg data). Early-stage startups are benefiting as utilities and industrials race to deploy AI-powered hardware solutions, a trend expected to intensify with ongoing labor shortages.

Strategies for Investors Navigating the Robotics Surge

Investors tracking the Infravision raises $91M Series B may consider broader exposure to high-growth startups and ETFs focused on automation. While upside remains compelling, volatility is elevated—recent sector valuation spikes carry risks if commercialization timelines slip or regulatory shifts slow adoption. The Infravision funding underscores the opportunity in hardware-centric robotics, contrasting with software-dominated AI plays. Diversifying holdings to include both emerging private firms and established leaders, such as ABB ($ABB) and Rockwell Automation ($ROK), can balance risk. Those seeking targeted allocation may analyze the latest financial news for M&A signals or upcoming technology showcases.Investment strategy discussions increasingly highlight robotics as a portfolio hedge against wage inflation and utility grid transformation.

Analysts See Further Growth for Robotics Amid Infrastructure Drives

Industry analysts observe that the momentum behind aerial robotics is likely to persist as utilities worldwide modernize outdated infrastructure. According to market consensus surveyed by Bloomberg Intelligence before November 2025, investor interest should remain strong, particularly as governments increase spending on climate-resilient grid technologies. Investment strategists note that continued labor shortages and regulatory support could drive sustained demand for drone-enabled automation.

What Infravision’s $91M Raise Means for Robotics Investors in 2025

The Infravision raises $91M Series B signals accelerating mainstream adoption of robotics in critical infrastructure—an early-stage opportunity for investors tracking technology-driven industrial transformation. Close attention to public-private partnerships and new deployment contracts will be key as capital continues to flow into aerial robotics and automation. For investors, Infravision’s blockbuster funding round represents both a market validation and a prompt to recalibrate exposure to this surging sector.

Tags: Infravision, robotics funding, INFRAV, Series B, automation