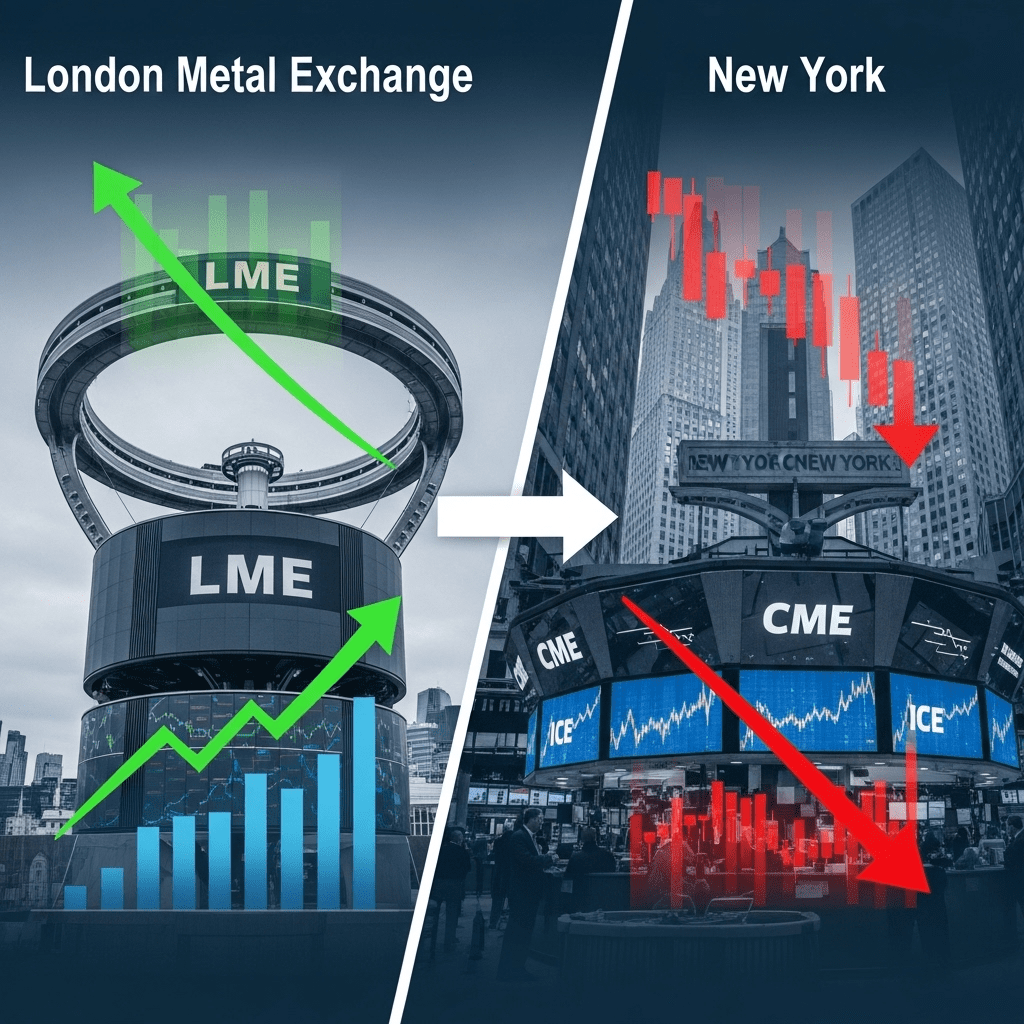

The recent escalation in U.S. trade policy—Trump’s tariffs hand surprise win to London Metal Exchange over New York rival—marks a pivotal shift in global metals trading for 2025. As tariffs disrupt established flows, the London Metal Exchange (LME) has seized strategic advantages while New York’s commodities markets scramble to adjust, highlighting how policy can accelerate capital reallocation on a global scale.

