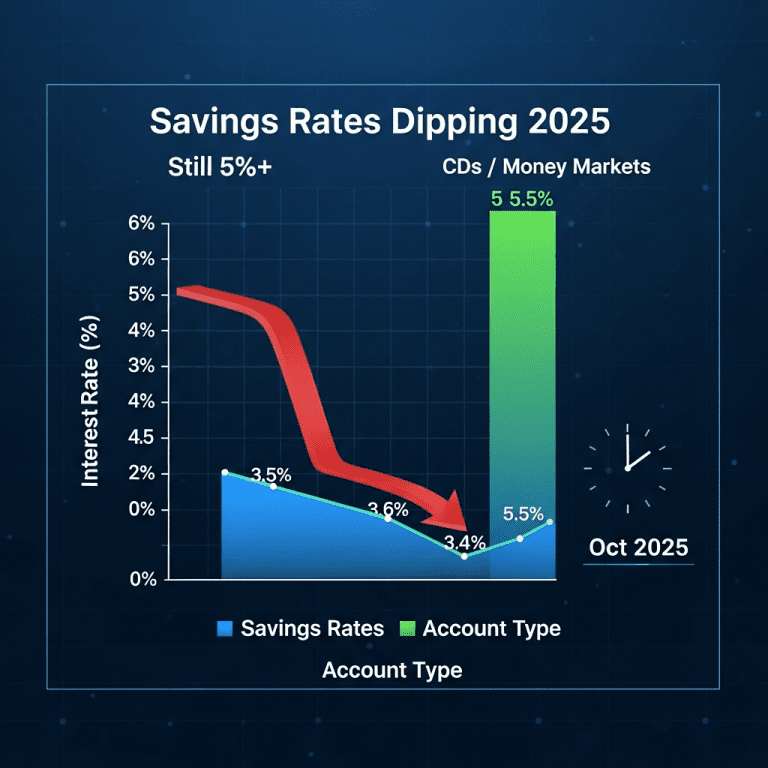

Major banks like JPMorgan Chase ($JPM) revealed cuts to top savings account yields this quarter, but the savings rates dipping 2025 trend holds a twist: alternative platforms still offer annual returns far above national averages. Where can investors really lock in 5% or more as rates slide?

Savings Account Yields Fall Below 4% as Online Banks Adjust Rates

The average U.S. savings account rate has now slipped to 0.53%, a decline from 0.61% in May, according to FDIC data as of October 2025. Even top national banks have trimmed their high-yield savings rates: Ally Financial ($ALLY) recently lowered its rate to 4.35% APY, down from 4.75% earlier this year, while Marcus by Goldman Sachs ($GS) now sits at 4.30%. These moves follow the Federal Reserve’s signal to pause rate hikes since Q2. Notably, leading online challenger banks like SoFi ($SOFI) initiated sequential cuts in September, reducing headline rates to the 4.2%–4.4% range. (Sources: FDIC, bank official disclosures, October 2025)

Why Fixed Income and CDs Outperform as Savings Rates Decline

The rapid adjustment in deposit rates contrasts with relative resilience in fixed income products. With the 1-year Treasury yield hovering at 4.97% (as of October 31, 2025, per U.S. Treasury data) and many online 12-month certificates of deposit (CDs) still available at 5.10%–5.35% APY, savers are shifting assets accordingly. Industry analysts at Bankrate note this gap is the widest since 2019, as traditional banks prioritize liquidity over aggressive yield competition. Meanwhile, select money market accounts from brokerages including Fidelity and Vanguard are holding steady above 5%, bucking the trend seen at retail banks. Recent ECB guidance and the Fed’s “higher-for-longer” stance are contributing to continued strength in these instruments, even as consumer savings and checking yields compress. (Sources: Bankrate, U.S. Treasury, issuer disclosures)

How Investors Can Maximize Yields: CDs, Money Markets, and Alternatives

Investors seeking to outpace falling savings rates in 2025 face both risk and opportunity. Locking in rates with short- and medium-term CDs remains attractive: Synchrony Bank offers 5.20% APY on 12-month CDs, while Capital One ($COF) has reintroduced 5.05% APY products (as of October 2025). Money market funds run by Charles Schwab ($SCHW) and Vanguard reported average yields of 5.08%–5.15% for the latest quarter, according to Morningstar. For those looking beyond traditional banks, reputable fintech apps have maintained 5%–5.4% on insured savings for limited-time promotions. Savvy investors also diversify into Treasury bills with maturities under one year to capture near-peak yields. To compare asset class performance and dynamic allocations, explore stock market analysis for context on equities-to-cash flows, and check the latest financial news for regulatory updates impacting CD and money market rates. Short-term savings bond funds and select fixed annuities round out higher-yielding, lower-risk choices—though most now require upwards of $10,000 minimum to access top-tier rates.

What Analysts Expect as Rate Pressure Persists Into 2026

Industry analysts observe that while the Fed’s overarching pause on rate hikes is likely to continue through Q1 2026, deposit rates could lag further behind bond yields. Market consensus suggests that regional and online banks will pivot to attract deposits with promotional offers, but base interest rates on savings accounts are forecast to trend below 4% nationally if the Fed signals even mild easing. Investment strategists note investors should monitor upcoming CPI data and Fed minutes for signals on the timing of rate cuts or further pauses.

Savings Rates Dipping 2025: Where Savers Should Look Next

Savings rates dipping 2025 does not mean the era of 5%+ returns is over—but investors must move deliberately to seize remaining offers. Watch for updated CD and Treasury bill rates, shifting money market fund yields, and banks’ short-run promotional savings accounts. Adjusting allocations proactively remains critical as the rate environment turns more volatile for cash savers.

Tags: savings rates, high-yield accounts, CDs, money market, $JPM