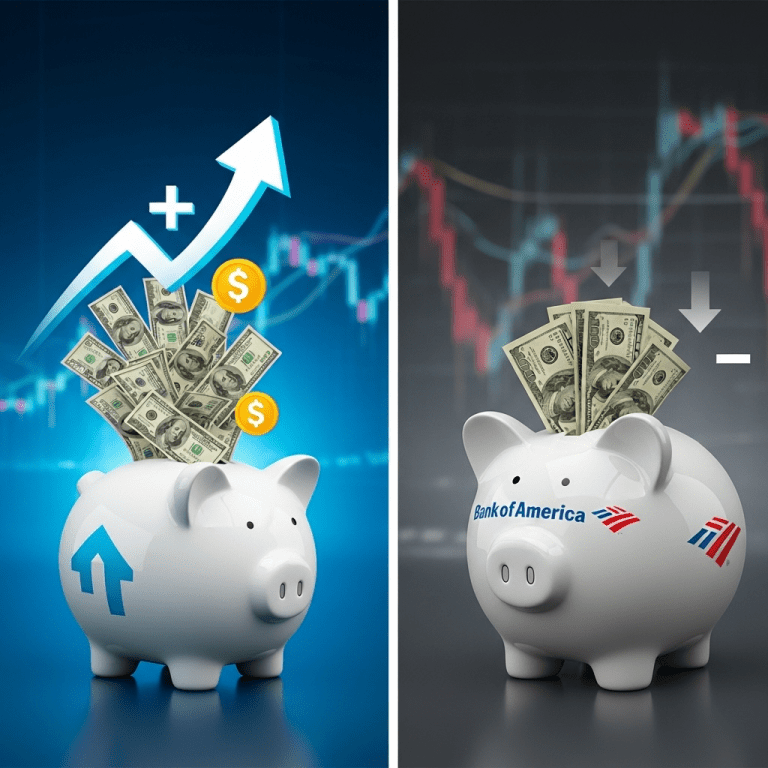

Saving at Bank of America might seem like a safe choice, but in today’s fast-evolving banking landscape, many Americans don’t realize they’re leaving over $1,000 a year on the table. With stagnant savings rates and competitive options proliferating in 2025, understanding where your money works hardest is more critical than ever.

Why Saving at Bank of America Could Be Costing You

Though tradition and convenience make Bank of America a popular choice for millions, the reality is these big banks typically offer some of the lowest interest rates on standard savings accounts. According to recent data, Bank of America’s standard savings account pays just 0.01% APY—well below the national average and far behind many online banks now offering rates above 4.00% APY.

The Hidden Cost: Lost Interest Adds Up Fast

Let’s look at the numbers. If you maintain a $25,000 balance in a Bank of America savings account at 0.01% APY, you’ll earn just $2.50 in annual interest. By comparison, moving that same amount to a high-yield online savings account earning 4.15% APY would net $1,037.50 in interest over the same period—a difference of over $1,000 each year.

This gap isn’t limited to large balances. Even with an emergency fund of $10,000, you could pocket an extra $400 or more every year just by switching to a better savings account.

High-Yield Savings: A Smarter 2025 Alternative

Fintech disruptors and online banks continue to push traditional banks like Bank of America to adapt. However, many have yet to close the interest gap. Today’s top high-yield savings accounts and CDs come with FDIC insurance and all the digital conveniences of legacy banks, but with yields that outpace inflation.

For those focused on maximizing cash returns, it’s crucial to research and compare rates. Established online institutions, credit unions, and even some newer app-based platforms now compete to offer the most attractive deals. Tools and comparisons available on sites offering investment insights can help you efficiently weigh your options.

Risks and Considerations

While higher rates are enticing, always verify that alternative banks are FDIC insured and read the fine print regarding fees, minimum balances, and withdrawal limits. Additionally, beware of introductory promotions that may drop after a few months. Using financial news updates and reviews from reputable aggregators helps keep your savings strategy on track.

How to Transition Away from Saving at Bank of America

If you’re ready to rethink your emergency fund strategy, begin by shopping for accounts with no monthly fees, high yields, and reliable customer service. Transferring funds from Bank of America is usually straightforward, requiring only standard identity verification and linked account setup.

Remember to monitor any pending transactions or recurring payments before closing your old account. Diversifying your savings, such as splitting between high-yield accounts and a safe investment platform, can further boost your returns and improve financial resilience.

The Bottom Line: Don’t Let Convenience Trump Earnings

While loyalty to traditional banks like Bank of America is understandable, current market dynamics in 2025 make it vital for savers to optimize their returns. Missing out on over $1,000 a year—simply by leaving money in a low-yield account—adds up to significant lost opportunity over time.

By evaluating your options and leveraging the plethora of digital resources available, you can ensure your savings not only keep pace with inflation but actively grow for the future.