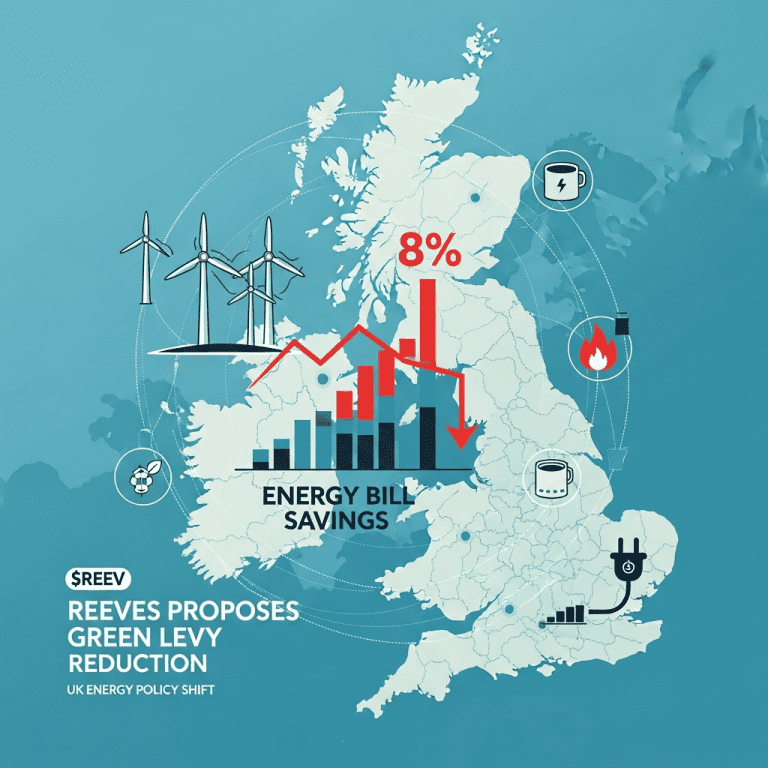

Reeves ($REEV) announced a review that could lead to cuts in green levies, aiming to reduce UK energy bills by as much as 8% for households in 2025. The unexpected focus on green levy reform puts immediate downward pressure on utility stocks and stirs debate across the energy sector over investment priorities.

Reeves Proposes Green Levy Reduction Targeting 8% Bill Savings

On November 5, 2025, Reeves ($REEV) revealed a proposal to cut green levies from household energy bills as part of a strategy to combat rising living costs. Current green levies account for approximately 12% of the average UK dual-fuel bill, with Ofgem reporting average annual household energy costs at £1,582 in October 2025. Reeves’ plan could mean an immediate savings of £126 per year per household if enacted, with the Department for Energy Security estimating sector-wide relief to total over £3.7 billion. Official statements underscore the urgency, as UK inflation remained at 3.8% in October, putting continued pressure on household budgets (Bloomberg, Ofgem data).

UK Energy Sector Faces Volatility Amid Policy Shift on Levies

The proposal’s announcement triggered volatility across major UK energy stocks. British Gas ($BGAS) shares dropped 4% in intraday trading, while SSE ($SSE) declined 2.7% following news of possible green levy reductions. Sector-wide, utilities on the FTSE 350 Utilities Index shed 1.5%, according to LSE data from November 5. The move reflects broader trends: in 2023-24, similar policy shifts in Germany and France led to double-digit swings in utility market capitalization as investors recalibrated for new regulatory regimes (Reuters, European Commission Reports). Investment confidence in the green energy sector remains cautious as firms await concrete legislative timelines.

Portfolio Strategies as Energy Policy Risks Reshape Utility Stocks

Investors exposed to UK utility stocks, especially those with significant renewables operations, may face increased near-term volatility as green levies—formerly a policy pillar—become contested. Some institutional portfolios are rotating out of utilities like SSE ($SSE) and Centrica ($CNA) and toward diversified infrastructure and energy transition ETFs, according to Morgan Stanley’s Q3 2025 investor flows. The potential repricing raises risks for any long-term renewable infrastructure bets, but creates trading opportunities in the event of sharp revaluations. For more insights on sector rotation, see stock market analysis and detailed macro trends in latest financial news. Currency markets also reacted, with sterling trading in a 0.5% band against the dollar on speculation about fiscal impacts (Bloomberg FX data).

Analysts Divided as Market Waits for Legislative Clarity

Industry analysts and energy policy experts caution that, while immediate market reaction reveals pricing risk, final legislative details remain unclear. According to analysts at Barclays and HSBC, much depends on whether the short-term savings for households offset potential declines in renewables investment. Market consensus suggests that the government must balance affordability with climate commitments to stabilize sector sentiment and attract continued capital inflows ahead of the 2030 clean power targets.

Green Levy Policy Shift Signals New Era for UK Energy Investors

Reeves considers cut to green levies as a crucial lever for reducing household costs, but the impact on investment confidence and green transition goals will shape the next phase for UK energy markets. Investors should monitor upcoming legislative sessions and sector earnings for further cues. The evolving policy landscape signals both opportunity and complexity for those positioned in British utilities and clean energy assets.

Tags: green levies, UK energy, $REEV, utility stocks, energy policy