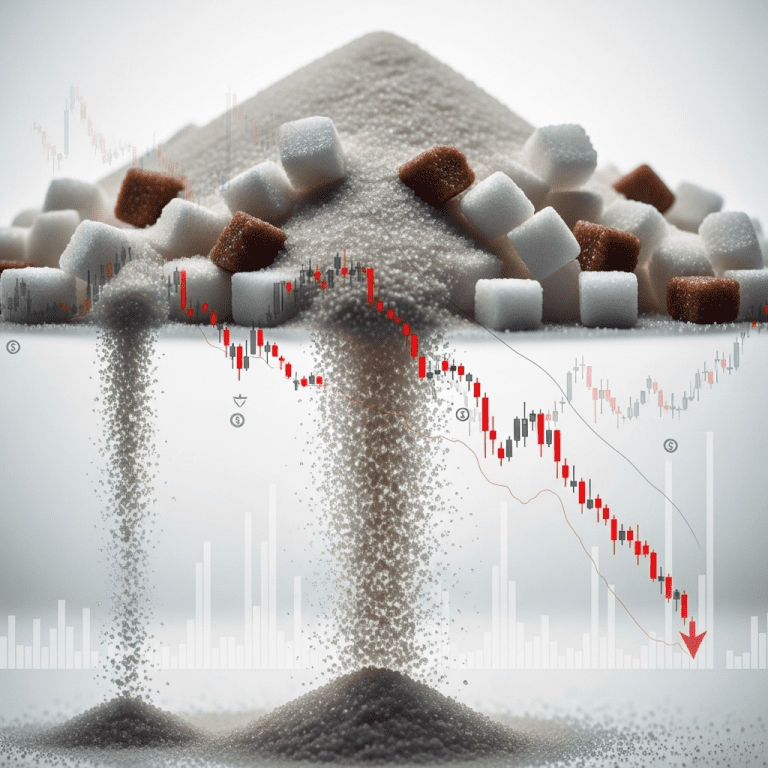

Sugar prices extend sell-off as ICE Futures U.S. ($SB) contracts sank 4.5% to 18.26 cents per pound, marking the lowest levels since July 2021. Traders eye global surplus signals, but what’s fueling this sharp decline and how could it reshape commodity portfolios?

Sugar Futures Tumble 4.5% to July 2021 Lows Amid Global Surplus

Raw sugar contracts on the Intercontinental Exchange (ICE US: $SB) fell 4.5% to 18.26 cents per pound in New York trading on October 29, 2025—down nearly 37% from January’s peak of 29.09 cents. Trading volumes hit 210,000 contracts, double the five-year average, according to data from ICE Futures U.S. The sell-off accelerated as Indian and Brazilian exporters increased shipments, further swelling a market that has absorbed record harvests in both regions. Bloomberg reports this marks sugar’s weakest close since July 2021, putting sustained pressure on producers and traders worldwide.

How Global Sugar Glut and Weather Shifts Impact Commodity Markets

The ongoing sell-off in sugar underscores the broader commodity market’s sensitivity to supply shocks and weather patterns. Brazil’s 2024/25 sugar output surged 13% year-over-year to 46.3 million metric tons, per UNICA’s October report, while India’s exports spiked as early monsoon rains lifted cane yields. This combination has created a global surplus estimated at 5.1 million metric tons, the largest since the 2017/18 season (International Sugar Organization). The sugar slump mirrors recent declines across other soft commodities as El Niño conditions stabilized and export flows normalized, influencing sector-wide risk appetite. For context on broader cross-commodity trends, see stock market analysis.

Sugar Price Decline: Portfolio Risks and Strategic Moves for Investors

For investors with direct exposure to sugar-linked assets, October’s drop has triggered portfolio rebalancing. Commodity ETF holders, such as those in the iPath Series B Bloomberg Sugar Subindex Total Return ETN ($SGG), have seen year-to-date returns slump from +16% in early May to -11% as of October 29. The move has also pressured shares of major sugar refiners and agri-traders, trimming valuations across emerging markets subsidiaries. Short-term traders may find opportunity in volatility spikes, but long-term investors should reevaluate weighting toward soft commodities amid heightened supply uncertainty. Recent market commentary on latest financial news and investment strategy highlights the potential for further price adjustments if global demand softens.

Analysts Flag Ongoing Sugar Volatility as Market Rebalances

Industry analysts observe that persistent oversupply and resilient export flows could prolong sugar price volatility into 2026. According to Rabobank’s Q3 2025 commodities outlook, bearish sentiment remains entrenched as inventories rise and weather impacts fade. Market consensus suggests that unless unexpected production shortfalls or policy shifts emerge in key producers, a rapid rebound in sugar prices is unlikely. Investors are advised to monitor trade policy developments and any material changes in global consumption trends for early signs of reversal.

Sugar Prices Extend Sell-Off: Key Takeaways for Investors in 2025

This year’s sharp moves as sugar prices extend sell-off demonstrate the market’s vulnerability to oversupply and shifting trade flows. Investors should focus on monitoring policy changes among top exporters and closely track harvest data as potential catalysts. Those with exposure to commodities will likely need to adjust strategies to account for the possibility of further price pressure or abrupt recovery in the global sugar trade.

Tags: sugar prices, $SB, commodities, market sell-off, portfolio strategy