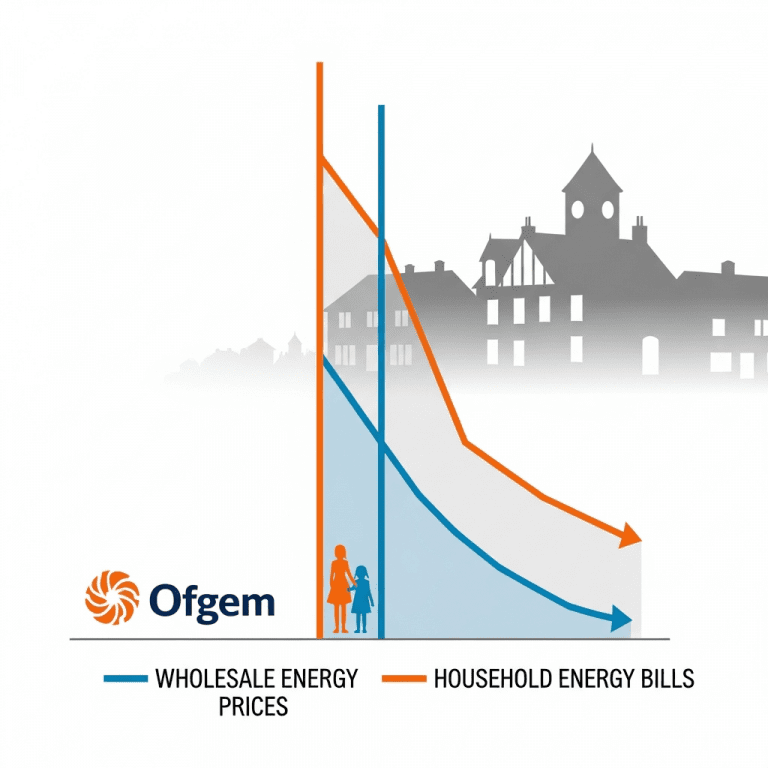

Ofgem ($OFGEM.L) revealed UK energy prices fell 28% year-to-date, but consumers still face higher bills—a key trend in UK energy prices 2025. What’s behind this disconnect, and why aren’t savings reaching households as expected?

UK Energy Prices Drop 28% in 2025, But Customer Bills Stay Elevated

UK wholesale gas and electricity prices declined sharply in 2025, with Ofgem’s cap dropping from £2,074 in January 2025 to £1,493 for Q4—a 28% reduction (source: Ofgem, October 2025). National Grid Plc ($NG.L) reports UK day-ahead electricity contracts averaged £75/MWh in October, down from the £140/MWh peak in January. Gas prices have fallen 35% since early 2024. Despite these drops, the average household bill only decreased 12% year-on-year, according to data from the UK Office for National Statistics.

Persistent Inflation and Policy Changes Offset Energy Price Relief

While energy markets rebounded from the 2022-2023 global price shock, persistent inflation and policy adjustments have diluted relief for end-users. The UK’s Consumer Price Index for essential goods rose 5.4% in 2025, and non-energy standing charges on bills increased 19% (ONS, September 2025). Ofgem’s regulatory reforms phased out several consumer support schemes in March, removing the £400 Energy Bill Support program. These factors, paired with lingering supplier costs from long-term supply contracts signed at higher price points in 2022-23, limit immediate pass-through of lower wholesale prices to consumers.

Portfolio Strategies: Navigating UK Utility Stocks and Market Volatility

For investors, the divergence between falling wholesale rates and sticky retail bills impacts the utility sector, including SSE plc ($SSE.L) and Centrica plc ($CNA.L). Companies’ Q3 earnings highlight resilient margins, but warn of regulatory risk if persistent bill pressures prompt policy intervention. Long-term investors tracking UK stock market analysis may find utilities defensive amid volatile global markets, though potential windfall taxes remain a threat. Meanwhile, energy price volatility continues to influence the wider European equities sector, as discussed in the latest financial news. Traders monitoring electricity spot prices may also seek opportunity in short-term futures, as price swings have narrowed but remain above pre-2022 levels (Bloomberg, October 2025).

Analysts Caution: Gap Between Energy Costs and Bills May Persist

Industry analysts observe that the gap between sharply lower energy costs and stubbornly high household bills may persist for several quarters. According to HSBC research published in September 2025, supplier hedging strategies and regulatory lag slow the transmission of market price improvements. Investment strategists note that inflation-linked costs and a cautious regulatory environment will determine whether further bill relief materializes in 2026.

UK Energy Prices 2025 Signal Challenging Outlook for Consumers

Although UK energy prices 2025 have fallen dramatically, regulatory factors and legacy contracts mean households are unlikely to see bills return to pre-crisis levels soon. Investors should watch upcoming Ofgem guidance and potential government interventions as signals for sector risk and opportunity. The UK energy market’s evolving structure demands close attention in Q4 2025 and beyond.

Tags: UK energy prices, Ofgem, utilities sector, SSE.L, inflation