Prime Video ($AMZN) revealed the Maxton Hall season 2 release date for episodes 1-3, stirring surprise among subscribers. The focus keyphrase, Maxton Hall season 2 release date, headlines unexpected early access for viewers. What does this mean for investors as streaming strategies evolve?

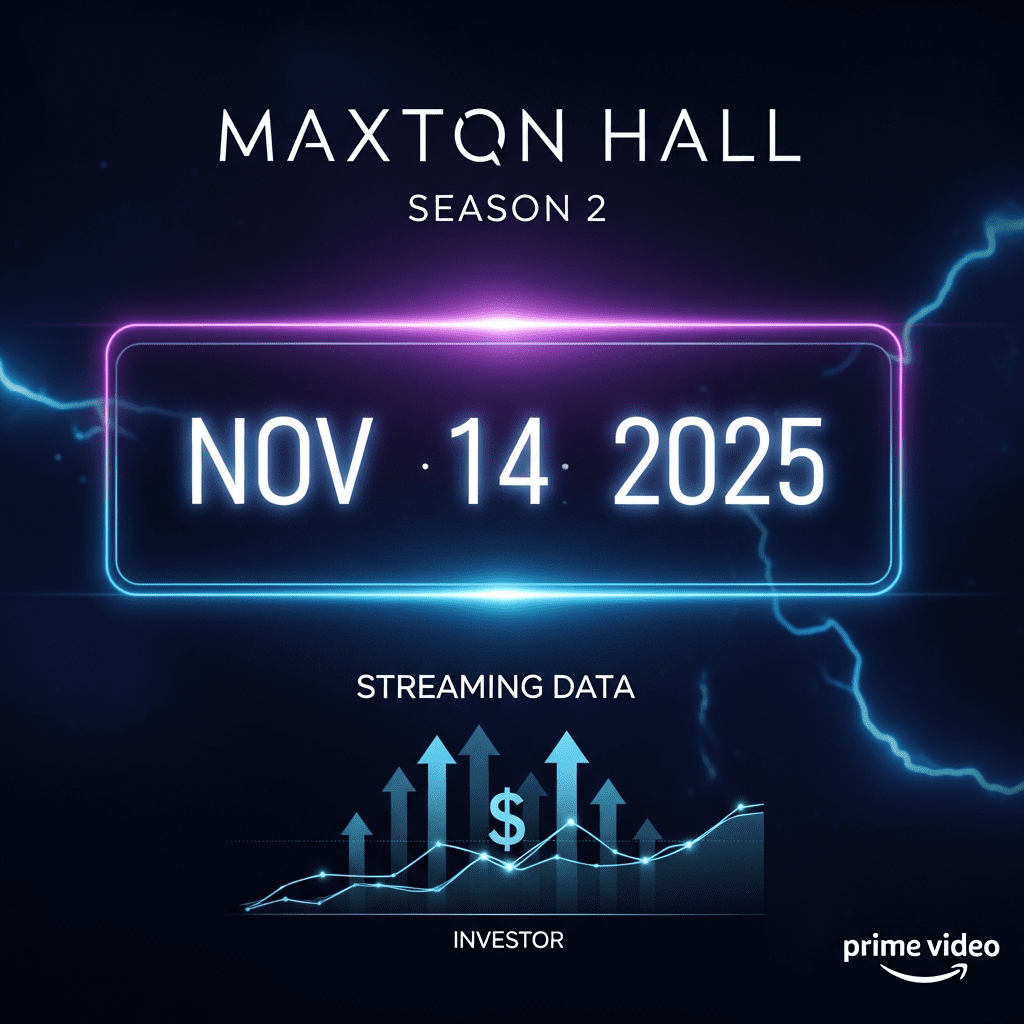

Prime Video Sets November 14, 2025 Launch for Maxton Hall S2 E1-3

Amazon’s Prime Video ($AMZN) confirmed that Maxton Hall season 2 episodes 1 to 3 will premiere globally on November 14, 2025, nearly two weeks ahead of industry forecasts. According to Variety (October 2025), the accelerated schedule reflects a strategic pivot toward event-based streaming launches. The surprise comes as Maxton Hall averaged 6.8 million global streams in its debut season, with season 2’s early rollout aimed at driving Q4 subscriber engagement. Prime Video’s official statement on November 2, 2025, emphasized that episodes 4-6 will follow with weekly releases, creating a hybrid binge-and-anticipation model.

Streaming Market Shifts: Early Releases Drive Subscriber Growth

The advanced launch of Maxton Hall season 2 underscores a larger trend in the competitive streaming sector. Ampere Analysis data (September 2025) revealed that platforms using early multi-episode drops saw a 13% faster new user acquisition rate compared to single-episode debuts. For Amazon’s $27.7 billion streaming division (2024 annual report), series like Maxton Hall act as critical levers, particularly in international markets where localized content drives 22% of new subscriptions. The move places pressure on rivals such as Netflix ($NFLX) and Disney+ ($DIS) to reconsider their content cadence as subscriber churn in Q3 2025 rose by 2.1 percentage points across the top five platforms (Statista, October 2025).

Investor Strategies: Adapting Portfolios to Streamer Content Releases

Investors tracking Amazon ($AMZN) can anticipate potential share volatility as Prime Video’s programming choices impact both revenues and audience retention. The early Maxton Hall release may lead to a short-term lift in ARPU (Average Revenue Per User), a metric that rose 4.6% YoY in Q2 2025 per company filings. For those holding streaming sector ETFs or tech-heavy indexes, incorporating such stock market analysis offers insight into cyclical subscriber trends. Diversified investors may look to rebalance portfolios, factoring in latest financial news about content-driven surges and the related impacts on ad revenue. Traders should also watch for ratings, social sentiment, and subscriber guidance updates following release weekends, as short-term movement in $AMZN often aligns with high-profile streaming debuts.

What Analysts Expect for Amazon After Maxton Hall’s Release

Industry analysts observe that Prime Video’s multi-episode launches could accelerate Q4 2025 content spending but likely improve cost-per-acquisition via event-driven subscriber spikes. Market consensus (per MoffettNathanson, October 2025) suggests Amazon will leverage Maxton Hall momentum to exceed its projected 19% YoY digital content growth. Investment strategists note that timing high-profile international dramas around holidays historically boosts app downloads and retention, possibly lifting overall platform engagement above the Q4 sector average of 82 minutes per session.

Maxton Hall Season 2 Release Date Signals Streaming Strategy Shift

The Maxton Hall season 2 release date on Prime Video underscores Amazon’s evolving approach to content drops aimed at maximizing engagement and reducing churn. Investors should monitor subscriber trends and revenue metrics as these strategies reshape platform economics. The early global launch could set a new standard for streaming timelines, presenting both risks and opportunities into early 2026.

Tags: Maxton Hall, AMZN, streaming, release date, subscriber growth