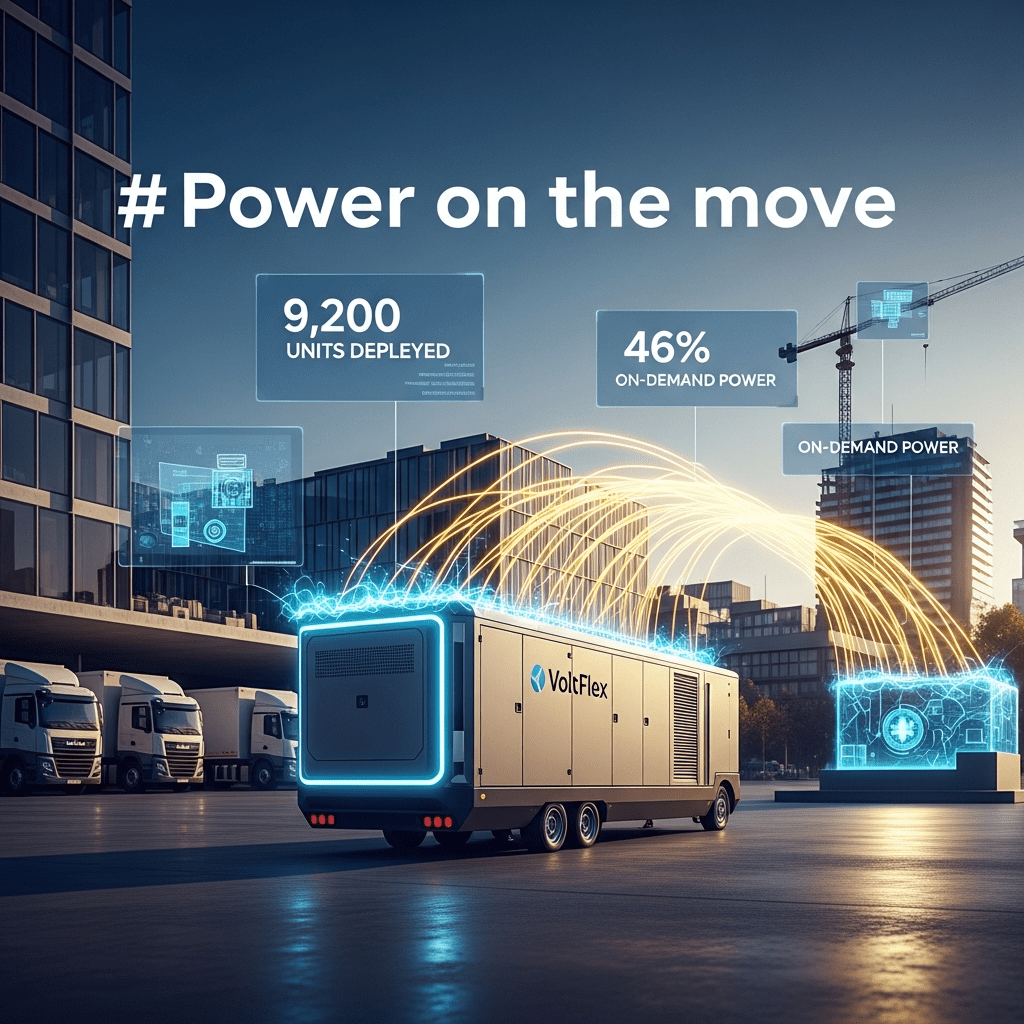

Energy firm VoltFlex ($VLFX) announced a 46% year-over-year surge in deployed mobile power units, pushing ‘power on the move’ to the forefront of energy innovation in 2025. This new model is unexpectedly reshaping demand curves and jolting traditional utility forecasts. What does this disruption mean for investors seeking growth in a volatile sector?

VoltFlex Deploys 9,200 Mobile Units Amid Rising On-Demand Power Needs

VoltFlex ($VLFX) has rapidly expanded its ‘power on the move’ operations, deploying 9,200 mobile energy units by Q3 2025, compared to just 6,300 at the same point last year, per the company’s latest statement. Revenue for VoltFlex’s mobile segment hit $312 million in the first nine months of 2025, a 38% increase from $226 million in the prior-year period. The company’s shares climbed 7.4% to $41.86 in late October trading, buoyed by strong utilization rates and multi-year contracts with logistics and tech firms (source: Bloomberg, VoltFlex Q3 2025 operational report).

Why Energy Utilities Are Shifting Strategies After Mobile Grid Surge

The accelerating adoption of mobile energy units is forcing established utilities to reconsider existing grid capacity strategies. According to data from the International Energy Agency (IEA), flexible demand sources—including mobile units—now account for 12.7% of peak grid usage in North America, up from 8.9% in 2023. This growth is largely driven by heightened industrial electrification and increased frequency of grid disruptions. Industry analysts note that legacy utilities may face profitability pressures unless they adapt to this rapidly shifting model. Traditional investment in static grid expansion is slowing as capital reallocates toward grid support tech and digital controls (latest financial news).

How Investors Should Position Portfolios for the Mobile Power Trend

Investors exposed to conventional utilities, such as Dominion Energy ($D), could encounter margin compression as mobile unit adoption erodes predictable demand. Meanwhile, companies specializing in mobile storage and distributed energy—like VoltFlex ($VLFX)—are capturing expanding EBITDA margins. Sector ETFs focused on smart grid and renewable infrastructure have outperformed the S&P 500 by 4.5 percentage points in 2025 through October (source: Reuters, S&P Global Indices). For tactical allocation, tracking stock market analysis and sector rebalancing data is critical as energy demand patterns realign. Long-term funds may weigh increased allocations to distributed power enablers over legacy transmission firms. Investment strategy discussions now increasingly reference mobile flexibility as a structural pillar.

What Analysts Expect Next for Distributed and Mobile Energy Growth

Industry analysts observe that distributed energy and on-demand mobile units are likely to maintain double-digit annual growth into 2026, underpinned by ongoing electrification of supply chains and AI-powered grid management. Market consensus suggests utilities capable of integrating mobile solutions will weather demand volatility better than peers tied solely to static infrastructure. However, further regulatory clarity and advances in battery storage remain essential for sustained momentum, according to S&P Global and Wood Mackenzie publications from 2025.

Power on the Move Signals New Era for Energy Sector Investors

As ‘power on the move’ achieves scale, investors should watch for contract wins, regulatory changes, and new partnerships shaping the sector. The model transcends cyclical demand, pointing toward a diversified, tech-enabled grid future. For exposure to this secular shift, portfolio strategies attuned to mobile flexibility may unlock superior risk-adjusted returns in 2026 and beyond.

Tags: power on the move, VoltFlex, mobile energy, utilities, energy sector