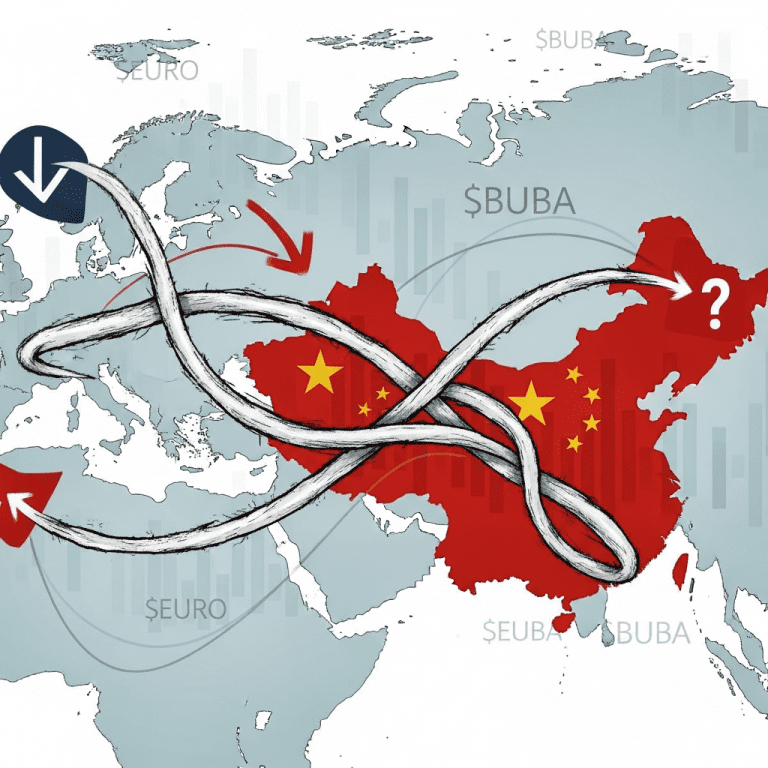

Bundesbank President Joachim Nagel ($BUBA) warned that Europe should mull China action if the situation deteriorates further, raising the stakes for EU-China trade relations. The call comes amid stagnating German exports to China, with the keyphrase ‘Europe should mull China action’ echoing across investor circles. Will markets price in decisive policy next?

Europe’s Export Woes: Nagel Flags Potential China Trade Response

Joachim Nagel, head of Germany’s Bundesbank ($BUBA), revealed on November 7 that policymakers may need to respond if tensions with China escalate. German exports to China dropped 14.6% year-over-year in the first half of 2025, falling from €53.2 billion to €45.4 billion, according to Destatis (German Federal Statistical Office) data. This marked the steepest semiannual decline since 2010. The European Union’s ($EURO) $450 billion annual trade relationship with China has faced growing pressure amid Beijing’s industrial overcapacity and reciprocal tariffs. Nagel emphasized that while Europe favors open markets, it “cannot look away if distortions persist or worsen.”

How Tougher China Stance Could Reshape European Markets in 2025

A shift toward tougher trade measures against China could have far-reaching effects on European equities, manufacturing, and supply chain resilience. The Euro Stoxx 50 Index fell 2.1% to 4,105 on November 6, reflecting investor unease over geopolitics and export headwinds, per Bloomberg data. In the auto sector—where manufacturers like Volkswagen AG ($VOW3) and BMW AG ($BMW) depend heavily on the Chinese market—first-half 2025 deliveries to China dropped 11% versus the prior year, company statements show. The broader European manufacturing Purchasing Managers’ Index (PMI) lingered at 47.6 in October, signaling contraction, as uncertainties over tariffs cloud the outlook. Analysts say any EU reprisal could spark retaliation, driving volatility in sectors reliant on global supply chains.

Investor Strategies: Navigating EU-China Risks and Market Shifts

Investors holding large positions in European industrials, automotives, and luxury names should closely monitor policy moves related to China. A more assertive EU trade policy could lead to sharp swings in companies like Siemens AG ($SIE), Richemont ($CFR), and chipmakers with significant Asia-Pacific exposure. Hedging strategies such as put options on Euro Stoxx 50 components or increased sector diversification are gaining traction. For global portfolios, increased allocations to U.S.-centric or domestically oriented European firms may mitigate China-related tail risk. Reviewing sector breakdowns and staying abreast of latest financial news is essential in this fluid landscape. For longer-term perspectives, investors should consult stock market analysis to understand potential rotations if further tariffs or trade limits materialize.

What Analysts Expect Next for EU-China Policy, Trade, and Markets

Industry analysts observe that the EU’s toolkit for addressing Chinese market practices—ranging from anti-subsidy investigations to sectoral tariffs—remains flexible. According to the European Commission’s July 2025 report, ongoing investigations into Chinese EV subsidies and solar module dumping could accelerate if macro risks mount. Market consensus suggests a wait-and-see approach for now, but strategists at major European banks warn of increased price swings and policy-driven catalysts as the year closes. Should growth in the euro area slow alongside trade shocks, the impetus for coordinated EU action could strengthen.

Europe Should Mull China Action Amid Rising Trade Uncertainty

As “Europe should mull China action” becomes a key discussion point, investors must watch for diplomatic signals, shifts in PMIs, and sharp sector moves that may precede formal EU measures. With German exports already down double digits, the coming months will be pivotal for trade-sensitive assets. Staying agile and data-focused may make the difference for portfolios exposed to evolving China risks.

Tags: Europe, China, EU trade, exports, $BUBA