In a landmark financial update, NatWest profits hit highest since 2008 bailout, marking a pivotal moment for both the UK’s banking sector and the broader economic landscape. This resurgence in profitability not only symbolizes NatWest’s long-awaited turnaround but also reflects shifting trends in the UK economy as it faces into 2025’s uncertainties.

NatWest profits hit highest since 2008 bailout: Analyzing the numbers

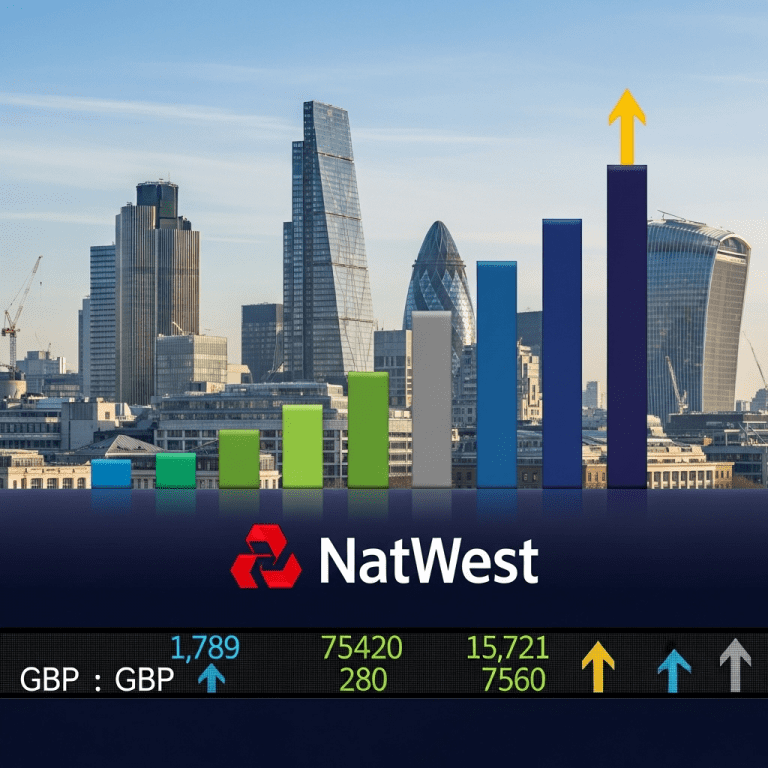

NatWest Group, formerly known as Royal Bank of Scotland, has reported annual profits not seen since before its dramatic government bailout during the global financial crisis. For the fiscal year ending 2024, NatWest posted a pre-tax profit that exceeded analyst expectations, underscoring the resilience of its core banking operations and effective cost management strategies. This strong performance is attributed to robust net interest income growth, driven primarily by rising interest rates and improved lending margins.

The bank’s reported statutory profits surpassed £5.1 billion, a remarkable leap from the previous year and the highest since the government’s £45.5 billion intervention in 2008. The numbers not only speak to NatWest’s revived earning power, but also highlight the bank’s successful navigation of a challenging inflationary environment and ever-evolving regulatory landscape.

UK banking sector rebounds amid economic uncertainty

NatWest’s resurgence is emblematic of a broader trend among UK lenders, as higher interest rates have bolstered banks’ bottom lines despite macroeconomic headwinds. While consumers and small businesses have faced the brunt of rate hikes through costlier loans and mortgages, banks like NatWest have capitalized on greater spreads between lending and savings rates.

Rival institutions have recorded similar upticks, but NatWest’s performance stands out as a symbol of renewed financial stability. As the last remnants of government ownership dwindle, investor confidence is further buoyed. For more on assessing UK financial stocks, read our latest investment insights.

Implications for investors as NatWest profits hit highest since 2008 bailout

The news that NatWest profits hit highest since 2008 bailout has captured investor attention across the City and beyond. The bank’s decision to increase its shareholder dividend and initiate new share buybacks signals a willingness to return capital, a move welcomed by both institutional and retail investors.

Market analysts caution, however, that the recent earnings surge could be tempered if interest rates plateau or decline in the coming quarters. For a detailed macro view on rate trends and market impacts, check our global economy analyses.

Regulatory and political landscape in 2025

The government’s ongoing reduction of its stake in NatWest, now below 15%, underscores a long-awaited shift from post-crisis stewardship to private sector normalcy. This transition has reignited debates about the proper regulatory framework, particularly as systemic banks adapt to post-Brexit rules and higher consumer protection standards.

Government officials have heralded NatWest’s turnaround as a success story in restoring stability and trust. Yet, watchdogs remain vigilant regarding lending practices, conduct risks, and the broader banking system’s resilience in the face of geopolitical and market shocks.

How NatWest’s profit resurgence shapes the UK economy

The fact that NatWest profits hit highest since 2008 bailout goes beyond balance sheet headlines—this trend bears real significance for the UK economy. A profitable, well-capitalized NatWest is positioned to support business investment, SME lending, and digital banking innovation. With consumer confidence in flux and cost-of-living pressures persisting, the bank’s solid capital buffers may prove crucial to economic recovery and growth initiatives.

Moreover, NatWest’s renewed profitability could encourage fresh waves of fintech partnerships and sustainability-focused initiatives. As ESG standards grow in prominence, NatWest’s ability to allocate capital toward green finance may serve as a bellwether for the sector. Visit our sustainable finance resources to learn more about evolving ESG trends.

2025 outlook: Risks and opportunities ahead

Despite the optimism surrounding NatWest’s robust results, the outlook for 2025 remains cautiously optimistic. Economic uncertainties—such as potential rate cuts by the Bank of England, regulatory shifts, and continued inflation—still pose risks to sustained earnings growth. Additionally, competition from digital challenger banks, intensifying cost pressures, and rapidly changing consumer behaviors demand ongoing adaptation.

However, if NatWest leverages its strengthened foundation to expand lending programs and accelerate digital transformation, the bank is well positioned to reinforce its leadership in the UK’s evolving financial landscape.

Conclusion: What NatWest’s record profits mean for the future

With NatWest profits hitting their highest since the 2008 bailout, the bank and the broader UK economy stand on firmer ground than at any time in over a decade. While challenges persist, NatWest’s resurgence offers hope and signals the transformative impact that prudent management and shifting macroeconomic conditions can have on a global banking institution. For investors, policymakers, and consumers alike, all eyes will remain on NatWest’s next steps—setting a critical benchmark for the sector in 2025 and beyond.