Seattle’s residential market surprised this month as Redfin ($RDFN) revealed the median list price stayed steady at $850,000, yet seller price cuts are rising. For those tracking the Seattle median list price 2025, this disconnect signals a shifting landscape and possible emerging opportunities. Why are prices holding firm even as discounts spread?

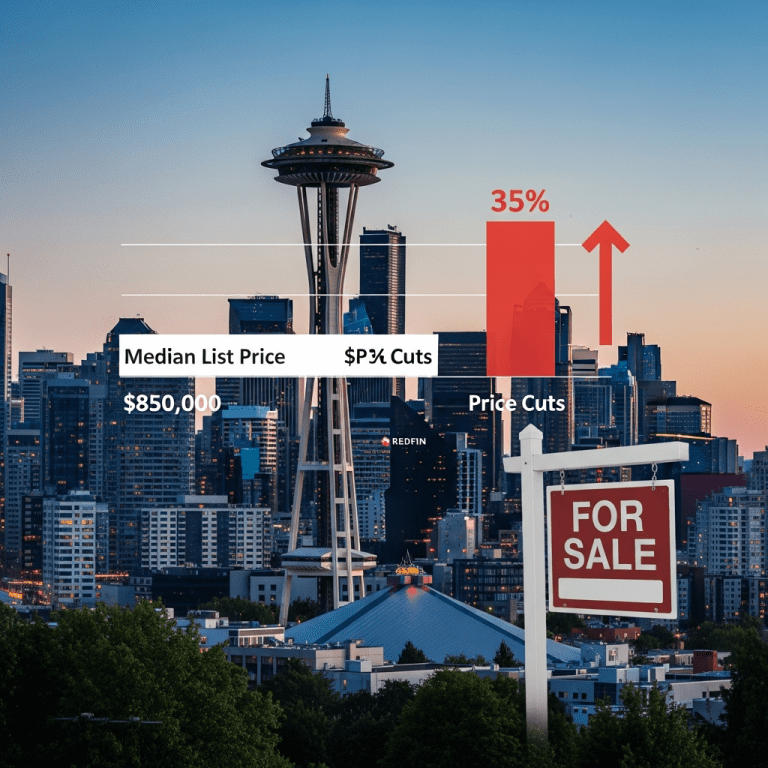

Seattle Home Prices Plateau at $850K as 35% of Listings See Cuts

Redfin data shows Seattle’s median list price remained unchanged at $850,000 during October 2025, matching levels from September. However, the share of active listings with price reductions climbed to 35%—a significant jump from 22% at the same time last year. Inventory is up 18% year-over-year, with 4,320 homes for sale as of November 1, 2025. These mixed signals point to weakening buyer demand, despite sellers holding out for high asking prices. (Source: Redfin Market Data, November 2025)

Price Cuts Reflect Cooling Demand in Seattle’s Real Estate Market

This rise in price cuts follows broader signs of a cooling U.S. housing market, as elevated mortgage rates and affordability concerns weigh on buyers. According to Freddie Mac, average 30-year fixed mortgage rates hovered at 7.25% in late October 2025, near two-decade highs. Seattle, once a top performer for rapid price growth, now mirrors national slowdowns. Historically, the city’s list-to-sale price ratio dropped from 103% in 2022 to 98% in October 2025, per Northwest MLS data, highlighting softer buyer competition. Economic uncertainty, including local tech layoffs, adds downward pressure to demand. For deeper context, see our latest financial news analysis.

How Investors Can Navigate Seattle Real Estate in 2025

For investors evaluating Seattle properties, rising price cuts alongside stagnant medians present both risk and opportunity. Those seeking long-term holds may benefit from increased inventory and negotiation leverage, while flippers should be cautious as time-on-market rises (averaging 34 days, up from 27 in 2024). Mortgage rate volatility and potential for further tech sector job cuts compound short-term risks. Investors already exposed to the region’s REITs, such as Equity Residential ($EQR), should monitor sector rotation and cash flow trends. For broader housing and stock market analysis, investors may diversify allocations as market crosswinds persist.

Analysts Anticipate More Price Pressure Heading Into 2026

Market analysts suggest that, unless mortgage rates decrease or employment confidence returns, Seattle may face further price moderation into early 2026. According to industry observers, sellers are likely to increase concessions and adjust expectations in response to elevated inventories. However, limited new construction and strong long-term demand fundamentals may keep a floor under sharp price declines.

Seattle Median List Price 2025 Signals Shift in Housing Dynamics

The stability of the Seattle median list price in 2025—despite rising discounts—signals a market transition from a seller’s advantage toward a more balanced environment. For those watching the Seattle median list price 2025, key indicators to monitor include inventory trends, mortgage rates, and local economic health. Investors should stay alert for tactical entry points as the market evolves.

Tags: Seattle real estate, $RDFN, median list price, housing market, price cuts