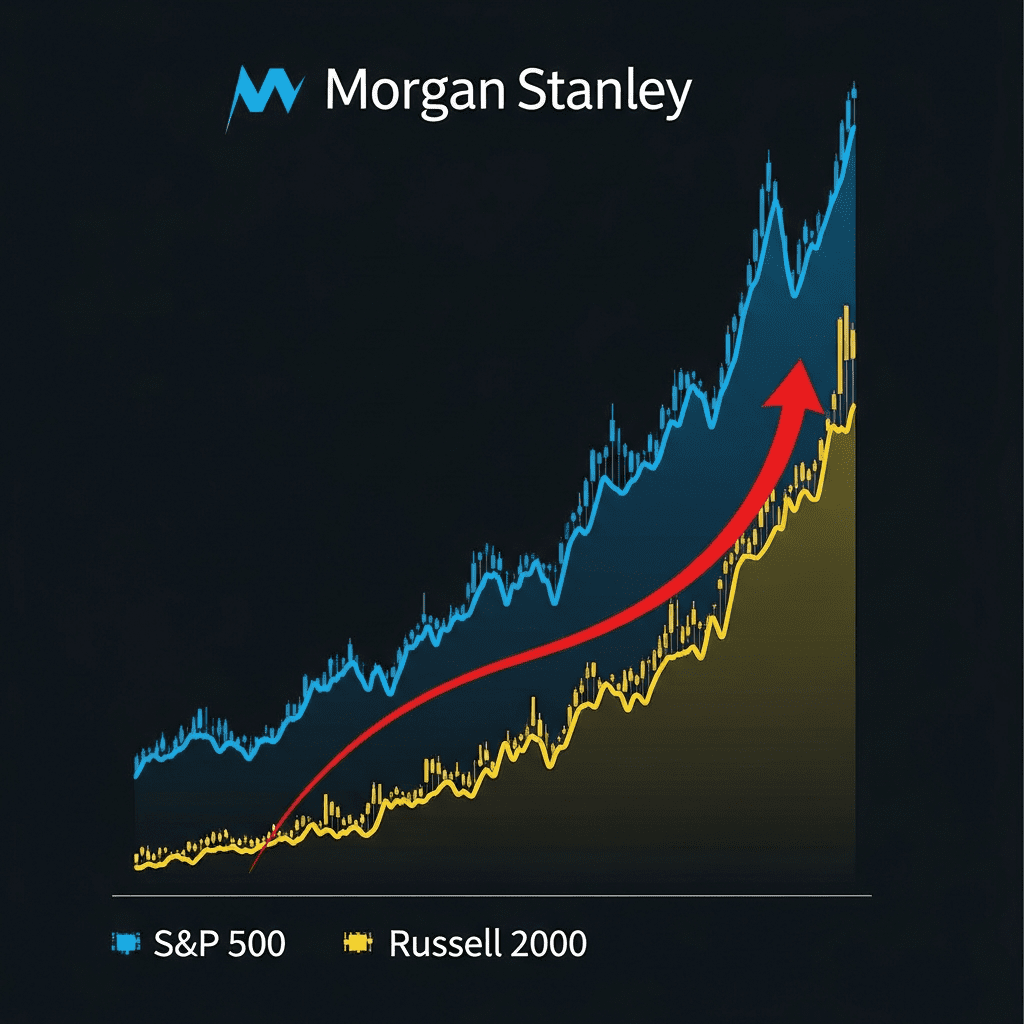

Morgan Stanley ($MS) revealed fresh optimism for U.S. small-cap stocks in its latest research note, despite the Russell 2000 trailing the S&P 500 by nearly 22% year-to-date. This Morgan Stanley small-cap stock outlook upends consensus, hinting that overlooked segments could soon lead the market higher.

Morgan Stanley Highlights Undervalued Small-Cap Opportunity in 2025

Morgan Stanley’s U.S. equity strategy team pointed to the Russell 2000 Index ($RUT) falling 4.8% year-to-date through October 31, 2025, while the S&P 500 ($SPX) gained 17.1% over the same period, per Bloomberg data. The bank emphasized that small caps now trade at a median forward price-to-earnings (P/E) ratio of 14.2 versus the S&P 500’s 20.1, representing a 30% valuation gap—the widest in more than two decades. Aggregate trading volumes in small-cap ETFs like the iShares Russell 2000 ETF ($IWM) surged by nearly 35% in late October, signaling renewed investor attention according to Cboe Global Markets data.

Why Small-Cap Stocks Lag and What Could Spark a Turnaround

The sharp divergence between small and large-cap U.S. equities throughout 2025 mirrors patterns seen during previous rate-hiking cycles, with investors favoring megacaps such as Apple ($AAPL) and Microsoft ($MSFT). According to FactSet, small-cap earnings growth estimates were cut by 9% since January, compared to just 3% for large caps. However, cooling inflation and potential Federal Reserve pivot toward rate cuts could ease borrowing costs—a major pain point for heavily indebted small-cap companies. Historically, periods following Fed pauses have seen small-caps outperform, rising an average of 14% in the 12 months post-pause since 1990 (per Jefferies, September 2023).

How Investors Can Position Portfolios for a Small-Cap Rebound

For diversified portfolios, Morgan Stanley recommends a gradual exposure shift toward quality small-cap stocks—particularly those in industrials and technology with robust balance sheets. Investors seeking tactical plays may consider ETFs such as iShares Russell 2000 ($IWM) or actively managed small-cap funds, given elevated volatility and stock dispersion. Caution remains warranted: high-yield spreads remain 110 basis points above their five-year average, flagging risk for weaker names. Active strategies that emphasize earnings resilience can help manage downside. For more on aligning allocations to evolving market risks, see our in-depth stock market analysis and the latest financial news updates on shifting sector trends.

What Analysts Expect Next for U.S. Small-Cap Equities

Investment strategists note early signs of flows returning to small-cap ETFs since late Q3 2025, with nearly $6.2 billion in net inflows recorded in October alone, per Morningstar. According to analysts at Morgan Stanley and Bank of America, sustained economic growth and a more accommodative Fed could drive small-cap outperformance through mid-2026, though volatility is expected to remain high. Industry analysts caution that meaningful upside will likely depend on a clear earnings recovery and greater macroeconomic clarity.

Morgan Stanley Small-Cap Stock Outlook Signals Opportunity Ahead

The Morgan Stanley small-cap stock outlook suggests that undervalued equities may soon lead after years of underperformance. Investors should monitor upcoming Fed policy and earnings season for early inflection points. Those able to weather volatility and focus on quality may benefit most from this emerging opportunity in the U.S. stock market.

Tags: Morgan Stanley, small-cap stocks, Russell 2000, S&P 500, IWM