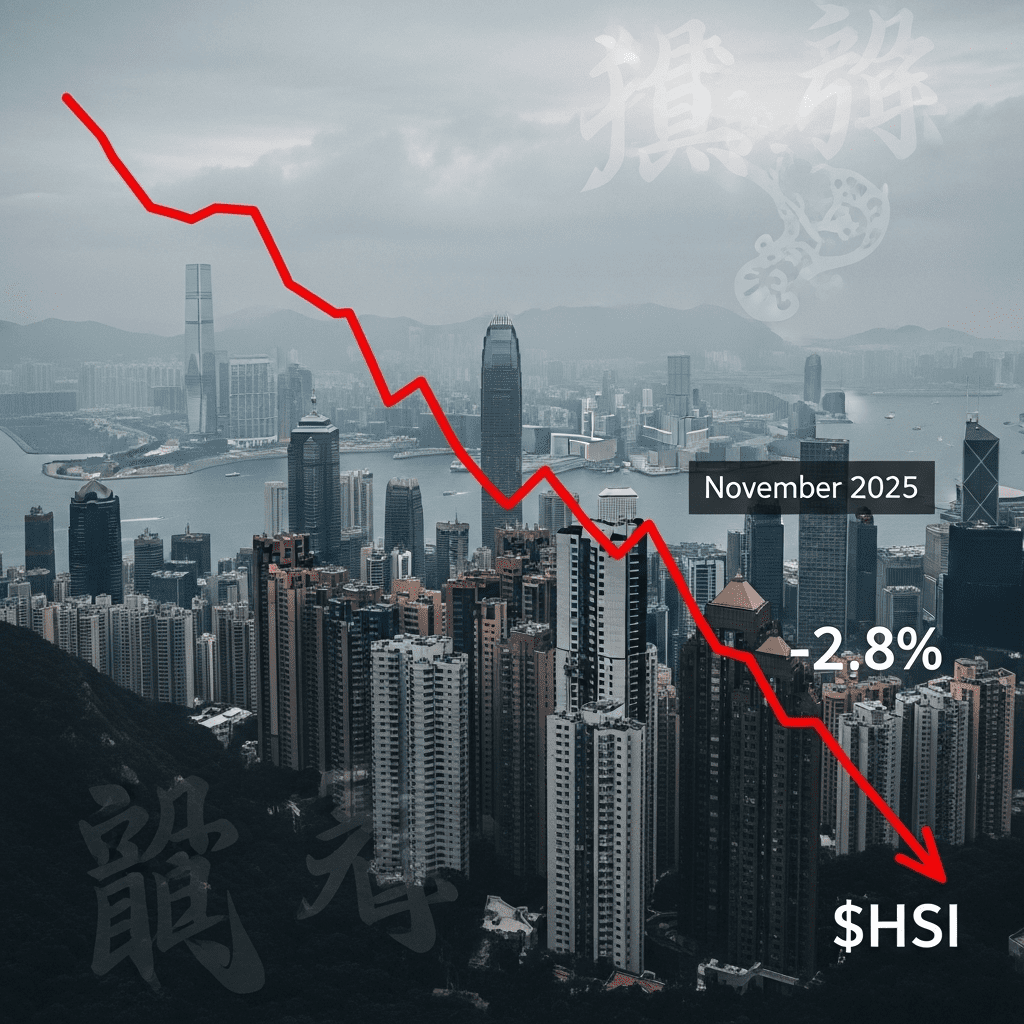

Chinese equities suffered a sharp setback as the Hang Seng Index ($HSI) plunged 2.8%, stalling a global stock rally and putting investors on alert. The sudden Chinese stock decline November 2025 rattled markets, showing that optimism remains fragile. Could further weakness in China deflate broader gains?

Hang Seng Plunges 2.8% as Chinese Stocks Trigger Global Selloff

The Hang Seng Index ($HSI) fell 2.8% to close at 16,410.55 on November 11, wiping out over HK$840 billion (US$107 billion) in market value, according to Bloomberg. Tech majors led declines, with Tencent Holdings Ltd. ($0700.HK) dropping 3.9% to HK$317.20 and Alibaba Group Holding Ltd. ($9988.HK) sliding 4.7% to HK$74.05. The selloff followed weaker-than-expected Chinese inflation data for October, as consumer prices fell 0.5% year-on-year, underscoring persistent deflationary pressures (National Bureau of Statistics of China, Nov. 10, 2025). Turnover on the Hong Kong Stock Exchange spiked to HK$159.7 billion, a two-month high.

Global Markets React as Chinese Equity Slide Sparks Volatility

The abrupt decline in Chinese shares immediately rippled through global equity futures. The MSCI Asia ex-Japan Index was down 1.9%, while Europe’s Stoxx 600 Index futures slipped 0.6% in early trading (Reuters, Nov. 11, 2025). US S&P 500 futures briefly declined 0.4% before paring losses. Market sentiment was dented as investors grew concerned that slowing demand in China could hamper global growth, given China’s 2025 GDP growth forecast was recently trimmed to 4.3% from 4.7% by the IMF (International Monetary Fund, Oct. 2025). Commodity prices also faced pressure, with copper futures losing 1.5% on the London Metal Exchange.

Investor Strategies Shift: Defensive Plays Dominate Amid China Fears

Investors are rotating out of China-exposed stocks, focusing instead on more defensive sectors like consumer staples and utilities. Major ETFs tracking China, such as iShares MSCI China ETF ($MCHI), saw outflows of $460 million in the week ending November 8 (Bloomberg ETF Flows, Nov. 2025). Traders are hedging portfolios, with options volume on the $HSI surging 29% above its 30-day average. Both institutional and retail investors are recalibrating risk, seeking safety in US Treasuries and large-cap US tech stocks, which have shown relative resilience. For more context, see stock market analysis and explore latest financial news for day-to-day market shifts.

What Analysts Expect Next as Chinese Stocks Face Continued Pressure

Market consensus suggests caution remains warranted as policy headwinds and economic uncertainty weigh on Chinese shares. According to UBS strategists, further stimulus from Beijing is expected but may fail to immediately revive risk appetite. Industry analysts observe that the ongoing property sector slump and soft export demand are likely to keep volatility elevated for the remainder of 2025.

Chinese Stock Decline November 2025 Raises Red Flags for Global Investors

The Chinese stock decline November 2025 signals potential headwinds for international markets, especially for funds heavily exposed to Asia. Investors should closely monitor policy responses from Beijing and upcoming economic releases as catalysts for volatility. Short-term defensive positioning, heightened vigilance, and diversification appear prudent as global markets digest China’s surprise stumble.

Tags: Hang Seng, $HSI, Chinese stocks, stock market selloff, Tencent