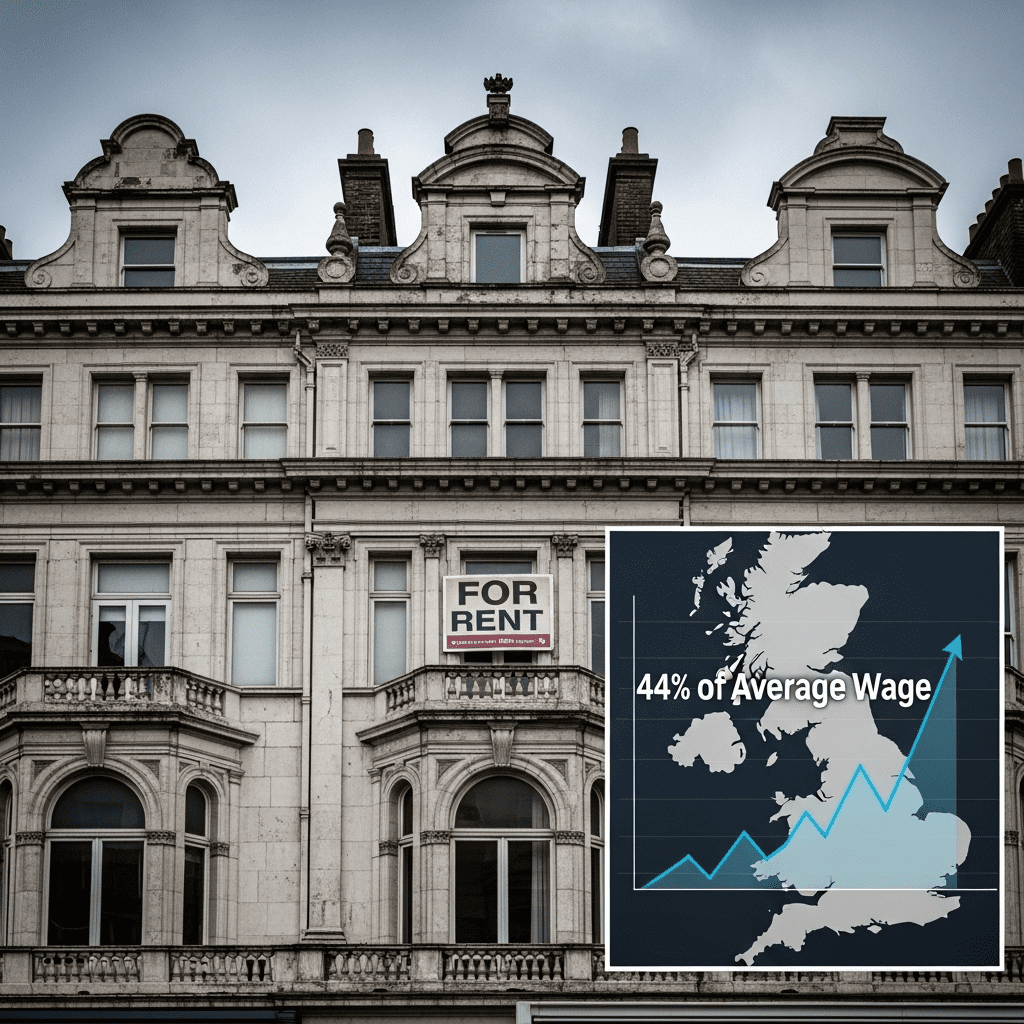

Private rent in Britain now swallows 44% of the average wage—a historic high that reflects surging housing costs and stagnant wage growth in 2025. This unprecedented rent-to-income ratio has broad impacts for renters, real estate markets, and property investors.

What Happened

Private rent in Britain now swallows 44% of the average wage, according to recently published data from property platform Zoopla (Bloomberg, June 2025). The report indicates that the national average monthly rent outside London has hit £1,226, driven by intense demand and constrained supply, while the average UK wage stands at just £2,800 per month. In London, the ratio is even higher, with average rents accounting for more than 50% of take-home pay. Richard Donnell, executive director at Zoopla, notes, “We’ve never seen the rent-to-income ratio this high, underscoring the acute pressure Britain’s tenants continue to face.” This development comes as interest rates remain elevated and new home building lags far behind government targets, leaving many would-be buyers in the rental market for longer.

Why It Matters

This sharp rise in the proportion of income devoted to private rent signals deeper structural challenges in the UK housing market. The 44% rent share is the highest since consistent records began, compared to an average of 33% over the past decade. Persistent inflation, stagnant real wage growth, and the Bank of England’s higher-for-longer rate policy have together made it even harder for renters to save for homeownership. According to the Office for National Statistics, private rental prices climbed 8.2% year-over-year in May 2025—well outpacing wage increases (Reuters, June 2025). If unaddressed, this dynamic risks entrenching wealth inequality and driving increased scrutiny from policymakers.

Impact on Investors

For investors exposed to the UK real estate sector, the jump in the rent-to-income ratio presents both risks and opportunities. Real estate investment trusts (REITs) such as Residential Secure Income Plc (LSE: RESI) and Grainger Plc (LSE: GRI) could see higher revenues as rents continue to climb. However, affordability constraints may cap further rent growth, particularly if regulatory pressures mount. “Rising rents increase near-term yields for landlords but also raise the risk of political intervention and potential caps,” says Maia Blomfield, senior real estate analyst at Barclays. Meanwhile, sectors reliant on consumer spending—retail, travel—could face headwinds if higher housing costs reduce disposable incomes, impacting key economic indicators tracked by investors. For more on sector performance, review our market analysis and recent investment insights.

Expert Take

Analysts note that the current dynamic favors institutional landlords with scale and diversified portfolios, but warn that persistent unaffordability could trigger government action on rent controls or tenant protections. Market strategists suggest monitoring policy developments closely and diversifying exposure within UK property markets.

The Bottom Line

With private rent in Britain now swallowing 44% of the average wage, real estate investors must carefully weigh ongoing rental growth against heightened regulatory and affordability risks. Looking ahead, any market stabilization will likely depend on policy responses and improved housing supply. For agile investors, select opportunities remain—but due diligence is essential. Stay updated via our property investment trends coverage and expert analysis.

Tags: UK real estate, private rent, housing market, investor risk, rent-to-income ratio.