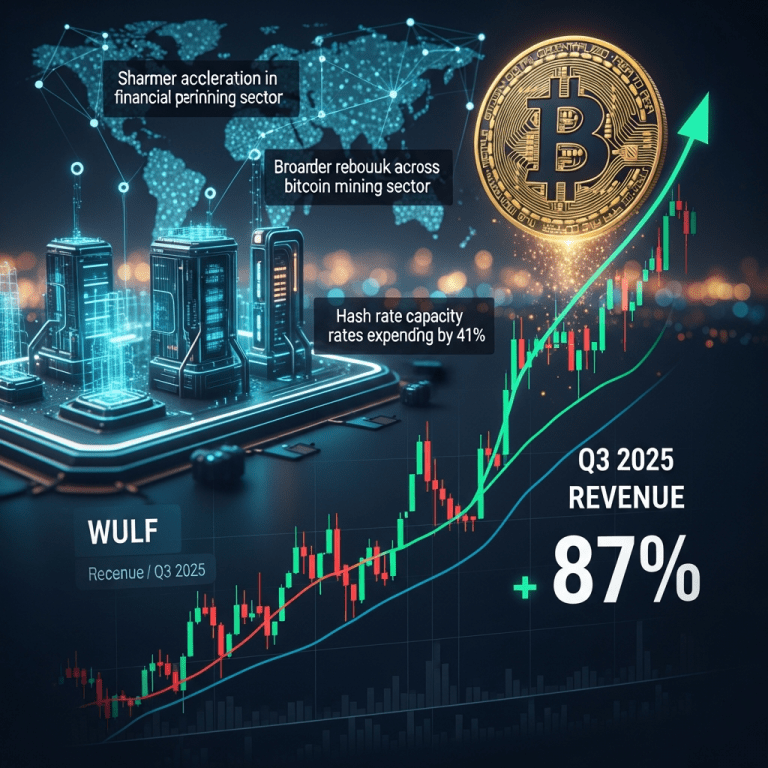

TeraWulf ($WULF) revealed its Q3 revenue up 87% year-over-year as Bitcoin prices nearly doubled since late 2024. This sharp acceleration in financial performance could reshape expectations for crypto mining stocks. How sustainable is TeraWulf’s growth amid bitcoin’s ongoing bull run?

TeraWulf Revenue Climbs 87% on Bitcoin’s Price Rally in Q3 2025

TeraWulf ($WULF) posted a remarkable 87% increase in Q3 2025 revenue, reaching $82.7 million compared to $44.2 million in Q3 2024, according to its latest earnings report. The company attributed this surge to robust bitcoin mining activity, with BTC trading near $64,100 as of October 31—up from approximately $33,800 a year prior (CoinMarketCap data). TeraWulf also reported mining over 2,100 bitcoins in Q3, a 53% increase in production volume year-over-year, with hash rate capacity expanding by 41% to 7.5 EH/s. These gains outpaced the broader market as the average price of bitcoin nearly doubled during the same timeframe (Reuters, November 2025).

Bitcoin Mining Sector Rebounds as Digital Asset Prices Soar

The surge in TeraWulf’s topline mirrors a broader rebound across the bitcoin mining sector in 2025. After weathering compressed margins during previous bear cycles, miners like Marathon Digital ($MARA), Riot Platforms ($RIOT), and CleanSpark ($CLSK) have all reported improved profitability this year as bitcoin’s price climbed nearly 90% year-on-year (Bloomberg, October 2025). Sector-wide hash rates hit record levels above 580 EH/s by late October, signaling increased competition alongside rising revenues. Recent data from The Block Research show the total global mining revenue for Q3 jumped to $3.9 billion, the highest quarterly figure since late 2021. These dynamics reinforce the renewed correlation between bitcoin price trends and miners’ financial performance (cryptocurrency market trends).

How Investors Can Navigate Crypto Miner Volatility in 2025

For investors, TeraWulf’s rapid revenue expansion spotlights both opportunities and risks across crypto mining equities. While higher bitcoin prices boost near-term cash flow, sector volatility remains elevated as network difficulty rises and regulatory uncertainty lingers in key markets. Investors holding diversified crypto mining ETFs, like the Valkyrie Bitcoin Miners ETF ($WGMI), may benefit from broader exposure but should monitor hash rate inflation and energy cost dynamics. Active traders often look for asymmetric moves during bitcoin price rallies, given the sector’s historical beta. As highlighted in crypto investing strategies and recent financial news, risk management is increasingly vital amid shifting miner economics and regulatory scrutiny.

What Analysts Expect for TeraWulf and Mining Stocks Next

Industry analysts observe that TeraWulf’s operational scaling places it among North America’s leading mining firms, especially as capital markets remain open for top-tier operators. Market consensus suggests that miner profitability will remain closely tied to bitcoin price momentum but warns of potential margin compression if energy costs rebound or bitcoin’s volatility increases. Investment strategists note that hash rate growth and regulatory clarity will be critical drivers to watch as Q4 progresses.

TeraWulf Q3 Revenue Signals New Era for Crypto Mining Investors

TeraWulf Q3 revenue up 87% underscores resilience and leverage among major crypto miners during bitcoin’s surge. Investors tracking the sector should watch upcoming regulatory updates and capacity expansions that may shift competitive dynamics. Sustainable growth in mining revenues could signal lasting shifts in digital asset market structure.

Tags: TeraWulf,WULF,bitcoin mining,crypto stocks,crypto news