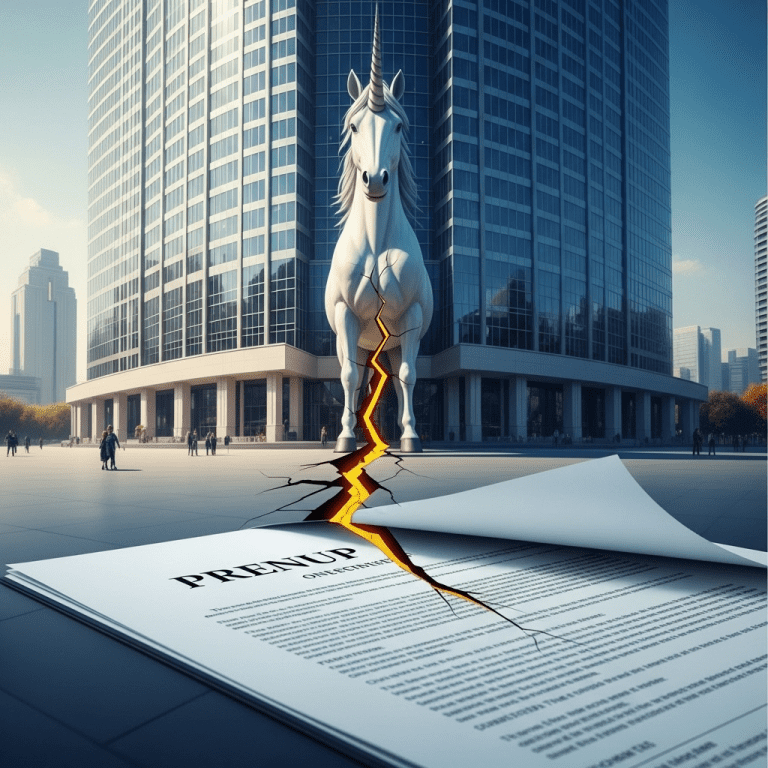

If you’re a founder, you may feel confident your prenup will shield your company in the event of marital turbulence. But think your prenup protects your business? Think again — as startup valuations and equity structures evolve in 2025, traditional prenuptial agreements often have major blind spots that could put your venture at risk.

Think Your Prenup Protects Your Business? Not So Fast

Founders often overlook crucial details when signing prenuptial agreements, assuming they’ve insulated their business assets. But in today’s landscape — with complex funding rounds, vesting schedules, and rapid company growth — the lines between marital and business property are readily blurred. If your prenup is based on outdated templates or lacks specificity about current and future equity, your most valuable assets could be exposed in a divorce.

The Modern Startup: New Challenges for Prenups

Prenups in 2025 must go beyond the basics. Startups aren’t static: companies raise capital, issue new stock, or undergo mergers and exits over the years. Without explicitly addressing how new shares, dilution, or post-marriage appreciation are handled, even a well-intentioned prenup may fail to withstand legal scrutiny. Corporate governance policies and asset protection strategies should be considered in parallel. When vesting agreements or options are granted during the marriage, it can trigger property claims if your prenup doesn’t specify ownership terms.

Common Gaps in Prenups for Founders

Here are key gaps many founders overlook:

- Future Equity and Vesting: If shares are earned or appreciate after marriage, are they considered marital property?

- Derivative Interests: Secondary interests like options, RSUs, or convertible notes may not be covered.

- Intellectual Property: The value of patents, trademarks, or code created during marriage might not be clearly assigned to the business.

- Valuation Methods: How is the company’s worth determined — especially if it has not exited or is pre-revenue?

Each of these gaps can lead to costly legal battles and uncertainty. Engaging legal counsel who understands startup structuring is critical. Aligning with seasoned legal and investment advisors ensures your documents keep pace with your business growth.

Prenup Protection Strategies for Startup Founders

What proactive measures can entrepreneurs take?

- Custom Drafting: Avoid generic prenup templates. Work with a legal professional who specializes in startups and can address unique startup assets in the agreement.

- Define Business Interests Clearly: List all stock, IP, and potential forms of compensation you may receive and how they will be treated in the case of divorce.

- Include Future Scenarios: Articulate explicit terms on dilution, future capital raises, liquidity events, and changes in ownership.

- Periodic Updates: As your business grows, regularly review and update your prenup to match new realities, just as you would with investment insights or partnership agreements.

The Cost of Overlooking Prenup Weaknesses

Too many founders learn too late that their “protective” prenup fails at the exact moment it matters most. High-profile exit valuations or a unicorn status can turn an oversight into a multi-million dollar liability. With private equity and VC firms scrutinizing founder stability and business continuity more closely in 2025, a messy divorce influenced by an insufficient prenup could negatively impact funding rounds and even deal terms.

Key Takeaways for Founders: Don’t Rely Solely on Your Prenup

Think your prenup protects your business? Think again: in the dynamic environment of startups, standard prenups aren’t enough. Proactive legal strategies, personalized agreements, and continuous review with experts are essential to safeguard your business — and your peace of mind — as you scale and fundraise.