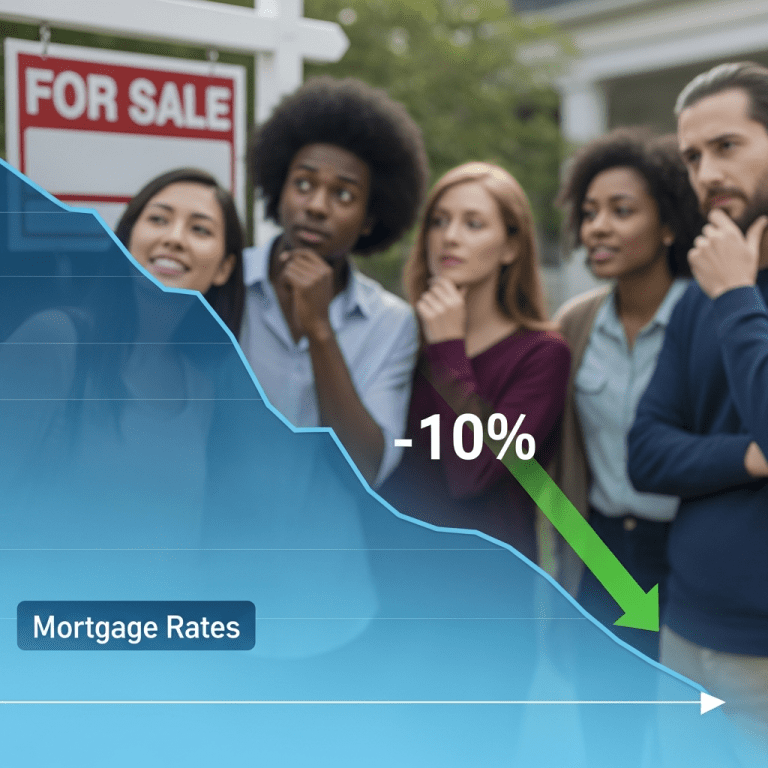

U.S. mortgage rates ($FMCC) plunged, now nearly 10% lower than their May 2025 peak—an unexpected reversal in this volatile year. The focus keyphrase ‘mortgage rates nearly 10% lower’ is driving search curiosity as homebuyers debate if it’s truly the right moment to secure rates. Does this drop signal lasting relief or just a temporary dip?

Mortgage Rates Fall to 6.41%: Sharpest Drop Since Late 2023

Freddie Mac ($FMCC) revealed that the average 30-year fixed mortgage rate has slid to 6.41% as of November 1, 2025, marking a sharp decline from the 7.11% recorded in the third week of May—a drop of almost 10%. According to Mortgage Bankers Association data, weekly loan application volumes surged 15% in October, their highest jump since early 2024, as buyers rushed to take advantage of improving affordability. The National Association of Realtors reported that pending home sales jumped 6.3% month-over-month in September, a sign that rate-sensitive segments are responding to the recent move (sources: Freddie Mac, Mortgage Bankers Association, NAR).

Why Lower Mortgage Rates Are Reigniting U.S. Housing Demand

Lower borrowing costs are easing pressure on both first-time buyers and repeat purchasers, with the S&P/Case-Shiller national home price index stable but finally showing slower growth at 4.8% annualized (August 2025). While higher rates earlier this year eroded affordability, recent declines are narrowing the gap between buyers’ and sellers’ expectations. Moreover, mortgage lenders such as Rocket Companies ($RKT) report renewed activity, with Q3 application volumes up 12% sequentially, as noted in their latest earnings call. However, inventory remains tight: active listings are still 17% below their pre-pandemic average, sustaining competitive conditions (sources: S&P/Case-Shiller, Rocket Companies, Realtor.com).

Investor Moves: How to Navigate Mortgage Rate Volatility Now

For investors and would-be homeowners, the nearly 10% pullback in mortgage rates presents a window, but uncertainty persists. Those seeking exposure via real estate investment trusts (REITs) such as Simon Property Group ($SPG) or homebuilder equities like D.R. Horton ($DHI) may find renewed upside as lower rates unlock demand and catalyze stock market analysis. Meanwhile, fixed-income investors should monitor Treasury yield movements, as the 10-year yield fell from 4.61% in May to 4.04% in early November, pointing to broader market recalibration (source: U.S. Treasury Department). To keep up with rapid developments and housing data, check the latest financial news and tap into ongoing investment strategy insights for actionable updates. But with the Federal Reserve’s next decision approaching in December, interest rate risk remains a key consideration.

Market Analysis: What Experts Expect From Mortgage Rates Into 2026

Industry analysts observe that the recent slide in rates is heavily tied to easing inflation readings and dovish signals from the Federal Reserve in its October 2025 meeting. However, consensus suggests that volatility may persist, as traders remain attuned to upcoming jobs reports and inflation data. According to a late-October Reuters poll, most economists forecast that 30-year mortgage rates will stabilize between 6.2% and 6.5% through the rest of 2025, barring unexpected macro shocks.

What Mortgage Rates Nearly 10% Lower Signal for Buyers in 2025

This sharp drop in mortgage rates nearly 10% lower than May’s highs offers a potential entry point for buyers and investors alike. Watch for the Federal Reserve’s next move and how swiftly lenders adjust rate sheets. As rate swings could continue, those looking to lock in should act decisively—while staying alert for further volatility in 2025.

Tags: mortgage rates, FMCC, housing market, homebuyers, Federal Reserve