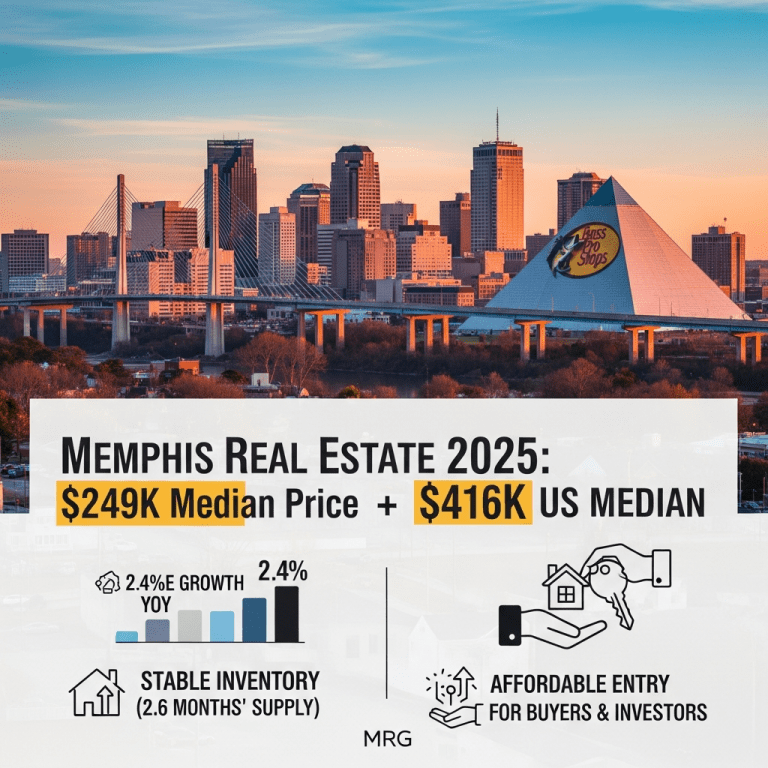

Memphis Realty Group ($MRG) revealed that the Memphis real estate market 2025 continues to offer standout value, with median home prices stabilizing at $249,000—far below the U.S. average. As other metro areas eclipse $400,000, Memphis defies national trends, attracting cautious buyers and investors seeking opportunity in a tightening housing landscape.

Memphis Home Prices Hold at $249K as U.S. Median Surges to $416K

In October 2025, Memphis homebuyers benefit from a median sale price of $249,000, according to Redfin and Greater Memphis Association of Realtors data. This figure edges up just 2.4% year-over-year, contrasting sharply with the national median of $416,100, which climbed 5.1% from 2024 (National Association of Realtors, September 2025). Local transaction volumes have remained resilient, with 1,215 homes sold in September 2025—a modest 1.7% year-on-year dip—while some U.S. cities saw double-digit declines. Inventory stands at a balanced 2.6 months’ supply, alleviating the supply crunch plaguing cities like Austin and Denver.

Why Affordability Sets Memphis Apart in 2025 Housing Markets

Broader U.S. housing markets are strained by surging mortgage rates—averaging 7.2% for 30-year fixed loans in October 2025, per Freddie Mac. Many coastal markets such as San Jose and Boston now face median prices exceeding $1 million, pricing out first-time buyers. In contrast, Memphis maintains relative affordability, with a home-price-to-income ratio of 3.5, compared to 5.8 nationally. Historically, Memphis weathered the post-pandemic speculative surge with lower volatility: peak-to-trough declines in 2022–2023 stayed under 1.5%, per Zillow, while other cities experienced 10%+ corrections. According to a 2025 Realtor.com market report, Memphis rents have also stabilized at $1,315/month—less than half of large coastal metros—attracting both buyers and investors seeking yield.

Actionable Strategies: Navigating Memphis Real Estate Opportunities

Investors and homebuyers eyeing Memphis can leverage the market’s steady inventory and affordability metrics. Long-term investors targeting rental income may find cap rates averaging 6.1%—substantially outpacing national averages in 2025 (Moody’s Analytics). Entry-level buyers can access FHA-backed loans with a relatively low average down payment of $14,900, easing barriers amid high rates. Tracking local job growth—Memphis added 8,450 nonfarm jobs in Q3 2025 (U.S. Bureau of Labor Statistics)—provides further context for sustainable price growth and rental demand. For in-depth latest financial news or broader investment strategy considerations in shifting housing cycles, investors should assess evolving policy and macroeconomic risks as well.

What Analysts Expect Next for Memphis Real Estate Market

Market consensus suggests Memphis will retain its value advantage into early 2026, supported by steady in-migration and stable employment data. Industry analysts observe that local supply constraints remain moderate compared to headline-driven markets. While mortgage rates could weigh further on buyer demand, investment strategists note that Memphis’s low entry costs continue to shield it from the sharper corrections seen elsewhere.

Memphis Real Estate Market 2025 Signals Buying Potential Ahead

As the Memphis real estate market 2025 sustains affordability against national and regional headwinds, both first-time buyers and yield-focused investors should keep watch. Key indicators—including stable pricing, resilient volume, and job growth—suggest continued relative strength. The market’s combination of value and steady fundamentals may signal new opportunities as tightening conditions reshape U.S. housing.

Tags: Memphis, real estate, housing market, MRG, affordability