Springfield Realty Group ($SRG) revealed Springfield homes sell faster than the Illinois average, with median days on market plunging to just 19. The focus keyphrase, Springfield homes sell faster, takes on new urgency as local listings outperform broader state trends—why is Springfield beating the odds as other Illinois cities slow?

Springfield Median Home Sales Outpace State With 19-Day Listings

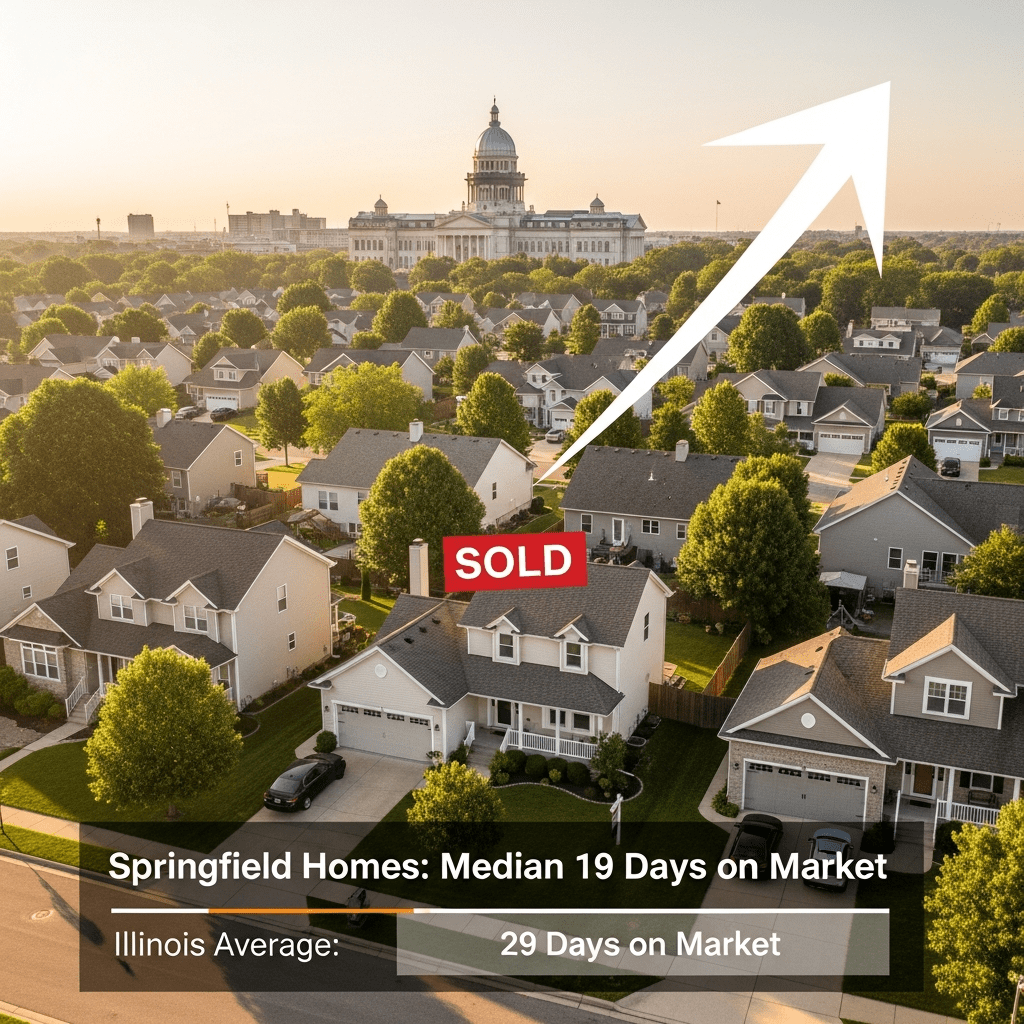

Homes in Springfield average just 19 days on the market in Q3 2025, according to Illinois REALTORS® data, versus a statewide median of 29 days—a dramatic 35% speed advantage. The city saw 1,150 closed transactions from July through September, rising 4.8% year-over-year despite Illinois’s overall transaction volume dropping 2.3%. Median sale prices also climbed to $204,000, up 5.9% from Q3 2024. Springfield’s shrinking inventory—down 18% year-over-year—has tightened supply even as statewide inventory expands by 7%. (Source: Illinois REALTORS® Market Statistics, September 2025.)

Why Illinois Real Estate Lags as Springfield Accelerates in 2025

The gap between Springfield and the state average underscores a remarkable micro-market shift. Illinois’s overall home sales growth has stagnated due to rising mortgage rates, with Freddie Mac reporting a 30-year rate average of 6.79% in September 2025—up from 6.26% a year prior. However, Springfield’s steadier employment base, led by the public sector, and affordable price points have insulated it from headwinds that challenge Chicago, Peoria, and Rockford. According to Redfin, statewide housing affordability declined 8% in the past year, while Springfield’s affordability held steady. This divergence demonstrates why Springfield outperforms larger metros in home velocity and buyer demand this year.

How Investors Are Leveraging Fast Springfield Sales for Portfolio Growth

Institutional and individual investors recognize Springfield’s rapid home turnover as a signal of robust liquidity amid market uncertainty. Shorter listing durations mean lower carrying costs and accelerated access to capital. In contrast, longer marketing periods in other Illinois metros risk price erosion as sellers chase fewer buyers. Investors prioritizing yield are shifting from major metro rentals to Springfield, as illustrated by a 14% spike in out-of-town investor purchases in 2025 (National Association of Realtors® Investor Insights, August 2025). For those looking to diversify, Springfield offers opportunities even as the suburban Chicago market cools. For broader stock market analysis or the latest financial news, monitoring local markets like Springfield has become central to understanding real estate trends in 2025.

What Analysts Expect Next for Springfield Real Estate Outperformance

Industry analysts observe that Springfield’s housing resilience stands out in a slowing Midwest market. Market consensus suggests pent-up demand and limited housing stock will support brisk sales through early 2026, barring unexpected rate hikes or local economic shocks. Investment strategists note that regional policy stability and ongoing job growth continue to anchor confidence in Springfield’s real estate market.

Springfield Homes Sell Faster: Signals New Era for Illinois Housing

Springfield homes sell faster than anywhere else in Illinois, marking a clear shift in housing market dynamics for investors and homeowners alike. Watch for inventory shifts and rate movements that could affect this trend, but Springfield’s unique blend of affordability and economic stability suggests it will remain a standout well into 2026. The data signals compelling opportunities for those tracking the next wave in Illinois real estate.

Tags: Springfield real estate, Illinois housing market, home sales data, property investment, $SRG