The global energy market witnessed dramatic volatility this week as oil prices surge as Trump sanctions Russian energy giants. The latest round of U.S. sanctions, announced on Monday, targets major Russian oil and gas producers, signaling a seismic shift for investors and policymakers alike. As the market digests these developments, analysts at leading financial institutions caution that the repercussions may linger throughout 2025, impacting supply chains and energy prices worldwide.

Oil Prices Surge as Trump Sanctions Russian Energy Giants: Immediate Market Impact

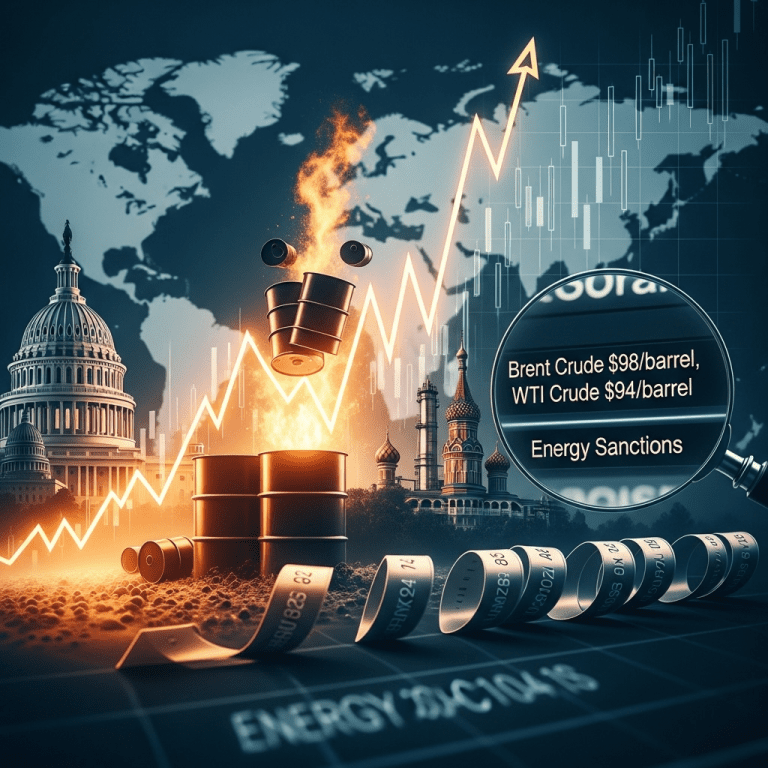

President Donald Trump’s administration reimposed sweeping sanctions on Russia’s largest oil companies, including Rosneft and Gazprom, following escalating geopolitical tensions in Eastern Europe. In direct response, Brent crude futures spiked above $98 per barrel—an 18-month high—while WTI crude exceeded $94. The focus keyphrase—oil prices surge as Trump sanctions Russian energy giants—now dominates global headlines and financial discussions.

Market experts highlight the immediate impact: the removal of millions of barrels per day from international markets has exacerbated an already tight supply environment. Major oil-importing economies, such as India and China, are now scrambling to secure alternative supplies, driving up spot prices and intensifying competition among refiners.

Investment and Risk Implications in the Energy Sector

Risk management analysts at JPMorgan and Barclays warn that increased volatility will present both challenges and opportunities. Portfolio managers are eyeing energy stocks, midstream operators, and alternative energy firms for potential upside, while heightened uncertainty could pressure manufacturing and transportation sectors reliant on consistent fuel costs.

According to recent research highlighted in market mood reports, trading volumes in energy ETFs and futures have surged nearly 30% since the announcement, while oil-linked currencies—like the Russian ruble and Canadian dollar—have experienced pronounced swings.

Geopolitical Fallout and Global Energy Flows

The Biden administration, European Union, and partners in the G7 have signaled support for U.S. measures, but questions remain over enforcement and broader geopolitical repercussions. Russian authorities condemn the actions as “economic warfare,” vowing countermeasures and threatening to curtail natural gas shipments to Europe. As such, the oil prices surge as Trump sanctions Russian energy giants could spark renewed energy security concerns for NATO nations, especially as winter approaches.

Long-term Shifts Toward Diversification

Oil market strategists suggest this crisis could accelerate structural changes already underway: the EU, Japan, and South Korea are increasing investments in renewable energy and considering fresh nuclear projects. Analysts at the International Energy Agency suggest that if the Russian supply remains restricted into 2025, alternative exporters—such as Saudi Arabia, the United States, and new Middle Eastern projects—will be critical in balancing the market.

Energy consultancy Rystad Energy estimates global spare production capacity is now at its lowest since 2011, highlighting the fragility of current supply-demand dynamics. As more investors seek diversification, resources like investment insights recommend reviewing exposure to both traditional and emerging energy classes.

Analyst Outlook: Oil Prices Surge as Trump Sanctions Change Investment Strategies

With the market in flux, energy analysts predict sustained price volatility throughout 2025. Key watchpoints include global compliance with sanctions, OPEC+ response, and unforeseen shocks—such as supply disruptions or rapid demand changes. For investors and financial advisors, staying abreast of these shifts is critical. Emerging technologies, like AI-driven energy trading models—a trend explored in AI investment trends—may help market participants capitalize on short-term inefficiencies or hedge against geopolitical risks.

In summary, as oil prices surge as Trump sanctions Russian energy giants, energy markets stand at a crossroads. Both risks and opportunities abound for those attuned to geopolitical, financial, and technological disruptions. Strategic diversification and rigorous risk analysis will remain paramount for investors navigating this new era of energy uncertainty.