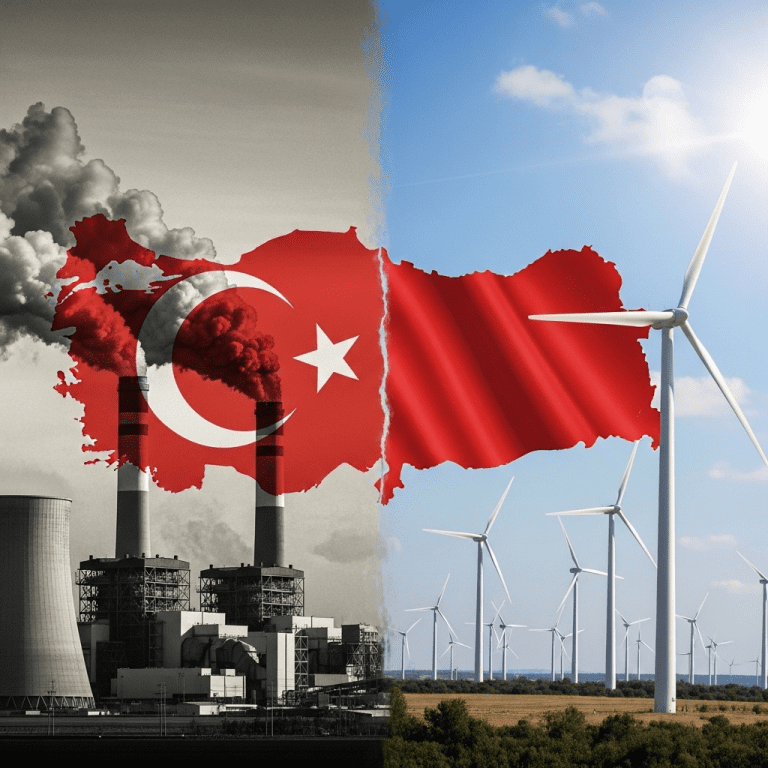

What Happened

Türkiye’s coal incentives challenge green energy transition as the government moves to expand support for domestic coal production in 2025. According to a Bloomberg report published in June 2024, Türkiye’s Ministry of Energy and Natural Resources approved a new round of financial incentives for local lignite and hard coal producers, totaling over $800 million in subsidies and low-interest loans aimed at boosting capacity and mitigating import costs. While the official statement emphasizes “energy security and employment,” the policy comes amid ongoing commitments to the Paris Agreement and national plans to reduce carbon emissions by 41% by 2030. The energy ministry stated, “We are balancing reliable supply with sustainable transformation.” However, environmental organizations warn the move could delay the country’s clean energy goals, especially as renewables attracted a record-high $4.7 billion in new investments last year (Reuters, Jan. 2024).

Why It Matters

Türkiye’s continued coal support carries significant implications for its energy markets and international partnerships. Despite rapid growth in wind and solar capacity—renewables now account for nearly 45% of Türkiye’s power mix—coal remains a strategic pillar, providing around 34% of electricity generation as of the end of 2024 (IEA data). Unlike European Union neighbors accelerating decommissioning plans, Türkiye’s policy risks diverging from the region’s decarbonization trajectory. Analysts note that this could complicate access to green financing and delay full integration into Europe’s emerging carbon border adjustment mechanisms. Historically, countries prioritizing domestic coal have seen elevated carbon costs and stranded asset risks, especially as global capital pools increasingly screen exposures for ESG alignment.

Impact on Investors

For investors exposed to Türkiye’s energy and industrial sectors, the coal incentives represent a double-edged sword. On one hand, state-backed coal producers—including major listed names on Borsa İstanbul such as Maden Enerji AS (ticker: MDAEN)—may benefit from near-term financial inflows and market stabilization. However, sustained coal expansion increases regulatory and reputational risks, notably for utilities and exporters reliant on European partnerships. “Türkiye’s tilt back towards coal could weigh on long-term sector valuations, especially as ESG metrics factor more heavily in capital allocation,” said Ekin Karahan, Istanbul-based energy strategist at Anatolia Investment Group. Yet, the renewable segment continues to attract robust foreign interest, with project developers and equipment suppliers leveraging Türkiye’s grid modernization drive. Investors are advised to monitor evolving policy signals and diversify holdings accordingly, referencing market analysis and regional ESG trends for guidance.

Expert Take

Analysts note that Türkiye’s coal incentives may offer short-term energy cost relief but risk eroding investor confidence in the country’s long-term green transition strategy. Market strategists suggest closely tracking policy developments and corporate transition plans to gauge future impacts on listed equities and debt instruments.

The Bottom Line

Türkiye’s coal incentives challenge green energy transition ambitions, creating a complex landscape for investors seeking sustainable growth in the region’s energy market. The balance between energy security and environmental responsibility remains pivotal as Türkiye navigates its path through 2025. Ongoing monitoring and selective exposure—guided by investment insights and sector outlooks—are critical as policy and market dynamics evolve.

Tags: Turkey energy, coal incentives, green transition, ESG investing, emerging markets.