More supertankers divert after U.S. sanctions hit Chinese oil port, sending shockwaves across global energy markets and prompting investors to reassess maritime risk and crude supply chains entering 2025. The new sanctions, imposed in response to alleged violations related to sanctioned Iranian shipments, have rapidly reconfigured traditional tanker routes and heightened volatility in oil pricing and logistics.

More Supertankers Divert After U.S. Sanctions Hit Chinese Oil Port: A Disrupted Supply Chain

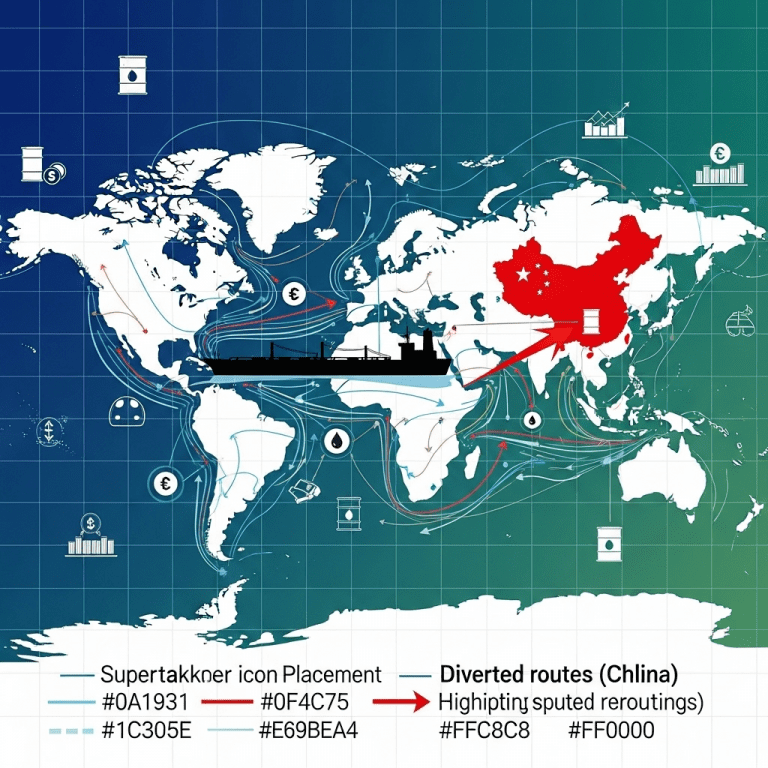

The White House’s latest sanctions against China’s Qingdao port, a strategic hub for crude imports and a key gateway for Asian energy demand, have forced dozens of very large crude carriers (VLCCs) and other supertankers to reroute. The affected vessels, many flagged by third-party states, are now navigating longer, costlier paths to deliver crude from the Middle East and Africa to East Asian refineries. Market intelligence platforms confirm that since the sanctions were implemented in late Q2 2025, tanker traffic bound directly for Qingdao has dropped by over 40%, while alternative Chinese ports and regional transshipment hubs are seeing sharp upticks in arrivals.

Impact on Global Crude Market Dynamics

This redrawing of the maritime oil map reverberates well beyond China. Crude futures have responded with heightened volatility: Brent prices climbed nearly 6% over two weeks as traders priced in extended delivery times and mounting uncertainty over Asian oil flows. Industry analysts warn that persistent rerouting could tighten available tanker supply and increase freight costs globally, squeezing refinery margins in China, South Korea, and Japan.

The logistical strain is exacerbated by China’s immense role as the world’s number one crude importer. According to data tracked by the International Energy Agency (IEA), China imported over 11 million barrels per day in 2024. With Qingdao previously handling over 15% of these flows, disruptions here send ripple effects from commodity exchanges in Singapore to shipping insurance markets in London. For more on related energy market shifts, see our investment strategy resources.

Sanctions Evasion Tactics and Enforcement Challenges

Shipping companies and traders are seeking workarounds amid compliance uncertainty. Some vessels are declaring alternative destinations to avoid scrutiny, then conducting mid-sea transfers to ultimately reach Chinese buyers. Others are leveraging new partnerships in Southeast Asian ports. Yet, satellite tracking and advanced AI-based cargo manifests analysis are making such strategies less effective; U.S. Treasury and international enforcement agencies are increasing their monitoring, warning that secondary sanctions could be imposed on shippers and insurers facilitating prohibited trade.

Legal experts from top maritime law firms note that risk management has become paramount. “Every player along the chain – from ship owners to banks financing cargo – faces an enhanced due diligence burden in 2025,” says maritime consultant Lily Miros. For a look at risk management best practices in volatile environments, explore our financial education hub.

Geopolitical and Investment Implications of Supertanker Diversions

The focus on the phrase ‘more supertankers divert after U.S. sanctions hit Chinese oil port’ highlights the scale of the disruption. As delays mount, energy importers may accelerate their efforts to diversify supplier portfolios, and Asian governments could ramp up oil stockpiling to buffer against further shocks. Meanwhile, U.S. diplomatic efforts to squeeze Iranian oil revenues through Chinese chokepoints have placed shipping, insurance, and even shipbuilding companies into the limelight for investors evaluating geopolitical risk. Advisory groups suggest that this growing regulatory scrutiny may spark innovation in maritime logistics and technology, including greater reliance on blockchain-based cargo verification and predictive supply chain analytics.

What Investors Need to Watch in 2025

The rerouting of oil tankers is likely to persist as long as the U.S. maintains pressure on Chinese ports engaged in sanctioned trade. The implications for oil prices, energy equities, and global shipping stocks are profound. Analysts recommend closely tracking tanker movement data, freight rate indices, and the responses from major Chinese refiners. If sanctions spill over to additional ports or related industries, expect heightened market swings and rapid rotation of capital within the energy sector.

For those looking for actionable guidance amidst the volatility, our in-depth market outlook reports offer timely data and scenario analysis tailored for institutional and individual investors alike.

Conclusion: A New Era of Energy Market Complexity

In sum, the fact that more supertankers divert after U.S. sanctions hit Chinese oil port illustrates how interconnected geopolitics and global energy supply chains have grown. As monitoring and enforcement intensify, expect evolving strategies from all sides—shippers, refiners, traders, and policymakers—making flexibility and data-driven decision-making essential for industry watchers and investors as 2025 unfolds.