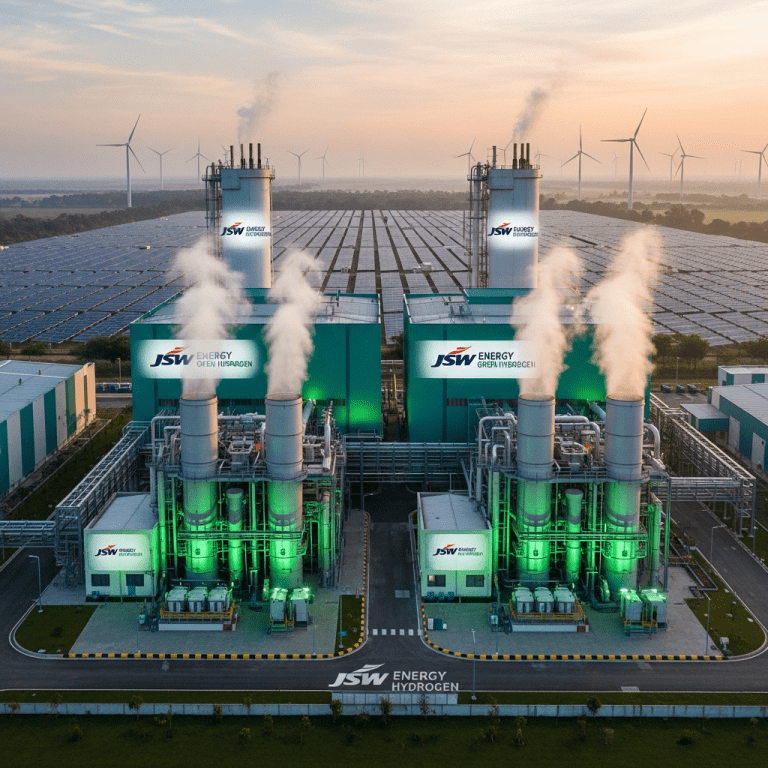

JSW Energy ($JSWENERGY) revealed the commissioning of India’s first industrial-scale green hydrogen plant, marking a major step in the nation’s clean energy ambitions. The focus keyphrase ‘JSW Energy green hydrogen plant’ highlights this game-changing move that caught analysts by surprise given its earlier-than-expected timeline.

JSW Energy Opens 350 Tonne Green Hydrogen Facility Ahead of Schedule

JSW Energy ($JSWENERGY) formally commissioned a 350-tonne per annum green hydrogen manufacturing plant in Maharashtra on November 15, 2025—six months ahead of its projected launch. The facility deploys 40 MW of renewable-powered electrolyzers and is expected to generate over 1,000 tonnes of green hydrogen annually once ramped to full capacity by 2026, according to the company’s official statement (JSW Energy Press Release, Nov 15, 2025). The initiative positions JSW Energy among Asia’s early-movers in commercial green hydrogen, with shares rising 4.1% to ₹408.20 on the National Stock Exchange following the announcement (Reuters, Nov 15, 2025).

Why Green Hydrogen Signals a Shift in India’s Energy Sector

The commissioning of the JSW Energy green hydrogen plant underscores a rapid transformation under India’s National Green Hydrogen Mission, which targets 5 million tonnes of annual capacity by 2030, as per the Ministry of New and Renewable Energy (MNRE, 2024). Until now, India’s hydrogen supply was dominated by grey hydrogen sourced from natural gas; green hydrogen’s share stood below 2% in 2024. This launch could accelerate industry adoption, especially across refining and steel, where decarbonization is a growing priority. The International Energy Agency (IEA) forecasts global green hydrogen demand to triple by 2030, driven by such industrial projects (IEA Hydrogen Market Report, 2024).

How Investors Can Capitalize on India’s Green Hydrogen Push

Investors in Indian clean energy are now positioned to reassess portfolios as capital begins to flow into green hydrogen infrastructure. JSW Energy ($JSWENERGY) has signaled plans to expand capacity, potentially catalyzing upstream equipment makers and grid technology suppliers. Long-term investors may see opportunity in the growing pipeline of green hydrogen projects, which received total investment commitments exceeding $3.4 billion in India by mid-2025 (Bloomberg, July 10, 2025). Key sector players, including Tata Power ($TATAPOWER) and Reliance Industries ($RELIANCE), have already outlined similar ventures, indicating a broad energy market shift. For deeper energy sector trends, see stock market analysis and related latest financial news on ThinkInvest.

What Analysts Expect After JSW Energy’s Hydrogen Breakthrough

Industry analysts observe that JSW Energy’s early commissioning demonstrates both technical feasibility and investor confidence in India’s nascent hydrogen sector. Market consensus suggests regulatory support—such as production incentives and purchase mandates—will play a decisive role in scaling up new projects. As more corporate buyers seek low-carbon hydrogen to meet emissions targets, upstream suppliers and green energy developers are likely to draw increased institutional interest.

JSW Energy Green Hydrogen Plant Signals New Era for Investors

The successful start of the JSW Energy green hydrogen plant marks a pivotal point for India’s transition to low-carbon industry. Investors should watch for updates on production ramp-up, evolving government incentives, and downstream adoption in steel or chemicals. As green hydrogen moves from pilot to industrial scale, this focus keyphrase will shape energy portfolios and present both new risks and opportunities.

Tags: JSWENERGY, green hydrogen, clean energy, India energy sector, energy transition