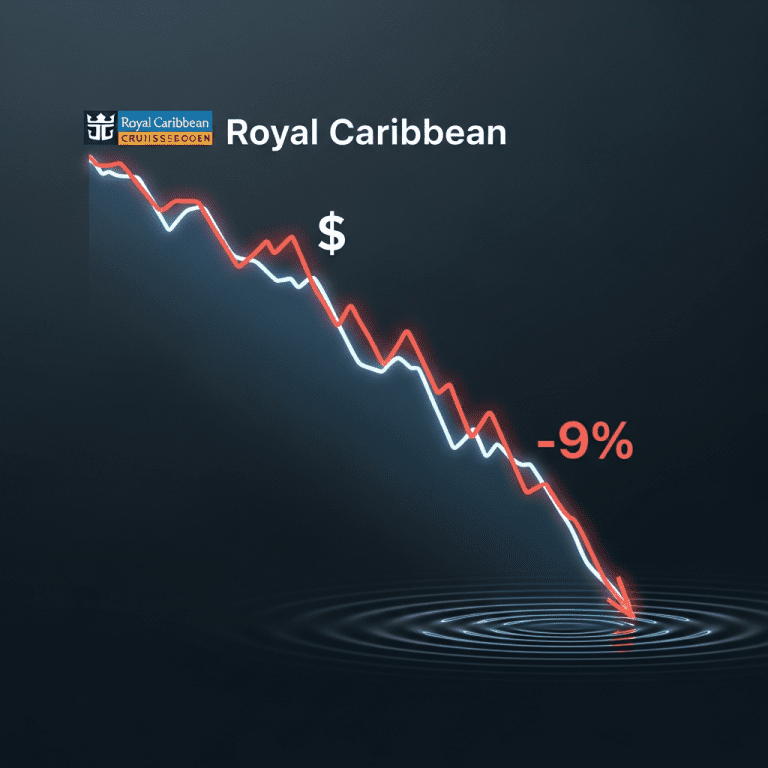

Royal Caribbean Group ($RCL) shares plunged 9.2% to $95.82 on October 31 after the company reported Q3 earnings below analyst estimates, sparking concerns across the cruise sector. The Royal Caribbean stock decline surprised many, with CNBC’s Jim Cramer suggesting the market may have overreacted to short-term challenges.

Royal Caribbean Shares Tumble 9% After Q3 Earnings Miss

Royal Caribbean Group ($RCL) reported Q3 2025 adjusted earnings of $3.85 per share, falling short of the Bloomberg consensus estimate of $4.05. Revenue for the quarter reached $4.18 billion, up 9% year-over-year, but lower than the anticipated $4.21 billion. The stock saw one of its steepest single-day drops this year, with trading volume exceeding 22 million shares by market close on October 31 (source: Nasdaq exchange data). The company attributed its earnings miss to higher operating costs and softer late-season Caribbean bookings, despite rising overall demand for cruise travel.

Why the Cruise Sector Faces Volatility After Royal Caribbean Drop

The Royal Caribbean stock decline reverberated across the cruise and leisure sector. Both Carnival Corporation ($CCL) and Norwegian Cruise Line Holdings ($NCLH) dropped 6.1% and 7.3% respectively on the same day, outpacing the S&P 500’s 0.4% decline (source: Reuters market summary, 2025-10-31). The pullback reflects rising market sensitivity to cost inflation and discretionary travel spending trends. According to the Cruise Lines International Association, industry-wide passenger volumes for 2025 remain on track to surpass 2019 highs, but operators report increasing variability in near-term pricing power due to macroeconomic headwinds and fuel price volatility. For broader markets, leisure and travel stocks have underperformed the S&P 500 by 3.2 percentage points over the last month, highlighting a sector-wide risk aversion as investors weigh recessionary signals.

How Investors Can Navigate Cruise Stock Weakness Strategically

Investors reacting to Wednesday’s decline face a complex risk-reward equation in cruise sector equities. Long-term holders may view these sharp pullbacks as potential entry points, given Royal Caribbean’s guidance for full-year 2025 earnings of $10.40–$10.80 per share and continued strong forward bookings. Traders, however, should remain alert to volatility indicators, especially as the CBOE S&P 500 Volatility Index (VIX) edged up from 15.7 to 17.3 on October 31 (Bloomberg data). Portfolio managers with exposure to consumer discretionary sectors must assess position sizes in light of heightened sector correlations—especially considering Royal Caribbean’s 0.82 beta to the S&P 500. For a deeper market perspective, see stock market analysis and explore other cyclical trends via investment strategy resources at ThinkInvest.

What Analysts Expect Next for Royal Caribbean and Peers

Analysts from multiple research firms underscore that Royal Caribbean’s fundamentals remain robust, citing occupancy rates near pre-pandemic levels and a resilient order book into 2026. However, industry consensus notes continued caution on operating margins and booking pace for Q4 amid higher input costs. Investment strategists highlight that past earnings-driven selloffs in the cruise space have often been followed by gradual recoveries, pending macroeconomic stability (per FactSet consensus, accessed October 30, 2025).

Royal Caribbean Stock Decline Signals Opportunity Amid Volatility

The Royal Caribbean stock decline serves as a reminder of how earnings shortfalls can amplify sector volatility, even with underlying travel demand intact. Investors should monitor upcoming Q4 updates and macroeconomic data closely, as these will shape sector momentum. For those weighing exposure, recent volatility may uncover attractive valuations—but disciplined risk management remains essential.

Tags: Royal Caribbean, RCL, cruise stocks, stock market, earnings report