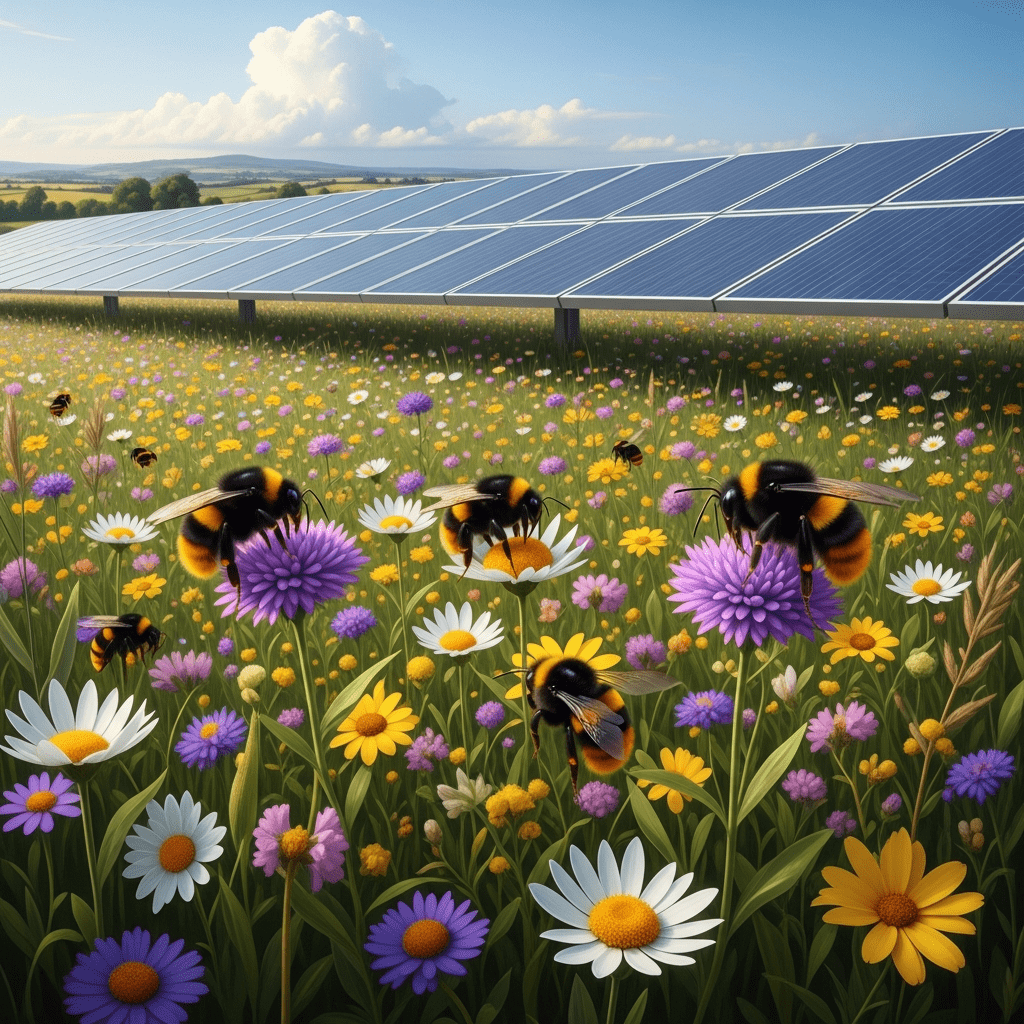

Ecotricity ($ECOT) revealed that red-tailed bumblebees flourished by 49% on their UK solar farms in 2024, stunning both conservationists and energy investors. This focus keyphrase—red-tailed bumblebees solar farms—is driving unexpected environmental and sector momentum. Why are solar arrays now critical to pollinator survival?

Solar Farms Drive 49% Increase in Red-Tailed Bumblebee Populations

Ecotricity ($ECOT), a leading British renewable energy company, announced on November 4 that populations of red-tailed bumblebees (Bombus lapidarius) rose by 49% at its Gloucestershire and Somerset solar farms in the 2024 growing season, compared to nearby conventional farmland. Infrared monitoring across 400 acres showed bee densities of 32.1 nests/hectare within solar sites, versus 21.5 nests/hectare in adjacent fields. The company stated that wildflower corridors seeded under and around solar panels contributed to a measurable rise in pollinator diversity, verified by data from the UK Centre for Ecology & Hydrology (CEH) published September 2024. These findings suggest a previously overlooked ecosystem benefit: large-scale solar infrastructure may shield imperiled native pollinators from agricultural decline, which saw UK bumblebee numbers drop by 17% between 2018 and 2023 (DEFRA, 2024).

Why Solar-Powered Biodiversity Matters for Britain’s Energy Market

Biodiversity gains from solar farms emerge as a differentiating factor in the UK’s £23 billion renewable energy sector. According to the Solar Energy UK 2024 Market Report, Britain added 3.7 GW of new solar capacity in the twelve months to June 2024—an 18% year-on-year increase—expanding habitat for pollinators alongside clean energy provision. Government policy aligns with this shift: under DEFRA’s Environmental Land Management (ELM) schemes, operators can earn biodiversity credits for ecological enhancements. These credits can offset rising costs of land access and regulation. The synergy between pollinator recovery and solar economics strengthens calls for sustainable site design, as investors and policymakers increasingly link ecological services with long-term asset value in the renewables sector. For context, pollinator-dependent crops contribute approximately £691 million annually to UK agriculture (DEFRA, 2024), underscoring wider market relevance.

How Energy Investors Can Capitalize on the Solar-Biodiversity Link

Investors seeking exposure to the intersection of ecological sustainability and energy infrastructure can identify several actionable strategies. Renewable energy developers integrating biodiversity programs may see reduced permitting friction and enhanced ESG scores, boosting appeal to institutional buyers. Portfolio managers holding Ecotricity ($ECOT), NextEnergy Solar Fund ($NESF.L), or Foresight Solar ($FSFL.L) gain diversified exposure as ecological stewardship becomes a differentiator in government contracting and public-private tenders. Furthermore, UK biodiversity net gain legislation—set to take full effect in late 2025—may serve as a near-term catalyst for firms with strong ecosystem impact metrics. Investors can monitor developments by following latest financial news and in-depth investment strategy analysis as the market discounts intangible asset value into share prices.

Analysts Predict ESG Premiums as Solar Farms Spur Pollinator Recovery

Industry analysts observe that solar operators with robust biodiversity enhancements are positioned to earn price premiums in both capital markets and land auctions. According to Jefferies’ UK Green Energy Outlook 2024, funds emphasizing documented ecological gain report heightened investor inflows and lower cost of capital, reflecting market appetite for quantifiable ESG impact. Market consensus suggests solar’s dual environmental and economic roles will intensify as DEFRA and the Financial Conduct Authority scrutinize ‘green’ disclosures, further differentiating leaders and laggards. Early evidence indicates that pollinator-friendly solar infrastructure may drive long-term resilience across portfolios.

Red-Tailed Bumblebees Solar Farms Trend Signals New Era for UK Investors

The red-tailed bumblebees solar farms trend highlights a pivotal convergence of biodiversity gains and renewable sector growth. Investors should watch for regulatory shifts and innovation in pollinator-friendly design—key drivers as ecological metrics become integral to asset valuation. Positioning portfolios toward ESG-focused renewables may yield both financial and environmental returns as this trend accelerates.

Tags: solar farms, red-tailed bumblebees, $ECOT, ESG investing, biodiversity