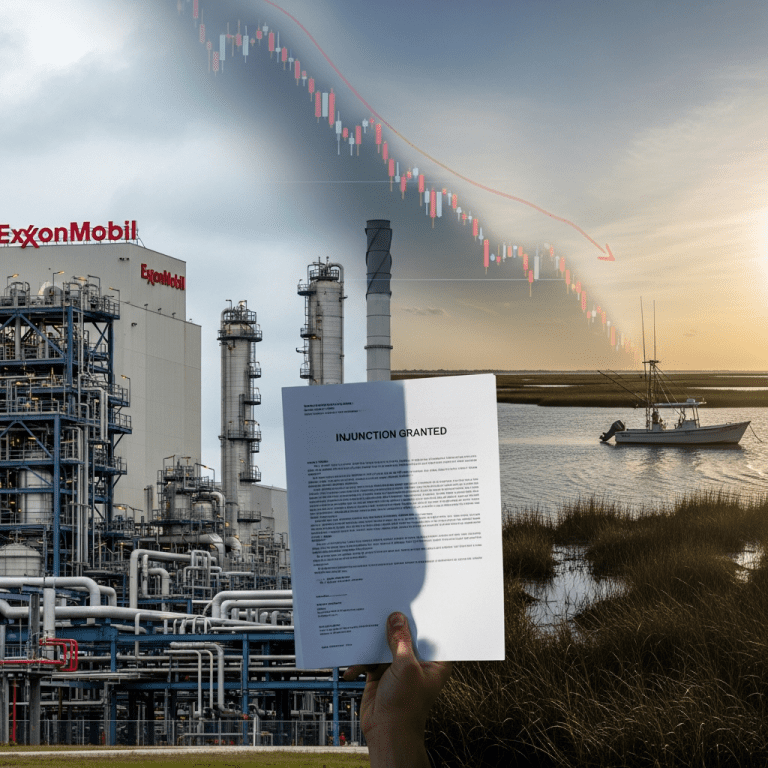

Shilpi Chhotray secured an unexpected injunction that froze ExxonMobil’s ($XOM) $10 billion plastics project in Texas, propelling the Exxon plastics plant lawsuit to the top of investor watchlists. Investors are now assessing what this high-stakes standoff means for the industry’s future—and for Exxon’s bottom line.

ExxonMobil Hit with $10B Project Delay After Legal Challenge

On November 14, 2025, federal judge Dianne Parker issued an emergency injunction that paused construction on ExxonMobil’s ($XOM) $10 billion polyethylene plant in Corpus Christi, Texas. The injunction, brought forward by local shrimper Diane Wilson and supported by Shilpi Chhotray, cited “inadequate environmental review,” particularly regarding microplastics risks to regional fisheries (U.S. District Court filings, Nov 14, 2025). The ruling disrupted ExxonMobil’s planned output of 2.5 million tons of polyethylene per year, which was slated to add 400 permanent jobs and boost local GDP by an estimated $450 million annually (Texas Economic Development Council, 2024). Exxon stock traded 1.8% lower at $103.22 following the court news, reversing a 3.5% gain year-to-date (Bloomberg data, Nov 15, 2025).

Plastics Sector Faces Scrutiny as Project Pauses Grow

The Exxon plastics plant lawsuit underscores a broader wave of regulatory and public scrutiny directed at the global plastics industry, which faces heightened pressure from both environmental groups and policymakers. According to the International Energy Agency, U.S. chemical and plastics investments surged by 18% between 2022 and 2024, but permitting delays have now pushed $35 billion in projects into review since early 2025 (IEA, June 2025 report). Similar pauses have occurred at Dow ($DOW) facilities in Louisiana and Chevron Phillips ($CVX) expansions in the Gulf. With rising concerns over plastic pollution, the American Chemistry Council reports that planned U.S. polyethylene capacity growth may fall 22% short of 2026 targets, reshaping sector earnings expectations.

Investor Playbook: Adjusting Portfolios Amid Exxon Lawsuit Uncertainty

Energy and materials investors should assess exposure to integrated oil companies and chemical producers as environmental lawsuits become more frequent. Firms with outsized growth in plastics, such as ExxonMobil ($XOM), Dow ($DOW), and LyondellBasell ($LYB), face elevated regulatory risk and potential project cost overruns. Meanwhile, sustainable materials and recycling pure-plays are attracting capital rotation, evidenced by a 16% fund inflow into ESG-labeled materials ETFs in Q3 2025 (Morningstar, Sep 2025). Investors seeking sector analysis can explore stock market analysis and the latest financial news on regulatory trends impacting energy and materials portfolios. Watching for policy developments and legal precedents is critical in the months ahead.

Analysts Cite Intensifying Regulatory Headwinds for Plastics

Investment strategists note that the Corpus Christi injunction adds momentum to global ESG initiatives and may erode confidence in heavy chemical capital expenditure. According to analysts at S&P Global, increased regulatory intervention could reduce sector EBITDA margins by 5-8% over the next 12 months if legal and permitting challenges persist (S&P Global Chemical Outlook, October 2025). Industry observers agree this case signals a new era of shareholder activism and environmental oversight.

Exxon Plastics Plant Lawsuit Signals Higher Volatility for 2025

The Exxon plastics plant lawsuit sets a new precedent for regulatory risk assessment in energy and chemical portfolios. Investors should monitor legal and policy outcomes in Texas and nationwide, as these cases are likely to shape capital allocation in 2025 and beyond. Vigilant tracking of project approvals and ESG trends will offer an advantage amid sector volatility.

Tags: ExxonMobil,XOM,plastics lawsuit,energy sector,regulatory risk