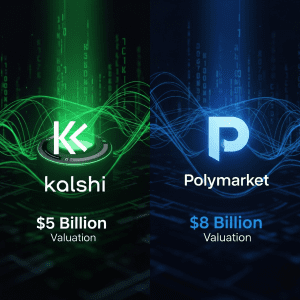

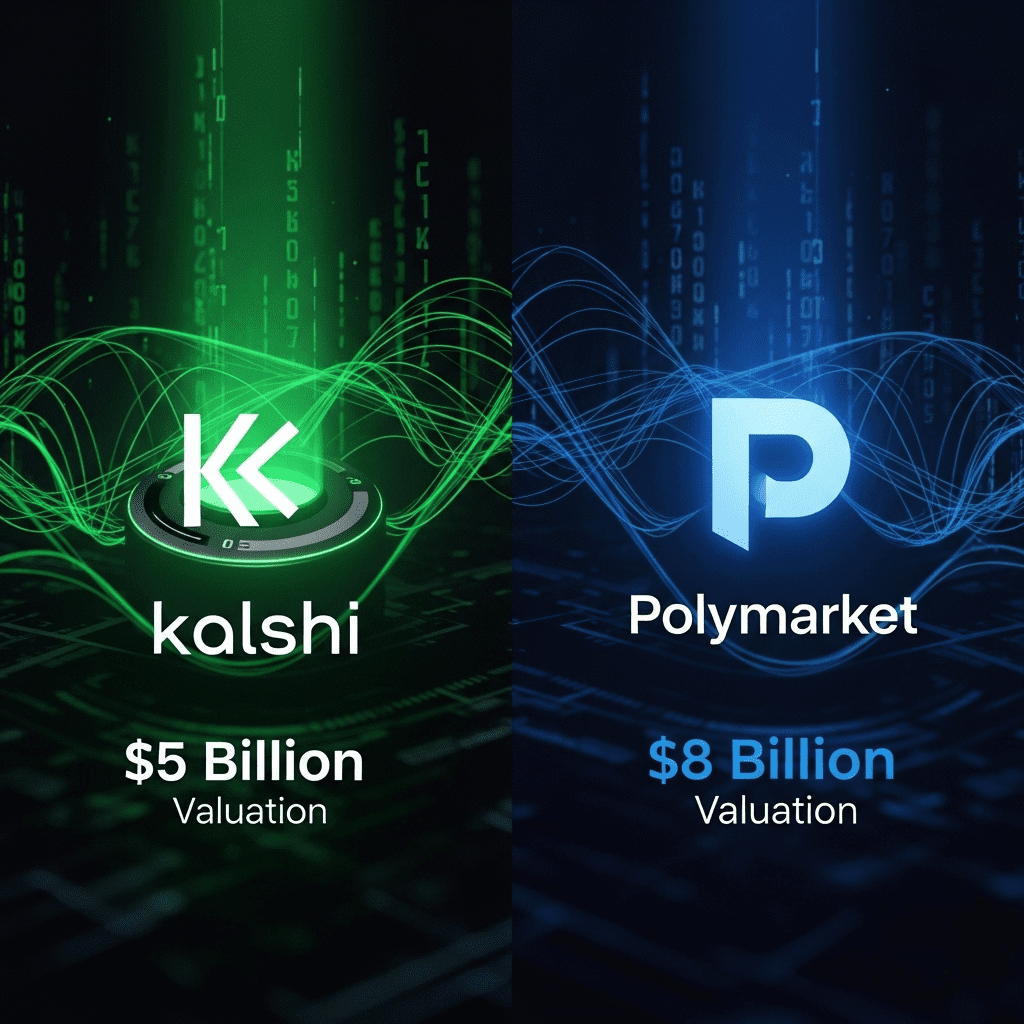

In an unprecedented week for event prediction markets, Kalshi hits $5B valuation after a major funding round, hot on the heels of rival Polymarket announcing a landmark $2B New York Stock Exchange (NYSE) backing at an $8B valuation. This remarkable series of developments signals a transformative era for prediction market technology and investor confidence in 2025.

