As retirement planning becomes more crucial in the face of economic uncertainty, many Americans are searching for ways to maximize their nest egg. One increasingly attractive strategy is relocating to states with zero tax on retirement income in 2025. For retirees, understanding which states allow them to keep every dollar of their hard-earned savings can make a significant difference in long-term financial well-being.

Why Choose States With Zero Tax on Retirement Income in 2025?

Retirees face various tax obligations, from Social Security income to withdrawals from IRAs and 401(k)s. However, certain states stand out by levying no state income tax—or by fully exempting retirement income from taxation—helping stretch every retirement dollar further. In 2025, the landscape is even more advantageous, with several states clarifying their policies to welcome retirees. Identifying these havens is key for those looking to boost cash flow and safeguard against inflation or health care costs.

The Benefits of Tax-Free Retirement Income

Choosing a state without retirement income taxes comes with several compelling financial benefits:

- Enhanced Savings: Retirees can retain a larger portion of Social Security, pensions, and investment income.

- Predictable Budgeting: Without state tax deductions, future income projections become more reliable.

- Appealing for Estate Planning: Keeping your money in tax-friendly states simplifies legacy planning for heirs.

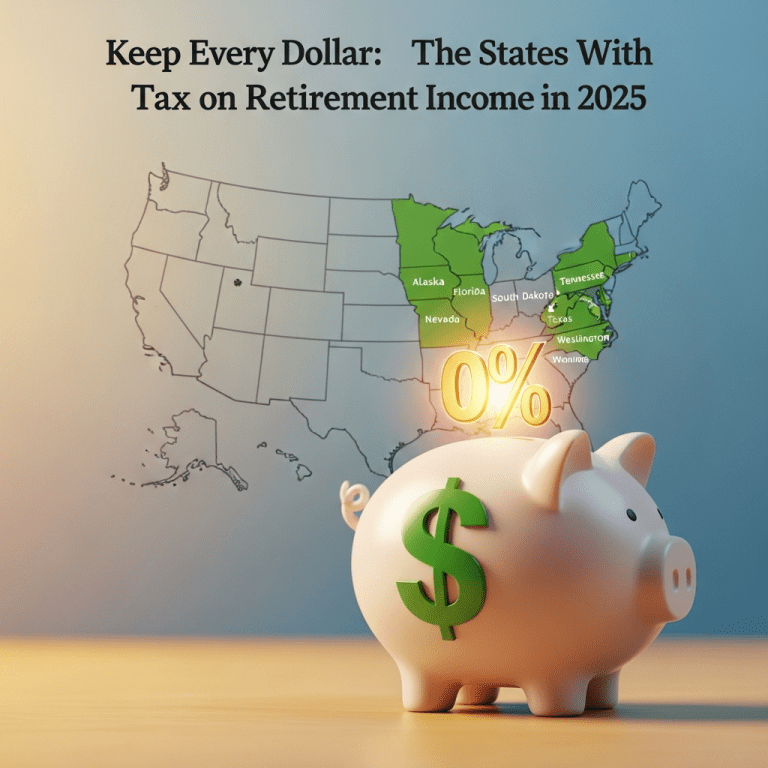

The Complete List: States With Zero Tax on Retirement Income in 2025

As of 2025, the following states stand tall as the most tax-friendly for retirees, offering zero state tax on retirement income:

- Alaska: No state income tax and no state sales tax (though some municipalities may charge sales taxes).

- Florida: A classic retiree haven, Florida imposes no personal income tax whatsoever, making it a top choice for sun-seeking savers.

- Nevada: Known for its favorable gambling laws, Nevada also charges no state income tax, including on retirement income.

- South Dakota: Enjoy zero tax on retirement income and a low overall tax burden for residents in the Mount Rushmore State.

- Tennessee: As of 2021, Tennessee eliminated its tax on interest and dividends; there is no longer any tax on retirement income.

- Texas: No state income tax means all forms of income—including retirement distributions—are kept intact.

- Washington: While there is no personal income tax, Washington does tax some capital gains but not typical retirement distributions.

- Wyoming: Consistently ranking high for retirees, Wyoming has no state income tax and low property taxes.

Other states, like Illinois, Mississippi, and Pennsylvania, exclude most retirement income—such as Social Security and qualified pensions—even though they do have a state income tax. These can also be attractive, though not truly zero-income-tax states.

Evaluating the Full Tax Landscape

While states with zero tax on retirement income in 2025 make an immediate appeal, it’s essential to consider the broader tax landscape. Property taxes, sales taxes, and local tax rates may offset some benefits. Alaska and Wyoming, for instance, have low overall tax burdens, but local costs of living and healthcare availability remain critical considerations for relocating retirees.

Retirement Planning Beyond State Taxes

State income tax is a major factor, but savvy retirees also evaluate:

- Healthcare Access: Proximity to quality healthcare providers and specialists can be just as important as tax rates.

- Cost of Living: Housing, utilities, and expenses like car insurance may vary greatly by state and region.

- Quality of Life: Cultural amenities, climate, and proximity to family all factor into choosing the ideal retirement destination.

For those moving assets, it’s wise to consult with a fiduciary or tax professional. Evaluating benefits within the context of your unique retirement plan ensures a smooth transition. Also, review state policies annually for legislative changes that may affect retirement taxation.

Key Takeaways for Retirees

The choice to relocate to one of the states with zero tax on retirement income in 2025 can preserve wealth and improve financial security for years to come. Before making a decision, compare total tax burdens by using interactive tools and official state resources. For deeper investment insights and strategy comparisons, comprehensive retirement planning guides can help you weigh all factors relevant to your situation.

Navigating Your Retirement Move

As you plan your next chapter, keep in mind that zero tax does not necessarily equal zero worries. Research local options, visit potential new hometowns, and use retirement calculators to model the financial impact of relocation. For personalized guidance, consider working with a Certified Financial Planner who understands the nuances of states with zero tax on retirement income in 2025 and can help optimize your tax strategy.

For more resources on optimizing your financial future, explore additional retirement strategies from industry experts.