How Trump’s Tariffs Hand Surprise Win to London Metal Exchange Over New York Rival

Punitive tariffs announced by the Trump administration in early 2025 targeted key imports of industrial metals, specifically steel, aluminum, nickel, and copper. These measures, aimed at strengthening U.S. manufacturing, inadvertently created significant barriers for non-U.S. metal producers trying to access New York’s CME and ICE exchanges. As a result, trading volume and liquidity migrated from New York to London.

The London Metal Exchange, already the world’s most influential metals marketplace, has experienced a surge in transaction volume. Industry data from S&P Global shows LME’s copper contracts rising 14% quarter-on-quarter since the tariffs took effect, while comparable volume in New York dropped by 11%. This shift represents not just a short-term reaction but a longer-term realignment as traders and producers adjust hedging strategies and inventory placements.

Global Implications and Market Reactions

The policy shock from U.S. tariffs has amplified London’s role in price discovery and risk management for base metals. According to metals analysts at CRU Group, companies headquartered in Asia, Europe, and even Latin America are diverting more trades to London to avoid U.S. regulatory risk and higher costs. Furthermore, currency volatility stemming from an appreciating dollar makes LME’s euro- and pound-denominated contracts even more attractive to international investors.

LME’s strategic advantage was also reflected in a surge in open interest, with trading desks from major banks—including HSBC, Barclays, and Société Générale—reporting record client participation. Meanwhile, the New York exchanges face waning foreign interest due to logistical complications and tariff-driven price distortions.

Beyond Tariffs: Strengthening London’s Trading Ecosystem

While the direct impact of Trump’s tariffs is clear, several intertwined factors have consolidated London’s dominance. The LME benefits from deep liquidity, physical delivery capabilities, and robust clearing mechanisms—features that appeal to global industrial consumers and speculative investors alike. In contrast, New York’s platforms rely heavily on U.S. domestic flows and have limited options for physical settlement outside U.S. jurisdiction.

This environment has fostered closer partnerships across European and Asian industrial sectors. Companies seeking alternative investment insights have looked to the LME’s electronic trading platforms to hedge risk, while asset managers searching for stable returns amid global fluctuations have gravitated toward London metal ETFs and futures.

Long-Term Strategic Shifts in Metals Trading

Analysts believe the rebalancing could persist beyond the tariff period. Regulatory certainty in the UK, combined with London’s proximity to the world’s largest auto, electronics, and renewable energy manufacturers, solidifies the city’s role as the preeminent metals hub. In interviews with ThinkInvest’s editorial team, several institutional traders highlighted London’s transparency and reporting standards as key reasons for moving business from the U.S. to the UK.

Moreover, U.S. importers now face higher overhead, pushing downstream producers toward locating facilities in Europe or Southeast Asia. This reconfiguration spurs investment in alternative trading venues and infrastructure outside American borders, reinforcing London’s position.

Investment Opportunities and Strategic Moves Amid Policy Shifts

The ongoing transformation opens new global market opportunities for asset allocators, fund managers, and private investors. London-listed mining and metals companies have outperformed U.S. peers in year-to-date returns, reflecting international confidence in the LME and its surrounding financial infrastructure.

Trading houses are also diversifying with increased positions in London-based contracts, leveraging arbitrage opportunities introduced by widening spreads between London and New York prices. Investors looking for exposure to metals may benefit from understanding the underlying market structure and the regulatory landscape’s role amid shifting policy dynamics.

Key Takeaways for Investors and Market Watchers

1. The focus keyphrase—Trump’s tariffs hand surprise win to London Metal Exchange over New York rival—captures how macro policy can reshape global financial centers.

2. London benefits from both a robust institutional framework and growing international order flow.

3. Market participants should monitor evolving U.S. trade policies while seeking diversification strategies that leverage access to international exchanges.

As headline risk remains high, investors and industry leaders will continue to navigate this changing landscape, watching closely whether London’s renewed dominance becomes an enduring feature of global commodities trading—or if policy winds shift yet again in the years ahead.