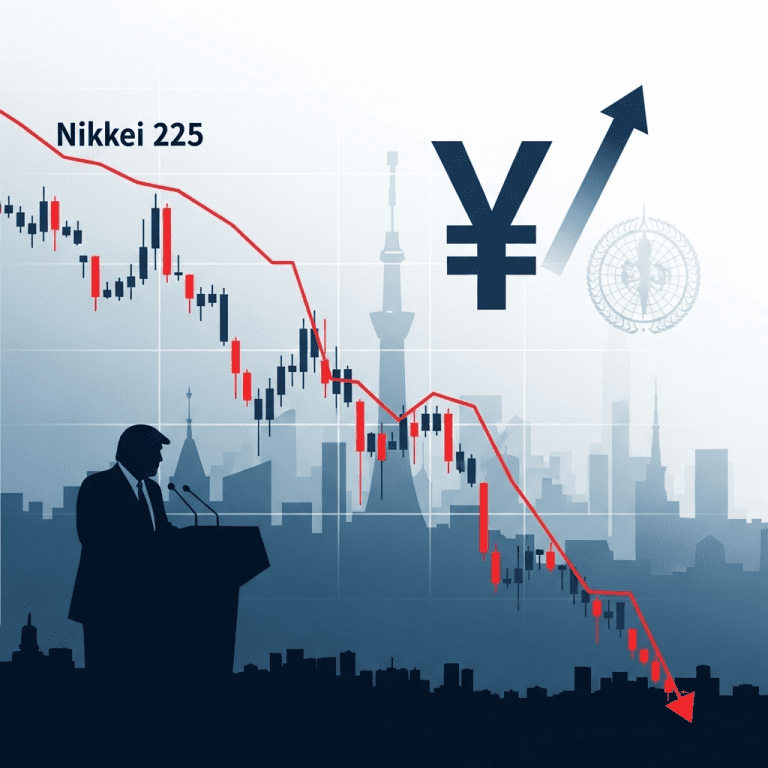

Japan’s stocks slip from peak on yen strength after Trump visit, signaling renewed currency turbulence and its impact on Japanese equities. Investors are re-evaluating risk as the Nikkei retreats from highs, reflecting shifting market dynamics post high-level diplomacy.

What Happened

Japan’s stocks slip from peak on yen strength after Trump visit— the Nikkei 225 Index fell 1.8% to close at 39,370.27 Tuesday, retreating from its historic high set just days earlier. According to data from Bloomberg, the Topix also slid 1.3% as the yen strengthened sharply, touching 140.92 per dollar, its highest level in nearly five months. The move followed former U.S. President Donald Trump’s closely watched trip to Tokyo, where he met with Prime Minister Fumio Kishida, stoking speculation about evolving United States-Japan trade policy and defense cooperation. Market participants cited Trump’s hawkish rhetoric on currency manipulation and his calls for a stronger yen as key triggers for the sudden shift. Meanwhile, major exporters like Toyota (7203.T) and Sony (6758.T) retreated, underscoring the sensitivity of Japan’s equities to foreign exchange dynamics.

Why It Matters

The yen’s rebound after Trump’s visit highlights Japan’s persistent vulnerability to currency volatility. A stronger yen diminishes the overseas profits of Japanese exporters when translated back to local currency, typically putting downward pressure on stock valuations. Historically, major policy signals from U.S. leaders have swayed the yen— most notably during prior episodes of trade negotiation uncertainty. According to analysts at Nomura Securities, persistent political risk, coupled with renewed scrutiny of the currency markets, challenges the bullish narrative that has propelled the Nikkei to record levels. As global funds weigh Japan’s role in international portfolios, yen strength could deter further inflows.

Impact on Investors

The rapid reversal in Japanese equities following the Trump visit underscores heightened volatility and the importance of global macro drivers for investors. Key tickers like Toyota (7203.T), Sony (6758.T), and Fast Retailing (9983.T) posted declines, while the broader Topix Index mirrored this pullback. According to market strategist Aika Yoshino of Daiwa Securities, “Short-term traders need to reassess currency hedges and monitor policy headlines, as yen appreciation may compress export-led earnings forecasts.” Sectors reliant on exports— such as automotive, electronics, and machinery— face immediate risk, while domestic-oriented firms may outperform. For investors looking for strategic market analysis, ThinkInvest’s investment insights highlight the role of yen dynamics in short-term Japan opportunities.

Expert Take

Analysts note that sharper yen moves, especially following high-profile diplomatic events, present dual risks: earnings pressure for exporters and broader sector rotation. Market strategists suggest maintaining a diversified approach, with exposure to domestically-focused industries serving as a buffer.

The Bottom Line

Japan’s stocks slip from peak on yen strength after Trump visit, underscoring the critical link between policy developments, currency markets, and equity performance. For active investors, watching both diplomatic signals and FX trends is key as the Japanese market searches for its next catalyst. For timely updates and deeper context, see ThinkInvest’s market analysis and explore currency volatility resources.

Tags: Japan stock market, yen strength, Trump visit Japan, Nikkei 225, currency volatility.