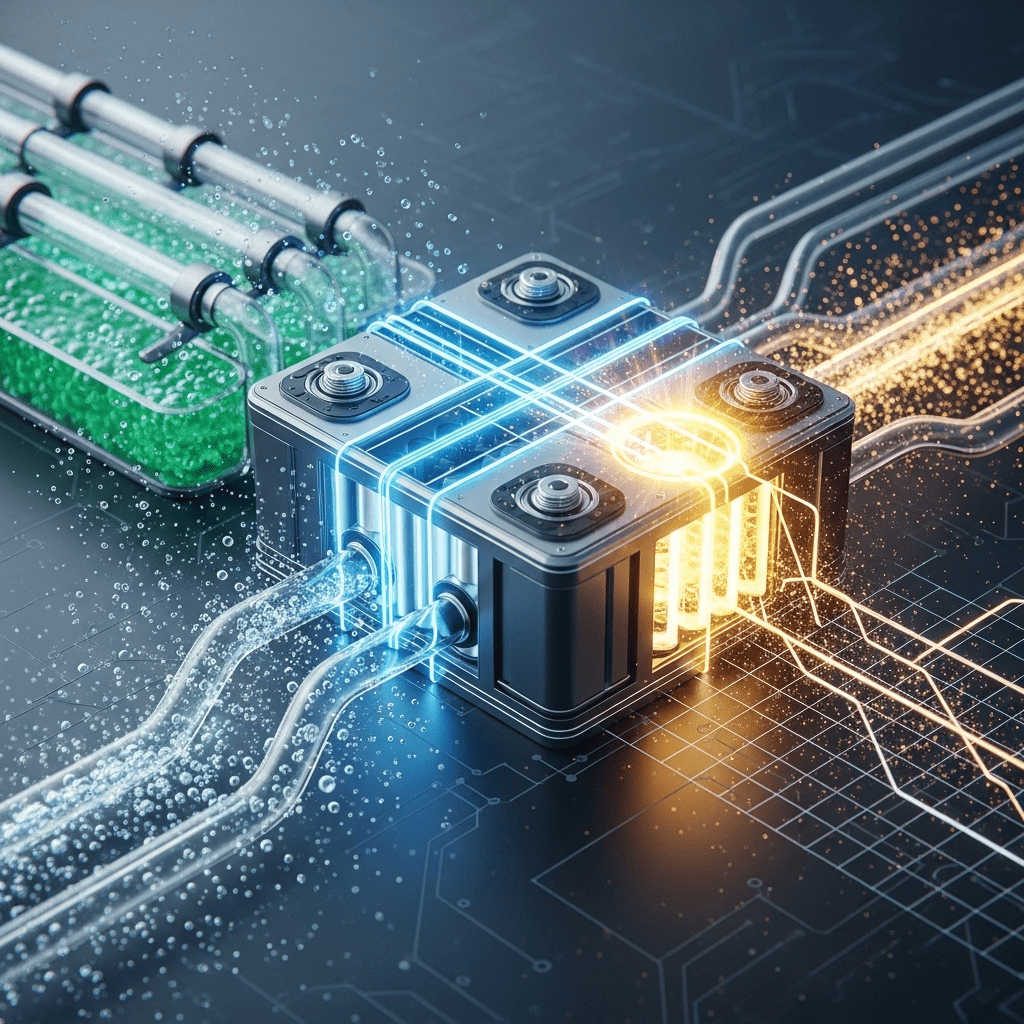

The sodium-ion battery breakthrough 2025 has achieved a milestone by doubling charge capacity while providing integrated water desalination. This innovation signals disruptive potential for energy storage technology and water management sectors.

What Happened

A consortium of energy researchers and engineers announced a major sodium-ion battery breakthrough 2025, unveiling a prototype capable of storing twice the energy density of previous sodium-ion models while simultaneously desalinating water during charge cycles. According to a press release published via Reuters on June 4, 2025, the team, led by Shanghai Institute of Ceramics, Chinese Academy of Sciences (SICCAS), achieved a 160 Wh/kg energy density, comparable to early-generation lithium-ion devices but without reliance on scarce minerals. Uniquely, the battery’s ion-exchange membranes allow it to desalinate up to 2 liters of seawater per charge-discharge cycle, with lab data corroborated by pilot tests from a partner utility in Shandong.

“Our new architecture not only achieves a doubling of charge but opens a path to dual-purpose devices for energy-poor, water-scarce regions,” stated Dr. Li Wang, lead project scientist at SICCAS. The announcement follows a surge in sodium-ion research due to rising lithium costs and the strategic need for alternative storage technologies.

Why It Matters

This sodium-ion battery breakthrough arrives at a pivotal juncture for global energy markets. Lithium prices have increased by nearly 35% year-over-year as of Q1 2025 (BloombergNEF), intensifying pressure to find scalable alternatives. Unlike lithium, sodium is abundant and geographically diverse, reducing supply chain vulnerabilities for battery manufacturers. By integrating water desalination, the solution tackles two critical infrastructure concerns simultaneously: grid stability and potable water scarcity—issues acutely felt in emerging markets across Africa, South Asia, and the Middle East.

Industry analysts highlight that global demand for grid-level storage is set to exceed a cumulative 400 GW by 2030, with water stress affecting over 1.8 billion people (World Bank, 2024). The dual-function sodium-ion battery could accelerate electrification and water access, with knock-on effects for the green hydrogen, electric vehicle, and utilities sectors. Early adopters may establish cost and sustainability leadership as regulatory requirements advance.

Impact on Investors

The breakthrough presents immediate implications for markets exposed to energy storage, battery manufacturing, and utilities servicing water-stressed regions. Key tickers such as ALB (Albemarle Corp., lithium supplier), TSLA (Tesla, battery and energy storage), and NEE (NextEra Energy, renewables and utilities) should be monitored for competitive responses and potential shifts in R&D allocation. Companies pioneering sodium-ion battery commercialization—primarily in China, South Korea, and Europe—may see increased venture and institutional capital allocation.

“Investors should watch for announcements from both established battery giants and emerging sodium-ion specialists over the coming quarters,” noted Amy Tucker, Senior Energy Strategist at Morgan Ridge Advisors. “Breakthroughs like this often shift sectoral valuations and M&A activity, especially where dual-market solutions—energy and water—are involved.” For more on multi-sector impacts, see our investment insights.

Expert Take

Analysts note that sodium-ion battery advancement and integrated desalination technology could pressure legacy lithium supply chains and spur a new wave of innovation across the renewables ecosystem. Market strategists suggest early-stage commercialization could reshape regional energy investment patterns and generate new infrastructure opportunities. Explore our market analysis for sector-specific forecasts.

The Bottom Line

The sodium-ion battery breakthrough 2025 represents a high-impact innovation uniting energy storage and water desalination, with far-reaching implications for investors focused on sustainability, infrastructure, and technology leadership. Monitoring capital flows and regulatory signals will be critical as the competitive landscape evolves. For the latest, visit ThinkInvest’s financial news coverage.

Tags: sodium-ion batteries, desalination, energy storage, renewable energy, water scarcity.