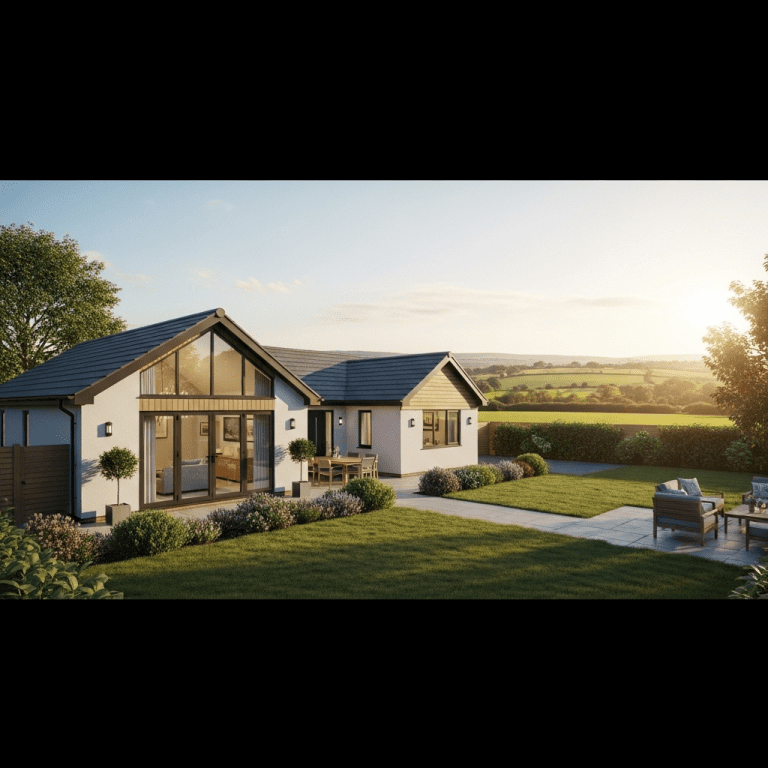

Rightmove plc ($RMV) revealed a surprising 18% annual jump in stylish bungalows for sale in England, pushing average prices to £426,000 in October 2025. Demand outpaces expectations as buyers seek single-level living with contemporary designs. What’s driving this premium growth in such a traditionally niche segment?

England Bungalow Market Sees 18% Price Spike in Prime Regions

England’s bungalow market recorded a sharp 18% rise in average sale prices year-on-year, according to Rightmove ($RMV) data spanning January to October 2025. The average listing now exceeds £426,000, up from £362,000 the previous year. Transaction volumes for bungalows increased by 11%, with southeast England leading the surge—Windsor and Maidenhead posted gains of 22% and 20% respectively. Knight Frank’s 2025 early market review cited enhanced architectural features, open-plan layouts, and integrated smart home tech as key value drivers for these properties.

Why Rising Bungalow Sales Are Shifting England’s Property Sector

The dynamic performance of stylish bungalows is reshaping the overall property sector in England. Nationwide Building Society’s August 2025 report noted bungalows now account for 14% of new-build transactions—up from 10% in 2023. This growth outpaces the 6% annual price increase for the broader residential market (ONS, Q3 2025). Accelerated demand is fueled by downsizers, retirees, and remote-working professionals seeking both accessibility and design appeal. This trend is also impacting the supply side, with developers prioritizing single-level homes on suburban plots. As a result, the bungalow segment is increasingly seen as less cyclical than flats or detached houses, offering resilience in periods of rate volatility or economic uncertainty.

How Investors Can Capitalize on England’s Bungalow Surge

Property investors looking to diversify are reassessing stylish bungalows as an attractive asset class. With rental yields for modern bungalows reaching 4.2% in the southeast (Zoopla, Q3 2025), compared to the regional all-homes average of 3.7%, demand from renters is robust. Long-term investors may find relative insulation from market corrections given continued demographic shifts and the premium attached to step-free living. Developers, especially those holding land portfolios near transport hubs, should note the uptick in planning applications for bungalows (up 13% YoY, Savills, September 2025). For deeper market context, recent stock market analysis has highlighted steady property REITs performance despite mortgage rate headwinds, while latest financial news suggests continued policy support for age-friendly housing.

What Analysts Expect for England’s Bungalow Market in 2026

Market consensus suggests price growth will moderate but remain positive into 2026. Industry analysts at JLL and Savills have reiterated that ongoing demographic changes—particularly an aging population—will sustain premium demand for stylish bungalows. However, prospective regulatory tightening on buy-to-let and second homes could constrain speculative interest. The National Association of Estate Agents, in its September 2025 outlook, described the segment as “robust but sensitive to planning policy and consumer confidence.”

Stylish Bungalows for Sale in England Signal New Investment Era

Stylish bungalows for sale in England are not only drawing record premiums, but also signaling a structural shift in residential preferences. Investors monitoring this market should watch for planning reforms and evolving demand in 2026. The premium for contemporary, step-free homes looks set to persist—underscoring bungalows as a compelling, resilient asset for portfolio diversification.

Tags: bungalows, England property, $RMV, real estate investment, stylish bungalows for sale England