Kalshi Hits $5B Valuation: What Sets It Apart?

Kalshi’s $5B valuation marks a pivotal moment in the evolution of event trading platforms. As regulatory clarity improves and tech adoption accelerates, Kalshi’s fully CFTC-regulated status is a compelling differentiator compared to other competitors, including Polymarket. By combining fintech innovation with rigorous compliance, Kalshi positions itself as a transparent venue where both retail and institutional investors can legally speculate on real-world events — from Fed rate decisions to geopolitical outcomes.

The Competitive Dynamics with Polymarket

Polymarket’s recent $2B NYSE investment at an $8B valuation represents not just substantial capital backing but also Wall Street’s growing acceptance of decentralized, blockchain-powered prediction platforms. While Polymarket remains technically offshore and unregulated by U.S. standards, its rapid user growth and strategic partnerships have propelled it into the global spotlight. The Kalshi-Polymarket rivalry underscores the market’s binary split: compliance-focused U.S. platforms versus borderless, blockchain-native alternatives.

The Expanding Landscape: Event Prediction Markets in 2025

With Kalshi hits $5B valuation, the event prediction market faces a new era of legitimacy and scale. 2025 promises accelerated mainstream adoption as investors seek alternatives to traditional asset classes. Prediction markets, once seen as fringe or niche, are earning their place alongside established financial products.

This shift is evident in rising trading volumes, major venture capital interest, and institutional attention. For those exploring diversified alternative assets, event markets offer dynamic risk exposure uncorrelated to stocks or bonds, appealing for growth-minded portfolios.

Regulatory Momentum and the Future

Much of Kalshi’s success rests on its proactive engagement with U.S. regulators. By securing Commodity Futures Trading Commission (CFTC) approval, Kalshi has blazed a trail many fintech startups aim to follow. In contrast, Polymarket continues to face scrutiny from U.S. authorities, leading some traders toward Kalshi for regulatory peace of mind. This compliance-first approach may help Kalshi attract large institutional players seeking exposure with minimized legal risk.

However, the gap between regulated and decentralized prediction markets won’t close overnight. Users still value the global, crypto-native accessibility of platforms like Polymarket. For investors seeking diversified market analysis, understanding this dichotomy is crucial when evaluating long-term opportunities in the space.

Investor Response to Kalshi Hitting $5B Valuation

The market’s response to Kalshi’s valuation milestone has been overwhelmingly positive. Venture capital firms, fintech funds, and individual investors alike view these developments as validation of the prediction market model. With the regulatory landscape caught up and the public appetite for alternative information-driven investing on the rise, both Kalshi and Polymarket could see significant user and revenue growth in 2025 and beyond.

Implications for Technology and Financial Markets

The technological underpinnings of both Kalshi and Polymarket set a strong precedent for future finance-focused innovation. Kalshi’s blend of traditional trading infrastructure and compliance software appeals to conservative investors, while Polymarket’s decentralized blockchain model caters to crypto-forward market enthusiasts. For those interested in keeping pace with next-generation fintech, tuning into technology trends around prediction markets is a sound strategy.

As these companies continue to innovate, their impact will extend beyond betting and speculation — shaping new market structures, reforming data gathering methods, and redefining how opinions and information are monetized in the financial system.

Conclusion: The Road Ahead After Kalshi Hits $5B Valuation

As Kalshi hits $5B valuation days after Polymarket secured NYSE backing at $8B, event-driven trading platforms are stepping firmly into the financial mainstream. Regulation, technology, and investor enthusiasm are converging to foster a dynamic new marketplace for speculators and data seekers alike. Whether the future belongs to compliance-led innovators like Kalshi or agile, decentralized disruptors like Polymarket, one thing is clear: event prediction markets are poised to be a cornerstone of technology and finance in 2025 and beyond.