UniCredit ($UCG.MI) and Intesa Sanpaolo ($ISP.MI) revealed support for the digital euro initiative, urging the ECB to stagger project costs—a move that caught analysts by surprise. The Italian banks digital euro ECB costs debate intensifies as stakeholders weigh financial and regulatory implications.

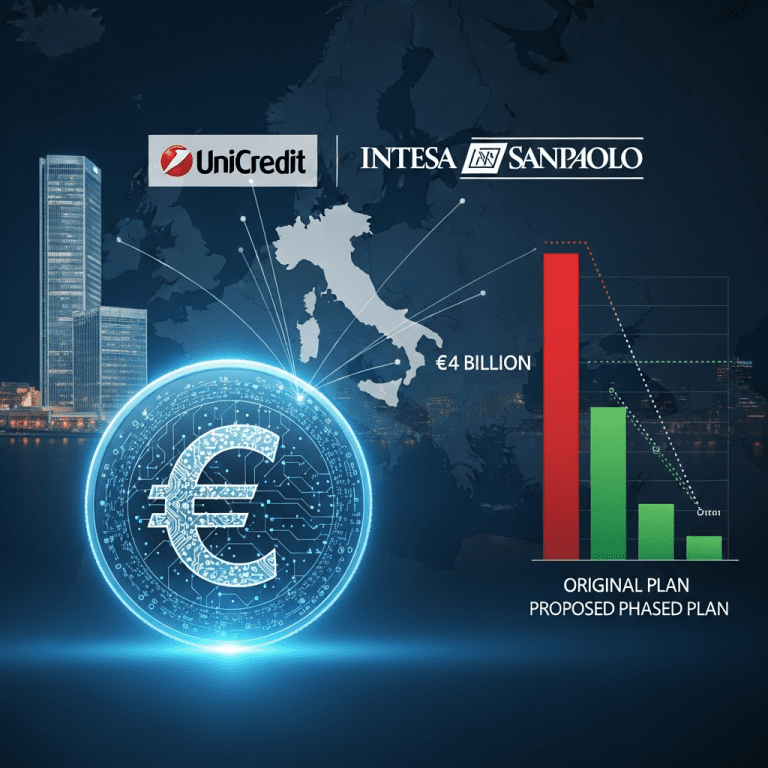

Italian Banks Urge ECB to Stagger €4B Digital Euro Costs

Leading Italian banks, including UniCredit ($UCG.MI) and Intesa Sanpaolo ($ISP.MI), have publicly endorsed the adoption of the digital euro but are pressing the European Central Bank (ECB) to distribute the estimated €4 billion in development costs over multiple years. According to a Reuters report dated November 8, 2025, the Italian Banking Association (ABI), representing over 90% of Italy’s banking assets, submitted a position paper questioning the pace and scope of cost-sharing. The ECB’s current timeline outlines initial rollout expenditures of €1.2 billion in 2026, scaling up to the full €4 billion by 2028. Italian banks argue this timeline places disproportionate strain on national institutions, especially those with limited digital infrastructure, and are pushing for a phased investment model. (Reuters)

Digital Euro Rollout Shifts European Banking Sector Dynamics

The Italian banks’ position coincides with broader eurozone debates about digital transformation and central bank digital currency (CBDC) adoption. Eurozone banks collectively reported IT investment growth rates of 9.1% YoY in 2024, driven in part by regulatory modernization and payments innovation, according to European Banking Federation (EBF) data (2024 report). The digital euro project accelerates competition among incumbent banks, neobanks, and fintechs, while prompting fresh regulation from the ECB and European Commission. Analysts caution that rapid digital euro onboarding—as suggested by the current ECB plan—could disrupt systemically important banks’ capital structures, impacting liquidity ratios and profitability across the region. Meanwhile, pilot programs in France and Germany, initiated in Q3 2024, have highlighted both operational efficiencies and cybersecurity challenges inherent to CBDC integration.

Portfolio Impact: Investor Strategies Amid Digital Euro Uncertainty

Investors tracking European financial stocks, particularly banking equities like UniCredit ($UCG.MI), CaixaBank ($CABK.MC), and Deutsche Bank ($DBK.DE), may encounter heightened volatility as digital euro implementation approaches key milestones. Potential regulatory shifts and increased IT expenditures are set to weigh on profit margins, especially for banks with below-average digitization scores. Conversely, tech-focused lenders and fintech collaborators could seize market share as transaction infrastructure pivots to CBDC standards. Those managing sector ETFs or euro-linked assets should monitor quarterly ECB communications for policy shifts. For a deep dive into related opportunities, explore cryptocurrency market trends or review latest financial news on central bank initiatives.

Analysts See Digital Euro Cost Controversy Shaping Policy Debate

Industry analysts observe that the Italian banks’ stance is amplifying debate on how ECB digital euro cost structures could influence policy within the eurozone’s fragmented banking sector. Market consensus suggests that, while phased spending is likely to reduce short-term capital impacts, delays could risk losing ground to private digital payment platforms. Strategists at Berenberg and Société Générale highlight that ongoing dialogue between the ECB and major banks will be crucial in shaping a CBDC policy that balances innovation, security, and financial stability.

Digital Euro Launch and Italian Banks Signal Shift in 2025 Investment Risks

The Italian banks digital euro ECB costs discussion highlights a pivotal shift for eurozone financial markets as regulatory dynamics reshape risk assessment and capital allocation. Investors should closely watch ECB decisions on cost phasing and national implementation timelines, as these will determine sector winners and laggards heading into 2026. For those navigating digital finance evolution, careful attention to project milestones and policy updates will be essential in the coming quarters.

Tags: digital euro, ECB, Italian banks, UniCredit, crypto policy