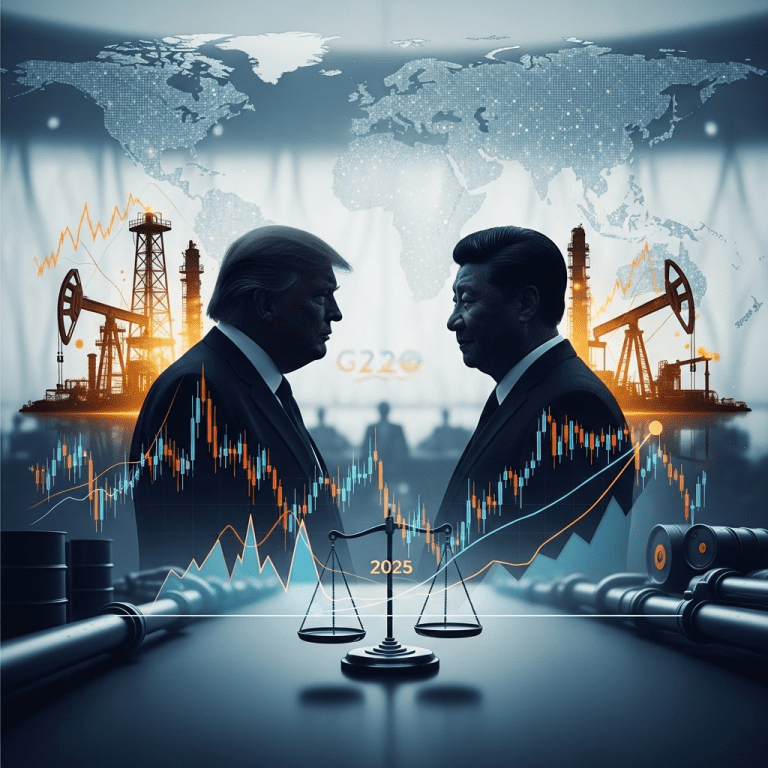

Global oil prices stabilize as traders eye Trump-Xi meeting, marking a pivotal moment for energy markets in 2025. As the industry braces for potential geopolitical shifts, investors closely monitor high-level diplomatic negotiations.

Oil Prices Stabilize as Traders Eye Trump-Xi Meeting

After months of volatility, oil markets have steadied in response to renewed optimism surrounding discussions between former U.S. President Donald Trump and Chinese President Xi Jinping. The anticipation of this significant meeting has reduced market turbulence, with Brent crude futures hovering near $83 per barrel and WTI futures maintaining a stable range around $79 per barrel. Analysts across Wall Street observe that expectations of trade dialogues and potential policy shifts have reduced uncertainty, ushering in a tentative calm amid ongoing global energy concerns.

Geopolitical Tensions Remain Central

The Trump-Xi diplomatic engagement arrives at a time when the energy sector faces enduring supply chain disruptions and shifting demand patterns. Both the U.S. and China—the world’s top oil consumers—are expected to discuss tariffs, energy security, and bilateral trade, all of which play critical roles in determining oil price direction. Market confidence has been buoyed by hopes that progress between the superpowers may lead to more stable energy flows and mitigated risks of supply interruptions.

OPEC+ Policy and Production Outlook

While focus currently sits on the U.S.-China summit, OPEC+ production strategies remain equally influential. The recent decision to maintain output quotas underscores the oil cartel’s commitment to price stability, supporting the recent plateau in oil prices. Many energy analysts at oil market forecasts believe OPEC+ will continue to adapt policy based on the outcomes of global diplomatic events and shifting demand in Asia.

Implications for Energy Investors and Markets

Stable oil prices as traders await signals from the Trump-Xi meeting have been welcomed by energy stocks, which saw modest gains during recent trading sessions. Integrated oil majors and smaller exploration firms alike are reassessing their capital expenditures and hedging strategies in light of diminished price volatility. For institutional investors, portfolio managers at leading asset houses recommend monitoring both geopolitical headlines and macroeconomic data to gain energy market insights as the situation unfolds.

Global Demand Trends and Transition Risks

Beyond the immediate news cycle, energy demand projections remain cautiously optimistic. While the post-pandemic recovery has spurred consumption, long-term risks persist as nations accelerate the transition to renewables. The stable outlook for oil prices following the Trump-Xi meeting could slow the urgency of major investment shifts, but policy evolution in both countries will be critical. Energy strategists emphasize closely following the intersection of politics, trade, and climate policy, which shapes supply-demand fundamentals globally.

What’s Next as Oil Prices Stabilize?

With oil prices stabilizing as traders eye the Trump-Xi meeting, energy markets face both opportunity and risk. Investors are advised to remain attuned to diplomatic developments, OPEC+ signals, and global economic trends in 2025. As always, those seeking more comprehensive investment insights should prioritize authoritative sources for data-driven analysis during this highly dynamic period.